Tax laws and practice

Found 32 free book(s)Paper 18- Indirect Tax Laws and Practice - icmai.in

icmai.inPaper 18- Indirect Tax Laws and Practice Full Marks: 100 Time allowed: 3 hours The figures in the margin on the right side indicate full marks. ...

PROFESSIONAL PROGRAMME STUDY MATERIAL …

www.icsi.inPROFESSIONAL PROGRAMME STUDY MATERIAL ADVANCED TAX LAWS AND PRACTICE MODULE III -PAPER 6ICSI House, 22, Institutional Area, Lodi Road, New Delhi 110 003

TAX LAWS AND PRACTICE - dl4a.org

dl4a.orgiii EXECUTIVE PROGRAMME – TAX LAWS AND PRACTICE This study material has been published to aid the students in preparing for the Tax Laws and Practice paper of

TAX LAWS AND PRACTICE - ICSI

www.icsi.eduiii EXECUTIVE PROGRAMME – TAX LAWS AND PRACTICE This study material has been published to aid the students in preparing for the Tax Laws and Practice paper of the

Transfer Pricing: Strategies, Practices, and Tax …

www.irs.govTransfer Pricing: Strategies, Practices, and Tax Minimization ... tinationals’ goal to comply with international tax laws. ... Strategies, Practices, and Tax ...

DOMESTIC TAX LAWS OF UGANDA - ura.go.ug

www.ura.go.ugIt also includes subsidiary legislation and practice notes under different the tax laws. In updating this version, the “Reprint of the Income Tax Act

Direct Tax Laws - Taxmann

www.taxmann.comincome tax appellate tribunal (itat) practice and procedure rp garg / beenu yadav 795 35 424 2016 2nd edition paper back ... direct tax laws printed books.

Direct Tax Laws - taxmann.com

taxmann.com9789386482464 TAX PRACTICE MANUAL Taxmann 2100 80 1688 2017 4TH EDITION PAPER BACK 9789386882080 ... Direct Tax Laws Printed Books. 9789386482235

Principles of Good Tax Administration Practice Note

www.oecd.orgPrinciples of Good Tax Administration – Practice Note ... Principles of Good Tax ... The main role of revenue authorities is to ensure compliance with tax laws.

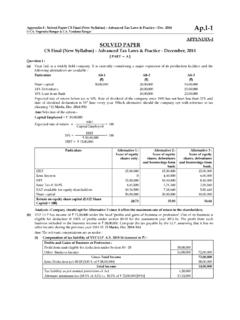

Appendix-I : Solved Paper CS Final (New Syllabus ...

aadhyas.comCS Final (New Syllabus) - Advanced Tax Laws & Practice - December, 2014 [ PART — A ] Question 1 : (a) Virat Ltd. is a widely held company.

Appendix : Solved Paper CS Final (New Syllabus ...

aadhyas.comCS Final (New Syllabus) - Advanced Tax Laws & Practice - June 2015 [ PART — A ] Question 1 : (a) ...

UNITED STATES TAX COURT

www.ustaxcourt.govUNITED STATES TAX COURT ... Tax Court Rules of Practice and Procedure. ... amended, and the general subject of the revenue laws and the

06- 150 - State

www.state.gov06- 150 AGREEMENT BETWEEN ... whether contained in the tax laws, ... a statement that the request conforms to the law and administrative practice of

ACCOUNTING FIRMS AND THE UNAUTHORI ZED …

mckinneylaw.iu.eduof attorneys because state laws prohibit, among other things, lawyers from ... Note focuses primarily on the area of tax practice, though some have concerns

Constitutionality of Retroactive Tax Legislation

fas.orgConstitutionality of Retroactive Tax Legislation ... amends the federal tax laws in a way that retroactively increases a ... “customary congressional practice. ...

Frequently Asked Questions About Tax Reform - …

www2.deloitte.comFrequently Asked Questions About Tax Reform ... input received or further developments in practice. ... 740 that the effect of a change in tax laws or rates on ...

The Income Tax Act Cap.340 4 - Uganda Investment …

www.ugandainvest.go.ugAct and the Value Added Tax Act; 4. Practice Notes under the ITA and VATA issued by the ... THE INCOME TAX ACT Cap. 340 - Laws of Uganda 2000

Tax Legislative Process - IMF

www.imf.orgTax Legislative Process ... An enormous amount has been written on the ideal structure of tax laws or on ... with comparative knowledge of practice of different ...

