Search results with tag "Gross income"

CERTIFICATION OF MICRO ENTITY STATUS (GROSS INCOME …

www.uspto.govThe applicant qualifies as a small entity as defined in 37 CFR 1.27. (2) ... Revenue Code of 1986 (26 U.S.C. 61(a)), exceeding the “Maximum Qualifying Gross Income” ... had a gross income, as defined in section 61(a) of the Internal Revenue Code of 1986, exceeding the “Maximum Qualifying Gross Income” reported on

NJ 1040 V- NJ Gross Income Tax Payment Voucher

www.state.nj.usTitle: NJ 1040 V- NJ Gross Income Tax Payment Voucher Author: NJ Taxation Subject: NJ 1040V - NJ Gross Income Tax Payment Voucher Keywords: NJ 1040V - NJ Gross Income ...

THE INCOME TAX ACT. CHAPTER 340 - Ministry of Finance ...

finance.go.ugGross income. 17. Gross income. 18. Business income. 19. Employment income. 20. ... Priority of tax withheld. 128. Adjustment on assessment and withholding agent’s indemnity. ... Sixth Schedule Depreciation rates and vehicle depreciation ceiling. Seventh Schedule Currency point. CHAPTER 340 THE INCOME TAX ACT. ...

Part I Section 62.—Adjusted Gross Income Defined 26 CFR 1 ...

www.irs.govSection 61 of the Code provides that gross income means all income from whatever source derived, including compensation for services, fees, commissions, fringe benefits, and similar items. Section 62(a)(2)(A) of the Code and § 1.62-2(b) of the Income Tax Regulations provide that, for purposes of determining adjusted gross income, an employee may

CHILDCARE AND PARENT SERVICES (CAPS) Georgia’s Subsidy …

caps.decal.ga.gov8.3 Gross Income The family’s gross applicable income must meet income guidelines to participate in the CAPS program. 8.3.1 When a family is initially approved for CAPS services, the gross applicable income of the family unit must be equal to or less than 50% of the current State Median Income (SMI) at the time of application.

What is Included in Gross Income? - National Paralegal College

nationalparalegal.edu§ 61. Gross income defined. (a) General definition. Except as otherwise provided in this sub title [ 26 USCS §§ 1 et seq.], gross income means all income from whatever source derived , including (but not limited to) the following items: (1) Compensation for services, including fees, commissions, fringe benefits, and similar items;

Section 61.-- Gross Income Defined 26 CFR 1.61-1: Gross ...

www.irs.govSection 61.-- Gross Income Defined . 26 CFR 1.61-1: Gross Income. (Also § 165; 1.165-10) Safe Harbor Method for Determining a Wagering Gain or Loss from Slot Machine Play . Notice 2015-21 . This notice provides a proposed revenue procedure that, if finalized, will provide

The Use of Modified Adjusted Gross Income (MAGI) in ...

sgp.fas.orgDec 06, 2018 · Gross income is “all income from whatever source derived” 1 Brian T. Yeh authored this section of the report. 2 26 U.S.C. §62. The Use of Modified Adjusted Gross Income (MAGI) in Federal Health Programs ... (other than for members of the Armed Forces). For further information, see CRS

Form MO-A - 2020 Individual Income Tax Adjustments

dor.mo.govgross income - Attach a detailed list or all Federal Form(s) 1099 ..... 9. Any state income tax refund included in federal adjusted gross income. Other (description) 11. Exempt contributions made to a qualified 529 plan ..... 2. Partnership Fiduciary S Corporation Net Operating Loss (Carryback/Carryforward) 2Y. 00 2S. 00 1Y. 00 1S. 00 5.

Maine Revenue Services Individual Income Tax

www.maine.govNext, complete your Maine individual income tax return (Form 1040ME). On Form 1040ME, line 14, enter your federal adjusted gross income from federal Form 1040 or Form 1040-SR, line 11. This amount will reflect the amount of unemployment compensation you received that is excluded from federal and Maine income tax.

