Transcription of FULL OR PARTIAL WITHDRAWAL REQUEST INSTRUCTIONS …

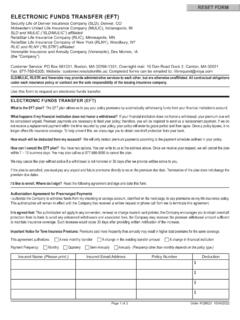

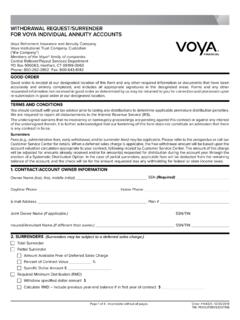

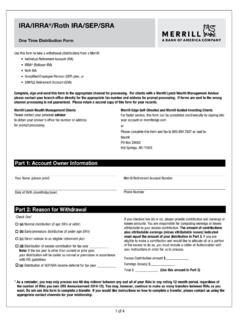

1 INSTRUCTIONS - Page 1 of 2 Order #119324 07/12/2021 TM: DISTRIBMNTFULL OR PARTIAL WITHDRAWAL REQUEST INSTRUCTIONSFIXED/VARIABLE ANNUITIESR eliaStar Life Insurance Company (Home Office: Minneapolis, MN)ReliaStar Life Insurance Company of New York (Home Office: Woodbury, NY)(the Company )Members of the Voya family of companiesCustomer Service: PO Box 1559, Hartford, CT 06144-1559 Phone: 877-884-5050 Use this form to REQUEST a WITHDRAWAL under the provisions of your annuity contract. Do not use this form to REQUEST a rollover, transfer, or exchange to another company. Please follow INSTRUCTIONS to avoid delays in processing your REQUEST . A distribution is a tax reportable event that may not be reversed. Check boxes are provided below to guide you as you complete each section of the Good orderPlease refer to this section of the form for important information .

2 For Employee Retirement Security Income (ERISA) plans only, complete and attach a Spousal Consent form. If the appropriate documentation or information is not received, your REQUEST may be considered not in good order, , Hardship WITHDRAWAL documentation. Future dated requests will not be accepted. c reTUrN CoMPLeTed ForMSComplete the form and mail or fax it to the Customer Service. Choose only one submission method. Multiple submissions may result in processing delays and/or duplicate CoNTrACT oWNer INForMATIoNPlease print clearly and complete the information requested in its entirety. If you are an Alternate Payee you are not required to complete this ALTerNATe PAYee INForMATIoNComplete this section if you are an Alternate Payee requesting a WITHDRAWAL due to a Qualified Domestic Relations WITHDRAWAL AMoUNTS elect option A, B, or C and specify the applicable dollar amount or percentage.

3 The Amount Available Free of WITHDRAWAL Charge option refers to the free amount as defined by the contract or prospectus. Please review your contract and/or prospectus for detailed information regarding WITHDRAWAL charges and other WITHDRAWAL provisions, as some products limit the number of withdrawals that can be requested. Net or Gross options Select one option if you are requesting a PARTIAL WITHDRAWAL or Hardship VArIABLe ANNUITY FUNd SeLeCTIoN For PARTIAL WITHdrAWALSIf you have a variable annuity contract and wish to have your PARTIAL WITHDRAWAL from a specific investment option, you may do so by specifying in this PARTIAL WITHDRAWAL To rePAY oUTSTANdING LoAN(S)Complete this section only if you are requesting a PARTIAL WITHDRAWAL and want to repay an active or defaulted outstanding loan balance(s) with amounts deducted from your contract value.

4 If completing this section, do not complete section reASoN For WITHdrAWALC omplete this section if the contract is a 403(b) or 401(a), or if the WITHDRAWAL is subject to a waiver of WITHDRAWAL charge due to disability or termination of employment as defined by the contract or prospectus. Also complete this section if you are requesting a WITHDRAWAL to repay a loan on your WITHDRAWAL CHArGe/MArKeT VALUe AdJUSTMeNT ACKNoWLedGMeNT Prior to processing your REQUEST , we require written acknowledgement of any WITHDRAWAL charge and/or market value adjustment of $500 or more. If not provided, your REQUEST will be returned for completion and re-submission. INSTRUCTIONS - Page 2 of 2 Order #119324 07/12/2021 TM: DISTRIBMNTc CoNTrACT oWNer, SPoUSe ANd ALTerNATe PAYee AUTHorIZed SIGNATUreS ANd TAX WITHHoLdING CerTIFICATIoNThe Owner s or Alternate Payee s, and if applicable the Joint Contract Owner and/or Spouse s signature is required on Page 6.

