Transcription of 202 CALIFORNIA EMPLOYER’S GUIDE

1 2022 CALIFORNIA . EMPLOYER'S GUIDE . 44 (1-22). DE 44 Rev. 48 (1-18) (INTERNET) Cover + 118 pages CU. Important Information Electronic Reporting and Payment Requirement: All employers must electronically submit employment tax returns, wage reports, and payroll tax deposits to the Employment Development Department (EDD). For more information, visit e-file and e-pay mandate for employers ( ) or refer to page 49. e-Services for Business: Employers can file, pay, and manage their employer payroll tax account online. For more information, visit e-Services for Business ( htm) or refer to page 50. State Information Data Exchange System (SIDES): Employers and third-party administrators can elect to electronically receive and respond to the EDD Notice of Unemployment Insurance Claim Filed (DE 1101CZ).

2 Using SIDES. For more information, visit SIDES ( ). New Employee Registry (NER): All employers are required by law to report all newly hired or rehired employees to the NER within 20 days of their start-of-work date. For more information, visit NER CALIFORNIA 's New Hire Reporting Program ( ) or refer to page 53. Payroll Tax Seminars: The EDD offers no-cost seminars to help employers comply with state payroll tax laws. For more information, visit Payroll Tax Seminars ( ) or refer to page 1. Fraud Prevention, Detection, Reporting, and UI Rate Manipulation: For information on how to prevent and detect UI fraud, visit UI Fraud ( ) or refer to page 83. Improper Payment of UI Benefits: Employers are financially impacted by improper UI payments. This problem can result in higher UI taxes for all employers.

3 You can help by responding timely to requests for wage information. For more information, visit UI claim notices ( ). CALIFORNIA Employer News and Updates: Find the latest tax news, annual updates, and resources to support you and your business. Subscribe to receive emails about employment and payroll tax updates. For more information, visit Employer News and Updates ( ). 2022 Payroll Tax Rates, Taxable Wage Limits, and Maximum Benefit Amounts Unemployment Insurance (UI). y The 2022 taxable wage limit is $7,000 per employee. y The UI maximum weekly benefit amount is $450. y The UI tax rate for new employers is percent (.034) for a period of two to three years. y The employer rates are available online at e-Services for Business ( ). Employment Training Tax (ETT). y The 2022 ETT rate is percent (.)

4 001) on the first $7,000 of each employee's wages. State Disability Insurance (SDI). y The 2022 SDI withholding rate is percent (.011). The rate includes Disability Insurance (DI) and Paid Family Leave (PFL). y The SDI taxable wage limit is $145,600 per employee, per year. y The 2022 DI/PFL maximum weekly benefit amount is $1, CALIFORNIA Personal Income Tax (PIT) Withholding CALIFORNIA PIT withholding is based on the amount of wages paid, the number of withholding allowances claimed by the employee, and the payroll period. Please refer to page 15 for additional information on PIT. withholding or refer to the PIT withholding schedules available on page 17. For additional rate or PIT withholding information refer to page 10 or visit Rates and Withholding ( ). DE 44 Rev.

5 48 (1-22) (INTERNET). Gavin Newsom, Governor CALIFORNIA Labor and Workforce Development Agency Dear CALIFORNIA Employer: We are committed to providing the resources needed to assist you in meeting your payroll tax obligations. We offer e-Services for Business, available 24 hours a day, 7 days a week. You can register your business, and manage your account easily online. With e-Services for Business, you can submit reports, make deposits, update your account, and much more. All you need is a computer, laptop, or a smart phone to stay connected. Enroll today at e-Services for Business ( ). We offer state payroll tax webinars at no cost to educate employers about their responsibilities. We also offer webinars with other state and federal agencies. Register at payroll tax seminars ( ).

6 Receive the latest updates, reminders and information with our email subscription service, subscribe online at ( ). For additional information about any of these services, visit the EDD website ( ) or call the Taxpayer Assistance Center at 1-888-745-3886. We are ready to answer your questions and help you meet your payroll tax obligations. Here at EDD our business is your success! Sincerely, Rita Saenz Director PO Box 826880 Sacramento, CA 94280-0001 DE 44 Rev. 48 (1-22) (INTERNET). MANAGE YOUR EMPLOYER PAYROLL TAX ACCOUNT ONLINE! Use e-Services for Business to electronically: File reports Make deposits Update addresses And much more. Enroll today at e-Services for Business ( ). DE 44 Rev. 48 (1-22) (INTERNET). Seminars to Help Employers Succeed .. 1. Introduction.