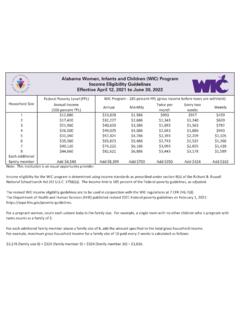

Alabama Women, Infants and Children (WIC) Program …

www.alabamapublichealth.govFor example, maximum gross household income for a family size of 10 paid every 2 weeks is calculated as follows: $3,178 (family size 8) + $324 (family member 9) + $324 (family member 10) = $3,826. WIC Program - 185 percent FPL (gross income before taxes are withheld) Household Size Alabama Women, Infants and Children (WIC) Program. Income ...

Applying for Affordable Housing: Applicant Income Guide

a806-housingconnect.nyc.gov• Armed Forces Reserves ... include gross income for each employer for the entire year. [PAGE 5] 2. INCOME FROM SELF-EMPLOYMENT Income from self-employment is all of the money you earn in a year from working for yourself, freelancing, or being an independent contractor. On your application, include the amount for the entire

Title 24: Housing and Urban Development

www.hud.govProgram income means gross income earned by the recipient that is directly generated by a supported activity or earned as a result of the award (see exclusions in §§84.24 (e) and (h)). Program income includes, but is not limited to, income from fees for services performed, the use

2022 Quick Tax Reference Guide - Voya

professionals.voya.comProvisional Income = Adjusted Gross Income + Nontaxable Income + 1/2 Social Security Benefits Age to receive full benefits Year of birth Full retirement age % reduced at age 62 1943-1954 66 25.00% 1955 66 and 2 months 25.83% 1956 66 and 4 months 26.67% 1957 66 and 6 months 27.50% 1958 66 and 8 months 28.33% 1959 66 and 10 months 29.17%

If the amount shown on Form W-2, Box 1, differs from the ...

apps.irs.govArmed Forces' Tax Guide, Table 1, and the Volunteer Resource Guide, Tab D, Income, are included in gross income, unless the pay is for service in a combat zone or in a qualified hazardous duty area. All includible military income will generally be shown on Form W …

Form MO-1040ES - Declaration of Estimated Tax for …

dor.mo.gov$400 on all income, with 90% of the adjusted gross income from Missouri; the Missouri estimated tax is $360 (90% of $400) . 6 . Changes in income - Even if your Missouri estimated tax on April 15 is such that you are not required to file a declaration at that time, the Missouri estimated tax may change so that you

Instructions for Form N-30, Rev 2020 - Hawaii

files.hawaii.govAct 61, SLH 2020 – The Renewable Energy . Technologies Income Tax Credit (RETITC) is ... set forth in section 1501 through 1505 and 1552, as amended. If the affiliated group in- ... DEFINED “Gross income” and “taxable income” are de-fined to have the same meaning as in the IRC of 1986, as amended, except as otherwise provided ...

Personal tax tip #51 - Maryland Office of the Comptroller

www.marylandtaxes.govmilitary retirement income, including death benefits you may be able to subtract up to . $5,000 of your military retirement income from your federal adjusted gross income if the taxpayer has not attained the age of 55 before determining your Maryland tax for tax year 2019, or up to $15,000 if the age of 55 or over.

Eligible Deferred Compensation Plans under Section 457 ...

www.irs.govnot includible in a participant=s gross income until that amount is paid to the participant or beneficiary. Section 457(a)(1)(B) retains the pre-EGTRRA rule that annual deferrals under a ' 457(b) plan of a tax-exempt entity and any income attributable to the amounts

Part I - IRS tax forms

www.irs.govSection 61(a) of the Internal Revenue Code defines gross income as income from whatever source derived, including (but not limited to) “compensation for services, including fees, commissions, fringe benefits, and similar items.” I.R.C. § 61(a)(1). Courts consistently have upheld the determination that wages fall within section