5 If the Owner lives in a community property state (AZ, CA, ID, LA, NM, NV, TX, WA, WI), the Spouse s signature is eMPLoYer, PLAN SPoNSor or NAMed FIdUCIArY AUTHorIZed SIGNATUre ANd CerTIFICATIoN ANd THIrd PArTY AdMINISTrATor AUTHorIZed SIGNATUre ANd CerTIFICATIoNAll 403(b) and 401(a) withdrawals will require certification and signature by your Employer or an authorized Third Party Administrator with few exceptions. Please contact your Employer, Plan Administrator, or TPA for their authorization and signature in section 12 and/or 13 before submitting your or fax your completed form to Customer Service. Keep a copy for your TAX WITHHoLdINGP lease read the Tax Withholding section carefully for important information . Read the attached State Income Tax Withholding Notification to determine your available state withholding eMPLoYer CoNTrIBUTIoNSThis section is to be completed by the Plan Sponsor or Third Party Administrator (TPA) for 403(b) contracts subject to ERISA or that have Employer contributions subject to vesting.

6 Contact your Employer to verify if your plan is subject to ERISA or has Employer contributions subject to CoNSerVATorSHIP/GUArdIANSHIP ANd dATeThe Conservator/Guardian signature is required on page 7 if there is an active Conservatorship/Guardianship on file. Page 1 of 9 Incomplete without all pages Order #119324 07/12/2021 TM: DISTRIBMNTFULL OR PARTIAL WITHDRAWAL REQUESTFIXED/VARIABLE ANNUITIESR eliaStar Life Insurance Company (Home Office: Minneapolis, MN)ReliaStar Life Insurance Company of New York (Home Office: Woodbury, NY)Members of the Voya family of companies(the Company )Customer Service: PO Box 1559, Hartford, CT 06144-1559 Phone: 877-884-5050 Use this form to REQUEST a WITHDRAWAL under the provisions of your annuity contract.

7 Do not use this form to REQUEST a rollover, transfer, or exchange to another transactions will be processed upon completion and receipt of this form and any other required document in good order. Good order is defined as receipt of any required information at our Service Center accurately and entirely completed, with any applicable signatures. If this form is not received in good order, including any required Employer, Plan Sponsor, or Third Party Administrator signature, a new form will be sent to you for completion and re-submission. If additional required documents are not properly executed and received within 30 days of receipt of the initial documentation, the entire submission will be closed and new paperwork will be required.

8 To allow adequate time for processing and reporting of your distribution in the current tax year, please return this form in good order by December 15. Sections 12 and 13 are not applicable to IRA or Non-qualified annuity contracts. For ERISA Plans only, complete and attach a Spousal Consent to Insurance Producer regarding New York Issued Annuity Contracts: Before making any recommendation, you must have adequate knowledge of the transaction you re recommending and provide your client with the relevant features of the annuity contract and potential consequences of the transaction, both favorable and unfavorable. If you have any questions about the annuity contract or transaction prior to making a recommendation, please contact the CoNTrACT oWNer information (Please print.)

9 MAIL CHeCK To:City ZIP State c Above addressc Alternate address (Please complete the following.)Address Good orderChoose only one submission method. Multiple submissions may result in processing delays and/or duplicate Note: All 403(b) and 401(a) withdrawals will require signature and certification by your employer or an authorized Third Party Administrator in section 12 or 13 with few exceptions. Please contact your employer or Plan Administrator for their signature and certification before submitting your form to the following address or fax Mail: overnight delivery: Fax:Customer Service Customer Service Customer ServicePO Box 1559 One Orange Way Toll-Free Fax: 800-382-5744 Hartford, CT 06144-1559 Windsor, CT 06095reTUrN CoMPLeTed ForMSContract Owner Name (Required) SSN/TIN (Required) City ZIP Phone State Address (Required) Contract Number (Required) (Financial transactions require a separate form for each contract.)

10 Joint Contract Owner Name SSN/TIN (Required) resident state for tax purposes: (If your current physical and/or mailing address is outside of your state of legal residence for tax purposes, please enter your tax state here and in section 9.)c Check here if the address provided below is your current permanent mailing address. We will update our records to reflect this address if not currently on the above box is not checked and the address provided above does not match the address we have on file, your REQUEST will be considered not in good order and a new form will be required. Page 2 of 9 Incomplete without all pages Order #119324 07/12/2021 TM: DISTRIBMNT2. ALTerNATe PAYee information (Please print.)