Transcription of Florida Communications DR-700016 Services Tax Return

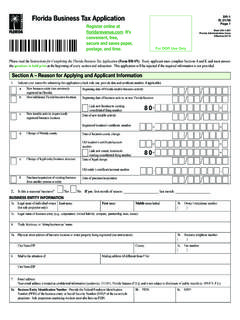

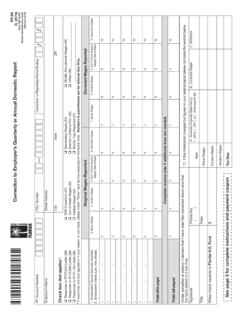

1 1. Tax due on sales subject to state and .15% gross receipts portions of Communications Services tax (from Summary of Schedule I, Line 3) .. Tax due on sales subject to gross receipts portion of Communications Services tax (from Summary of Schedule I, Line 6) .. Tax due on sales subject to local portion of Communications Services tax (from Summary of Schedule I, Line 7) .. Tax due for direct-to-home satellite Services (from Schedule II, Column C) Total Communications Services tax (add Lines 1 through 4) .. Collection allowance. Rate:_____ ..6. (If rate above is blank, check one) None applies .0025 .00757. Net Communications Services tax due (subtract Line 6 from Line 5) .. Penalty .. Interest .. Adjustments (from Schedule III, Column G and/or Schedule IV, Column U).

2 Multistate credits (from Schedule V) .. Amount due with Return ..12. NameAddressCity/State/ZIPTo ensure proper credit to your account, attach your check to this payment coupon. Mail with tax Return and all Coupon DO NOT DETACHC heck here if your address or business information changed and enter changes here if you are discontinuing your businessand this is your fi nal Return (see page 15). Florida CommunicationsServices Tax ReturnDR-700016R. 01/19 Page 1 of 24 BUSINESS PARTNER NUMBERA mount due from Line 12 Business Address Business Partner Number Reporting PeriodPayment is due on the 1st and LATE if postmarked or hand delivered afterCheck here if payment was transmitted electronically. 0 1 2 3 4 5 6 7 8 90123456789 Use black ink.

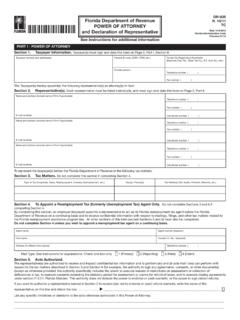

3 Handwritten Example Typed ExampleNew location address: _____Telephone number: (_____) _____New mailing address: _____ US Dollars CentsDOR USE ONLY postmark or hand delivery date ,,,,,,,,,,,,FEIN FROM: M M D D Y Y Y Y TO: M M D D Y Y Y YREPORTING PERIODC heck hereif negativeDR-700016R. 01/19,,,,,,,,,,,,..AUTHORIZATION Under penalties of perjury, I declare that I have read this Return and that the facts stated in it are true [ss. (2), (5), and , Florida Statutes].Type or print nameAuthorized signatureDatePreparer (type or print name)Preparer s signatureDateContact name (type or print name)Contact phone numberContact email address.

4 9100 0 99999999 0063004031 7 3999999999 0000 2 File electronically ..it s easy!The Department maintains a free and secure website to file and pay Communications Services file and pay, go to the Department s website at to send payments and returnsMake check payable to and send with Return to: Florida DEPARTMENT OF REVENUE PO BOX 6520 TALLAHASSEE FL 32314-6520 or File online using the Department s website at 01/19 Rule , 01/19 Page 2 of 24B. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxComplete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA.

5 Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueALACHUAU nincorporated St. City Harbour TOTALDR-700016SR. 01/19 Page 3 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueBROWARDU nincorporated eld Ranch TOTALDR-700016SR.

6 01/19 Page 4 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueCLAYU nincorporated Cove Duval (City of Jacksonville) TOTALDR-700016SR. 01/19 Page 5 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA.

7 Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueGADSDENU nincorporated St. TOTALDR-700016SR. 01/19 Page 6 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueHILLSBOROUGHU nincorporated De RIVERU nincorporated River TOTALDR-700016SR.

8 01/19 Page 7 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueLAKE - Myers TOTALDR-700016SR. 01/19 Page 8 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA.

9 Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueMARIONU nincorporated Harbour Harbor Creek Shores Bay Miami Isles TOTALDR-700016SR. 01/19 Page 9 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax dueMIAMI-DADE - Colony Walton Buena TOTALDR-700016SR.

10 01/19 Page 10 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA. Local jurisdictionB. Taxable sales subject to state tax and .15% gross receipts taxC. Taxable sales subject to gross receipts tax and local taxD. Local tax rateE. Local tax duePALM BEACHU nincorporated Inlet Clarke Palm Beach Beach Palm Palm Palm Port TOTALDR-700016SR. 01/19 Page 11 of 24 Complete Columns B, C, and E for all jurisdictions in which you provide or use Communications Services . Attach Schedule I and all other supporting schedules to the tax I - State, Gross Receipts, and Local Taxes DueBusiness nameBusiness partner numberA.