Final Group IV Paper 18: Indirect Tax Laws & Practice

icmai.inRevisionary Test Paper_Jun 2018 DoS, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament) Page 1 Final Group IV

AICPA Practice Guide for Fiduciary Trust Accounting

www.boa.virginia.govAICPA PRACTICE GUIDE FOR FIDUCIARY (TRUST) ACCOUNTING A Guide for Accountants Who Perform Fiduciary Accounting Services December 2007 AICPA Tax Division

INCOME TAX LAW AND PRACTICE - University of …

www.universityofcalicut.infoSchool of Distance Education Income Tax Page 1 UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION B.COM CORE COURSE SIXTH SEMESTER (2011 Admission) INCOME TAX LAW AND PRACTICE

96-1717 Handbook of Texas Property Tax Rules

comptroller.texas.govHandbook of Texas Property Tax Rules — A Glenn Hegar Handbook of Texas Property ... SUBCHAPTER A. PRACTICE AND PROCEDURE ...

TAX ISSUES FOR AWARDS - OPM.gov

www.opm.govTAX ISSUES FOR AWARDS. Introduction. This paper addresses the impact of the various tax laws on the Government’s awards program and focuses on awards given under the Governmentwide authority found in chapter 45 of title 5,

frequently asked questions New - GRA

www.gra.gov.ghFREQUENTLY ASKED QUESTIONS DOMESTIC TAX REVENUE DIVISION (INCOME TAX) ... know your rights and to understand and meet your obligations under the tax laws. To

U.S. Federal Tax Law Hierarchy Quick Reference Chart

www.aicpa.orgU.S. Federal Tax Law Hierarchy Quick Reference Chart ... Congressional power to enact tax laws) ... U.S. Tax Court ...

Managing Income Tax Compliance through Self …

www.imf.orgManaging Income Tax Compliance through Self ... A. Clear and Simple Tax Laws ... or are in the process of strengthening income tax compliance through self-assessment.

Sample RTRP Questions - Internal Revenue Service …

www.irs.govThe amount of excise tax that the ... B. the representative has never been under suspension or disbarment from practice ... Sample RTRP Questions Author:

VI SEMESTER CORE COURSE - University of Calicut

universityofcalicut.infoSchool of Distance Education Income Tax Law and Practice Page 2 UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION Study Material B.COM. VI SEMESTER CORE COURSE

B.Com. V Sem (Tax) Subject- Income Tax Law And …

rccmindore.comB.Com. V Sem (Tax) Subject- Income Tax Law And Practice 45, Anurag Nagar, Behind Press Complex, Indore (M.P.) Ph.: 4262100, www.rccmindore.com

CHAPTER 235 INCOME TAX LAW - hawaii.gov

files.hawaii.govCHAPTER 235 INCOME TAX LAW Part I. General Provisions Section 235-1 Definitions ... , and interrelationship of Internal Revenue Code and Public Laws with this

Practice Note on Charitable Organisation

www.gra.gov.ghPractice Note on Charitable Organisation GHANA REVENUE AUTHORITY Practice Note on Withholding of Tax under the Income Tax Act, 2015 (ACT 896)

Basic Income Tax 2016-2017 Fourth Edition - CALI

www.cali.orgBasic Income Tax 2016-2017 Fourth Edition . William Kratzke . Professor of Law . The University of Memphis . CALI eLangdell Press 2016

Similar queries

Tax Laws and Practice, PROFESSIONAL PROGRAMME STUDY MATERIAL, PROFESSIONAL PROGRAMME STUDY MATERIAL ADVANCED TAX LAWS AND PRACTICE, Transfer Pricing: Strategies, Practices, and Tax, Tax Laws, And Practice, Practice, Tax practice, Principles of Good Tax Administration Practice, Principles of Good Tax Administration, UNITED STATES TAX COURT, Laws, 06- 150, State, ACCOUNTING FIRMS AND THE UNAUTHORI, Constitutionality of Retroactive Tax Legislation, Frequently Asked Questions About Tax, THE INCOME TAX ACT, Tax Legislative Process, Group IV Paper 18: Indirect Tax Laws, AICPA Practice Guide for Fiduciary Trust Accounting, AICPA PRACTICE GUIDE FOR FIDUCIARY (TRUST) ACCOUNTING, INCOME TAX LAW AND PRACTICE, 1717 Handbook of Texas Property Tax, Handbook of Texas Property Tax, TAX ISSUES FOR AWARDS, Frequently asked questions New, FREQUENTLY ASKED QUESTIONS, Tax Law Hierarchy Quick Reference Chart, Managing Income Tax Compliance through Self, Income tax compliance through self, Sample RTRP Questions, Internal Revenue Service, VI SEMESTER CORE COURSE, Tax) Subject- Income Tax Law And, Tax) Subject- Income Tax Law And Practice, CHAPTER 235 INCOME TAX LAW, Practice Note on Charitable Organisation, Income Tax 2016-2017 Fourth Edition