Transcription of Beneficiary claim form – lump sum payment

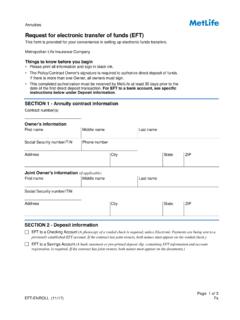

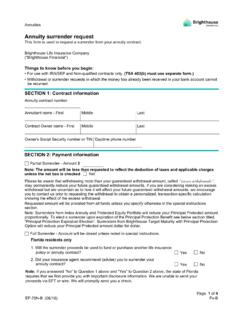

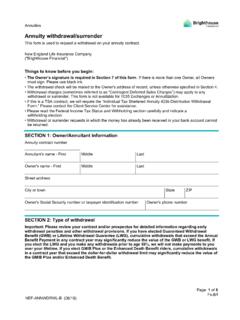

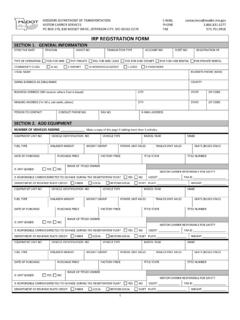

1 Annuities Beneficiary claim form lump sum payment Use this form to submit a claim for an annuity where the owner had started receiving Life Insurance Company Please use blue or black ink and please PRINT in all capital lettersANN-DC-LS-TCA (08/21)Page 1 of 9 FsGuide to making your claim You are receiving the lump sum payment claim form because it is the only option available under this contract. Please answer each question fully and accurately. Then sign, date, and if applicable include your title on the signature page of this form . If you return this form with missing or incorrect information, it will delay your claim . We reserve the right to ask you for additional information to settle the claim (if necessary). Required for all claims: Each Beneficiary submitting a claim must complete and submit a separate claim form . Copy of death certificate is required (one per decedent). If the total death benefit value across ALL contracts for the deceased is greater than $300,000 we require an original certified death certificate to be mailed in.

2 Certification of identity is required for each contract Beneficiary (detailed on the Identity certification section of this form ). Additional requirements, if your claim is filed by a: Estate- If the executor or administrator of an estate is filing a claim , he or she must complete and sign the claim form and submit a copy of the appointment papers. A tax identification number (TIN) must be provided or we are required to withhold for federal income tax. A title must be included with your signature in section 7. Trust- If a trustee is filing a claim , he or she must complete and sign the claim form and submit a completed and signed Trustee Certification for Death claim Benefits form . A title must be included with your signature in section 7. Power of Attorney- If the Power of Attorney (POA) is filing a claim on behalf of the Beneficiary , he or she must complete and sign the claim form and submit a copy of the Power of Attorney document and a Certification of Attorney-in-Fact.

3 A title must be included with your signature in section 7. Minor or appointed conservator- Where the Beneficiary is a minor, or has been appointed a conservator, court-certified letters of guardianship or conservatorship for the minor's estate is required. A MetLife certification of guardian/conservator form is also required. A title must be included with your signature in section 7. Corporation or other Institution(s)- The claim form should be completed and signed by an officer of the corporation or other institution(s). Submit it with a request for settlement on company letterhead, signed by two officers of the company with their titles. A title must be included with your signature in section 1: About your claim (Required for all requests)Please list the contract number(s) for all contracts you're making a claim on. You only need to complete one claim form if you choose the same tax and payment method for each to know before you begin New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

4 ANN-DC-LS-TCA (08/21)Page 2 of 9 FsSECTION 2: About the Beneficiary (All fields required)Option A - Complete only if an individual is the beneficiaryFirst nameMiddle nameLast nameMailing address (street number and name, apartment or suite)CityStateZIPP hone numberEmailDate of birth (mm/dd/yyyy)Social Security number(SSN)Relationship to deceasedI am a:MaleFemaleI am citizenResident alienNon-resident alienIf the above address is a Box, please also provide a street/physical address for our records;Street Address (street number and name, apartment or suite)CityStateZIPIf the Beneficiary has had a name change - We will require proof of the name change, such as a marriage certificate, divorce decree, or other court-issued document showing the change of B - Complete only if an entity is the beneficiaryName of trust, estate or other entityTax ID number (TIN)Date trust was created (mm/dd/yyyy)Name of trustee(s), executor, administrator, custodian, nameMiddle nameLast nameMailing address (street number and name, apartment or suite)CityStateZIPP hone numberEmailI am a:MaleFemaleI am citizenResident alienNon-resident alienIf the above address is a Box, please also provide a street/physical address for our records.