7 2. Payroll Tax Help, Forms, and Publications .. 3. How to Get Started .. 4. Flowchart .. 5. 2022 Forms and Due Dates .. 6. Who Is an Employer and When to Register .. 7. Who Is an Employee? .. 8. ABC Test Employee or Independent Contractor .. 8. What Are State Payroll Taxes? .. 9. Unemployment Insurance .. 9. Employment Training Tax .. 9. State Disability Insurance .. 9. CALIFORNIA Personal Income Tax .. 9. State Payroll Taxes (table) .. 10. Help Us Fight Fraud .. 10. What Are Wages? .. 11. Subject Wages .. 11. Personal Income Tax Wages .. 11. Are Subject Wages and Personal Income Tax Wages the Same? .. 11. Employers Subject to CALIFORNIA Personal Income Tax Only .. 11. Meals and Lodging .. 12. Additional Information .. 12. CALIFORNIA Personal Income Tax Withholding.

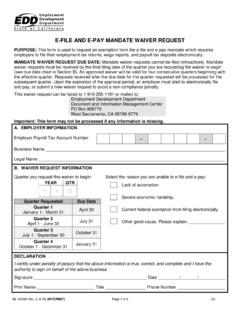

8 13. How to Determine Which Wages Require Personal Income Tax Withholding .. 13. Marital Status, Withholding Allowances, and Exemptions Form W-4 and DE 4 .. 13. Employer's Obligations for the Form W-4 and DE 4 .. 14. How to Determine Personal Income Tax Withholding Amounts .. 15. What if Your Employee Wants Additional Personal Income Tax Withholding? .. 15. How to Withhold Personal Income Tax on Supplemental Wages .. 15. Quarterly Estimated Payments .. 15. Wages Paid to: CALIFORNIA Residents .. 16. Nonresidents of CALIFORNIA .. 16. Personal Income Tax Withholding on Payments to Nonresident Independent Contractors .. 16. Additional Information .. 16. CALIFORNIA Withholding Schedules for 17. Electronic Filing and Payment Requirements .. 49. E-file and E-pay Mandate for Employer.

9 49. Online Services .. 50. e-Services for Business .. 50. Express Pay .. 51. Required Forms .. 52. Report of New Employee(s) (DE 34):.. 53. Overview .. 53. Sample DE 34 Form .. 54. Report of Independent Contractor(s) (DE 542): Overview .. 55. i Taxpayer Assistance Center 1-888-745-3886. DE 44 Rev. 48 (1-22) (INTERNET). Sample DE 542 Form .. 56. Payroll Tax Deposit (DE 88): Overview .. 57. Withholding Deposits .. 58. CALIFORNIA Deposit Requirements .. 58. Due Dates for Quarterly Tax Deposits .. 59. 2022 Quarterly Payment Table .. 59. Correcting Previously Submitted Payroll Tax Deposits .. 60. Quarterly Contribution Return and Report of Wages (DE 9): Overview .. 62. Correcting a Previously Filed DE 62. Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C): Overview.

10 63. Correcting a Previously Filed DE 64. Quarterly Contribution and Wage Adjustment Form (DE 9 ADJ): 65. Sample DE 9 ADJ 66. Federal Forms W-2 and 1099 .. 68. Change to Your Business Status .. 70. Business Name And Mailing Address Change .. 70. No Longer Have Employees .. 70. Close Your Business .. 71. Reopen Your Employer Payroll Tax Account .. 71. Purchase, Sell, Transfer, or Change Ownership .. 71. What Is a Successor Employer? .. 72. It Is Against the Law to Change/Purchase a Business Entity Solely to Obtain a Lower UI 72. Additional Requirements .. 72. Posting Requirements .. 72. Required Notices and Pamphlets .. 72. Earned Income Tax Credit Information Act .. 73. Plant Closure or Mass Layoff (WARN) .. 74. Government Contractor Job Listing Requirements .. 76. Recordkeeping.