Maine Revenue Services Individual Income Tax

Found 7 free book(s)Maine Revenue Services Individual Income Tax

www.maine.govIndividual Income Tax Booklet Form 1040ME Maine FastFile Electronic fi ling and payment services TAXPAYER ASSISTANCE and FORMS MAINE REVENUE SERVICES P.O. BOX 1060 AUGUSTA, ME 04332-1060 Printed Under Appropriation 010 18F 0002.07 Income Tax Assistance: (207) 626-8475 - Weekdays 9:00 a.m.- 12:00 p.m. Collection problems and …

INDIVIDUAL INCOME TAX Determining Residency Status - …

www.maine.govINDIVIDUAL INCOME TAX. Determining . Residency Status . GUIDANCE DOCUMENT . Maine Revenue Services, Income/Estate Tax Division . Last Revised: 2/21 . Residency Guidance – Page 2 of 10. INTRODUCTION . If you are a Maine resident for the entire tax year, you must pay Maine tax on all of your taxable income

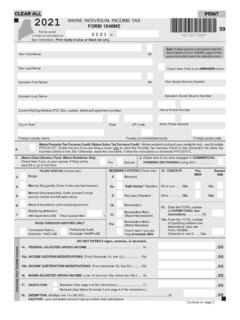

FORM 1040ME 99 For tax period 2 0 2 1 1/1/2021 to 12/31 ...

www1.maine.govMAINE INDIVIDUAL INCOME TAX. FORM 1040ME. For tax period. 1/1/2021 to 12/31/2021 or . 2 0 2 . 1. to. Check here if this is an . AMENDED. return. *2102100* See instructions. Print neatly in blue or black ink only. Your Social Security Number. Spouse’s Social Security Number. Home Phone Number. Work Phone Number. S. ingle. M. arried filing. j ...

Form SS-4 Application for Employer Identification ... - IRS

www.irs.govWithholding Tax Return for U.S. Source Income of Foreign Persons. c You file Schedule C, Profit or Loss From Business, Schedule C-EZ, Net Profit From Business, or Schedule F, Profit or Loss From Farming, of Form 1040, U.S. Individual Income Tax Return, and have a Keogh plan or are required to file excise, employment, or alcohol, tobacco, or

2021 Form 4868

www.irs.govfile a U.S. individual income tax return. 1. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or using a credit or debit card. See. How To Make a Payment, later. 2. You can file Form 4868 electronically by accessing IRS . e-file

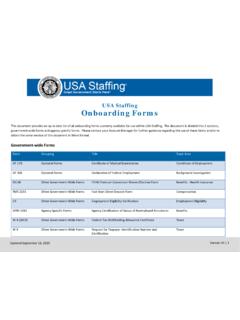

USA Staffing Onboarding Forms

help.usastaffing.govSep 18, 2020 · * These states either do not have state income tax and/or use the Form W-4 for taxes so therefore do not have an individual tax withholding form. **Latest version verified for all state tax forms 04/2020 . Agency Specific Forms . Form Grouping Title Agency Topic Area

Multistate Tax Symposium - Deloitte

www2.deloitte.commarket for services is in CT if and to the extent the services are used at a location in CT. For tax years beginning on or after January 1, 2014, sales, other than sales of tangible personal property, are “delivered” to Massachusetts (“MA”) if and to the extent that the taxpayer’s market for the services is in MA. G.L. c. 63, § 38(f).