5 Street Address (street number and name, apartment or suite)CityStateZIPANN-DC-LS-TCA (08/21)Page 3 of 9 FsSECTION 3: About the deceased (All fields required)Complete the fields below about the individual who passed nameMiddle nameLast nameMailing address (street number and name, apartment or suite)CityStateZIPS ingleMarriedDivorcedSeparatedWidow/Widow erSECTION 4: Federal/state income tax withholding (Required for all requests)We are required to withhold federal income tax on the taxable portion of your payment (s), unless the decedent s account is not a qualified retirement plan account and you tell us not to withhold federal income tax. Qualified retirement plan accounts are 401(a), 401(k), 403(b) and 457(b) governmental accounts. In addition, certain states require us to withhold state income tax when we withhold federal income tax. If you are a resident of one of these states and choose to have federal income taxes withheld, we withhold state income tax based on the state s may choose to: Opt out of federal, and state if applicable, income tax withholding in the case of accounts that are not qualified retirement plan accounts.

6 This means that we will not withhold income tax from your payment (s). You may not opt out of federal income tax withholding if you: Have not provided your correct Social Security or Taxpayer Identification Number (TIN), or Are a citizen or resident alien and the address listed in Section 2 is outside of the or its possessions. Have 10% (20% in the case of qualified retirement accounts) federal income tax, and state, if applicable, income tax withheld from your payment (s). Have more than 10% (20% in the case of qualified retirement accounts) federal income tax, and state, if applicable, income tax withheld from your payment (s). You can write in the specific percentage that you want to note: If you choose to opt out of federal (and state if applicable) income tax withholding, you may be required to pay estimated tax directly to the Internal Revenue Service (or your state s Department of Taxation).

7 You may incur penalties under federal (and state if applicable) estimated tax rules if the estimated tax payments are not enough to pay the anticipated taxes. Consult with your tax advisor to determine if these state tax rules and penalties apply to you. If you do not choose a tax withholding option (when required), we automatically withhold 10% (20% in the case of any account that is a qualified retirement plan account) federal income tax and state, if applicable, income tax withheld from your payment (except for citizens). If you are not a citizen, we are required to withhold 30% federal income tax from the taxable portion of your payment (s). However, this rate may be less than 30% if there is a tax treaty in effect between your country and the United States, and you furnish with the proper documentation. To be eligible for treaty benefits, you must reside in a treaty country and provide us with an IRS form W-8 BEN that is available on the IRS website at Your W-8 BEN must include your foreign tax identifying number in Box 6, and your date of birth in Box 8.

8 Please return the form with your claim (08/21)Page 4 of 9 FsCheck one:I choose not to have federal, and state if applicable, income tax withheld from my payment (s). Cannot be used for qualified retirement plan accounts ( , 401(a), 401(k), 403(b) and 457(b) governmental accounts).I choose to have 10% (20% in the case of any account that is a qualified retirement plan account) federal income tax and state income tax, if applicable, withheld federal income tax and state income tax, if applicable, withheld from the taxable portion of my payment (s).I choose to have federal, and state if applicable, income tax withheld from my payment (s) as follows: Federal % (Cannot be less than 10% or 20% in the case of any account that is a qualified retirement plan account) State % (Cannot be less than your state s rate)I chose to have Federal, and State if applicable, Income Tax withheld from the distribution as follows: Federal - withhold fixed dollar amount $ (Cannot be less than 10% or 20% in the case of any account that is a qualified retirement plan account) State - withhold fixed dollar amount $ (Cannot be less than the applicable state rate)SECTION 5: Tell us how you want to receive your claim payment (Required for all requests)Tell us how you want to receive your claim payment (s).

9 If you do not make a choice below, you will automatically receive a check at the address listed in Section 2 of this claim want you to (check one):Open a Total Control Account (TCA) for me if the payment is $10,000 or more, or transfer to the funds to my existing TCA. By selecting this payment method, you confirm that you have read the About the Total Control Account document included with this claim package. If want us to transfer these funds into your existing TCA, please provide your account number number (if applicable)Send a check to the name and address listed in Section 2 of this claim the funds directly to a bank account (via electronic funds transfer). You must attach a voided check to this form . If you want to transfer this money to a savings account, provide a letter from your bank with your account information. If you choose not to attach a check or provide a letter from your bank, you must complete the information below and obtain a Medallion signature Guarantee (MSG) on this claim (bank, brokerage firm, funeral home, etc.)

10 Mailing address (street number & name, apartment or suite)CityStateZIPA ccount numberABA routing number (if applicable)CheckingSavings (include bank letter with account information)ANN-DC-LS-TCA (08/21)Page 5 of 9 FsSend a check to a different address or made payable to a different name than the one listed in Section 2 of this claim form . You must obtain a Medallion signature Guarantee (MSG) on this claim (bank, brokerage firm, funeral home, etc.)Mailing address (street number & name, apartment or suite)CityStateZIPA ccount number (if applicable)SECTION 6: Certification and disclosuresClaim fraud warningsBefore signing this claim form , please read the warning for the state where you reside and for the state where the annuity contract under which you are claiming a benefit was , Arkansas, District of Columbia, Louisiana, Massachusetts, Minnesota, New Mexico, Ohio, Rhode Island and West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.