Transcription of Appendix : Solved Paper CS Final (New Syllabus ...

1 Appendix : Solved Paper CS Final (New Syllabus ) - Advanced Tax laws & Practice - June 2015 CA. Yogendra Bangar & CA. Vandana BangarAPPENDIXSOLVED PAPERCS Final (New Syllabus ) - Advanced Tax laws & Practice - June 2015[ PART A ]Question 1 :(a)Amar, an individual, resident of India, receives the following payments after TDS during the previous year 2014-15 : `(i)Professional fees on 17-08-20142,40,000(ii)Professional fees on 04-03-20151,60,000 Both the above services were rendered in Pakistan on which TDS of ` 50,000 and ` 30,000 respectively has beendeducted.

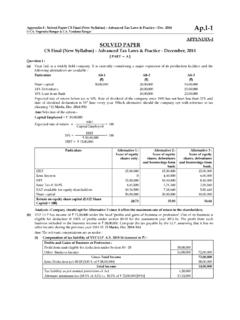

2 He had incurred an expenditure of ` 2,40,000 for earning both these receipts/income. His income from othersources in India is ` 3,00,000 and he has made payment of ` 70,000 towards the tax liability of Amar and also the relief under section 91, if any, for assessment year 2015-16. (5 Marks, June2015-NS)Ans: Computation of total income, tax payable and relief under section 91 (amounts in `) :Foreign Income : Professional fees on 17-08-2014 (Gross) [` 2,40,000 + ` 50,000]2,90,000 Professional fees on 04-03-2015 (Gross) [` 1,60,000 + ` 30,000]1,90,000 Gross Income 4,80,000 Less: Expenditure incurred to earn such income 2,40,0002,40,000 Indian Income : 3,00,000 Gross Total Income 5,40,000 Less.

3 Deductions under Section 80C [LIC payment]70,000 Total Income4,70,000 Income Tax on total income (after rebate under Section 87A)20,000 Add: Education Cess and SHEC @ 3% 600 Total Tax20,600 Indian rate of tax (Average Rate of Tax) [` 20,600 100 ` 4,70,000] rate of tax [` 80,000 ` 4,80,000] taxed income 2,40,000 Less: Relief under section 91 to the extent of the lower of (a) Doubly taxed income Indian rate of tax [` 2,40,000 ]10,519(b) Doubly taxed income Foreign rate of tax [` 2,40,000 ]40,00010,519 Tax payable (rounded off to nearest ` 10)10,080(b)Apple Industries Ltd.

4 Provides the following information for the financial year 2014-15 : (` in lakhs)Net profit as per statement of profit and loss after debiting/crediting the following : 120 Proposed dividend30 Profit from unit established in SEZ20 Provision for income-tax18 Provision for deferred tax10 Provision for permanent diminution in value of investments3 Depreciation debited to statement of profit and loss ` 10 lakh includes depreciation on revaluation ofassets to the tune of1 Brought forward losses and unabsorbed depreciation as per book of the company are as follows.

5 Previous YearBrought Forward LossesUnabsorbed Depreciation2010-11142011-12112012-13105 Compute the book profit of the company as per section 115JB for the assessment year 2015-16. (5 Marks, June 2015-NS) : Solved Paper CS Final (New Syllabus ) - Advanced Tax laws & Practice June 2015 CA. Yogendra Bangar & CA. Vandana BangarAns: Computation of book profit of ABP Ltd. under section 115JB (` in lakhs) -Net profit as per profit and loss account120 Add: Net profit to be increased by following amounts as per Explanation 1 to Section 115JB Provision for income tax 18 Provision for deferred tax10 Proposed dividend30 Depreciation10 Provision for diminution in value of investment3191 Less.

6 Net profit to be reduced by following amounts as per Explanation 1 to Section 115JB Depreciation (excluding depreciation on revaluation of assets) [` 10 lakhs ` 1 lakhs = ` 9lakhs]-9 Lower of (i) brought forward loss (1 + 1 + 10 = ` 12 lakhs)(ii) unabsorbed depreciation (4 + 1 + 5 = ` 10 lakhs), as per books of account-10 Book Profits172(c)Explain whether the benefit of exemption under section 54EC would be available in the case of 'capital gains arising ontransfer of depreciable asset'. (5 Mark, June 2015-NS)Ans: It is important to note that, according to Section 2(29A) of the Income-tax Act, the capital assets held for more than36 months (other than specified assets) are long term capital assets.

7 Sections 48 and 49 of the Act, provide forcomputation of capital gains and Section 50 carves out an exception in respect of depreciable asset providing that forpurposes of Sections 48 and 49, the gains arising on transfer of depreciable assets shall be treated as gains arising fromtransfer of short term capital the above provisions, it can be said that the deeming fiction created in Section 50 is restricted only to thecomputation of capital gains under sections 48 and 49, it does not deem an asset as short term capital asset.

8 Section 54F isan independent section which provides for exemption on fulfillment of certain conditions. It does not make anydistinction between the depreciable and non-depreciable assets and therefore, the benefit of exemption under this sectioncannot be denied merely on account of fiction created by Section a similar case of CIT v. Rajiv Shukla [2011] 334 ITR 138 (Del.), it was held that, since the capital asset transferred islong term capital asset (as used for more than 36 months), and the capital gains arising therefrom having been depositedin the Capital Gains Deposit Scheme as required by that section, therefore the exemption under section 54F shall beavailable to the 2 :(a)What are the 'specified domestic transactions' which are subject to transfer pricing provisions ?

9 (5 Marks, June 2015-NS)Ans: Refer Q. No. 6 in Chapter 7 of this book.(b)Comment on the following in the context of provisions contained in the Income-tax Act, 1961 : (i)The provisions of section 115JB are applicable in case of foreign companies. (2 Marks, June 2015-NS)(ii)The provisions of dividend distribution tax are applicable to an undertaking or enterprise engaged in developing,operating and maintaining a special economic zone (SEZ). (3 Marks, June 2015-NS)Ans: (i) Refer Q. No. 7 in Chapter 4 of this book.(ii) Yes, the provisions of dividend distribution tax are applicable to an undertaking or enterprise engaged in developing,operating and maintaining a special economic zone (SEZ).

10 Amendments were made by Finance Act, 2011 to provide forlevy of DDT to an undertaking or enterprise engaged in developing, operating and maintaining a special economic zone(SEZ). According to Section 115O, a domestic company shall in addition to the income-tax chargeable in respect of thetotal income be liable to pay tax on distributed profits @ 15% (plus 10% surcharge and EC & SHEC @ 3%) ofany amount declared, distributed or paid by such company by way of dividends (whether interim or otherwise) (otherthan dividends referred under section 2(22)(e)) whether out of current or accumulated profits.