IRS Issues Final Section 415 Rules for Defined Benefit Plans

retire.prudential.comDefined Benefit Plans WHO'S AFFECTED These rules affect sponsors of and participants in qualified defined benefit plans, including multiemployer plans, governmental plans and nonelecting church plans. ... gross income. This important clarification allows non-resident aliens who do not have U.S.-source income to

Rev. Proc. 2017-29 SECTION 1. PURPOSE - IRS tax forms

www.irs.govlimitations on the depreciation deductions imposed on owners of passenger automobiles. Under § 1.280F-7(a) of the Income Tax Regulations, this reduction requires a lessee to include in gross income an amount determined by applying a formula to the amount obtained from a table. Table 5 applies to lessees of passenger

2020 Limitations Adjusted As Provided in Section 415(d ...

www.irs.govAccordingly, under § 408A(c)(3)(A), the adjusted gross income phase-out range for taxpayers making contributions to a Roth IRA is $196,000 to $206,000 for married couples filing jointly, increased from $193,000 to $203,000. For singles and heads of household, the income phase-out range is $124,000 to $139,000, increased from

Notice 2014-21 SECTION 1. PURPOSE

www.irs.govYes. Generally, self-employment income includes all gross income derived by an individual from any trade or business carried on by the individual as other than an

2021 Limitations Adjusted as Provided in Section 415(d ...

www.irs.govout range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000. The adjusted gross income limitation under § 408A(c)(3)(B)(ii)(I) for determining the maximum Roth IRA contribution for married taxpayers filing a joint return or for taxpayers filing as a qualifying widow(er) is increased from $196,000 to $198,000.

2019 Standard Mileage Rates SECTION 1. PURPOSE - IRS tax …

www.irs.govRev. Proc. 2010-51. However, § 11045 of the Tax Cuts and Jobs Act, Public Law 115-97, 131. Stat. 2054 (December 22, 2017) (the “Act”) suspends all miscellaneous itemized deductions that are subject to the two-percent of adjusted gross income floor under § 67, including unreimbursed employee travel expenses, for taxable years

MaineCare Eligibility Guide - Consumers for Affordable ...

www.mainecahc.orgIn Section 3, we explain how Modified Adjusted Gross Income or MAGI screening works and which groups it applies to. The steps to screen for eligibility are given with tools and resources. Section 4 takes you through non-MAGI categories and steps to screen for adults over 64, people with disabilities and others.

2020 Standard Mileage Rates - IRS tax forms

www.irs.govdeductions for expenses that are deductible in determining adjusted gross income are not suspended. For example, members of a reserve component of the Armed Forces of the United States (Armed Forces), state or local government officials paid on a fee basis, and certain performing artists are entitled to deduct unreimbursed employee

Internal Revenue Service Memorandum

www.irs.govPOSTS-125750-13 3 subtracting all ordinary and necessary business expenses (e.g., §162(a)) from gross income. In 1981, the Tax Court allowed …

Income & Resident Rent Calculation Worksheet - HUD …

files.hudexchange.info*The total income of the household (Annual Gross Income) is from all sources anticipated to be received in the 12-month period following the effective date of the income certification. Therefore, income must be ANNUALIZED, ... All regular pay, special pay and allowances of a member of the Armed Forces (Except Hostile Fire Pay). $0 . 9) ANNUAL ...

Similar queries

MICRO ENTITY, Gross Income, Defined, Section 61, NJ 1040 V, NJ 1040V, Income Tax, Income, Adjustment, Depreciation, Section, Gross income defined, Gross, Section 61.-- Gross Income Defined 26 CFR, Section 61.-- Gross Income Defined . 26 CFR, Armed Forces, Maine Revenue Services Individual Income Tax, Maine, Maine income tax, Gross household income, Size, Household Size, Applying for Affordable Housing: Applicant Income Guide, 24: Housing and Urban Development, Tax Reference, Military income, Of Estimated Tax, Missouri, Missouri estimated tax, Hawaii, De-fined, IRS tax forms, Rev. Proc. 2017-29, Household, Notice 2014-21, Annual, IRS tax, Standard Mileage Rates, Internal Revenue Service, Income & Resident Rent