Transcription of 2021 Drake Update School Live Webcast CPE Details

1 2021 Drake Software Update Schools Live Webcast Course Description: Update Schools live Webcast provides the latest tax and industry information, program enhancements, and software instruction. Upon completion of the Update Schools, participants will know more about: The important tax law and industry updates for the upcoming tax season Changes made to return data entry based on tax law updates New features in Drake Software for 2021. Course Fee: The cost of the Update School is $179 per attendee for those who register before October 1, 2021; $199 for those who register on or after October 1, 2021. How to Register: Visit to access the Update Schools registration page.

2 CPE Facts: The Update Schools provide CPE in multiple fields of study. The total possible number of CPE awarded is based on the attendee's professional designation. Affiliation Course Format CPE/ Field of Study Course ID # Sponsor ID #. 5 Taxes NASBA Internet Based 3 Computer Software & Applications N/A 103137. 4/0 Federal Tax Law Update 3038-CE-0255. CTEC Live 3038. 1/0 Federal Tax Law 3038-CE-0257. 4 Federal Tax Update FQTGU-U-00427-21-O. IRS Online / Group FQTGU. 4 Federal Tax FQTGU-T-00428-21-O. TX State Board 5 Taxes 100352. Internet Based 002921. of Accountancy 3 Computer Software & Applications 100353. Course Level: Update Last Revision: Fall 2021 Course Expiration: January 31, 2022.

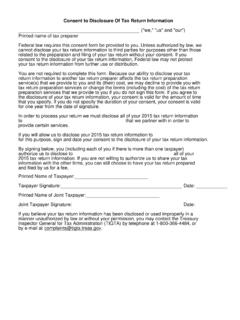

3 Prerequisites: The content presented at the Update School is geared toward Drake Software users. No advance preparation is necessary to attend. Course Policies: Drake will grant a full refund if the request is received within 72 hours of the start of the Webcast . Registrants who are "no-shows" for the Live Webcast will not qualify for a refund. Refund requests must be sent to Refunds will not be granted by phone. Drake Software is an IRS qualified sponsor of continuing professional education . Drake Software is registered with the Texas State Board of Public accountancy as a CPE. sponsor. This registration does not constitute an endorsement by the Board as to the quality of our CPE program.

4 Drake Software is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: Drake Software has been approved by the California Tax education Council to offer the 2019 Update School , CTEC. #3038-CE-0256, which provides 4 hours of federal tax Update credit and 0 hours of state credit, and 3038-CE-0256, which provides 1 hours of federal tax credit and 0 hours towards the annual continuing education requirement imposed by the State of California.

5 A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at Box 2890, Sacramento, CA 95812-2890, toll-free by phone at (877) 850-2832, or on the Internet at