Transcription of Surrender Application - Voya Financial

1 Page 1 of 3 - Incomplete without all pages. Order #131394 07/01/2020 The release of policy values may affect the guaranteed elements, non-guaranteed elements, face amount, or Surrender value of the policy from which the values are you are considering making changes in the status of your policy, you should consult with a licensed insurance or Financial your policy is an indexed universal life (IUL) insurance product and you have elected an indexed strategy, surrendering your policy before the block maturity date(s) will result in the loss of any index credit associated with each block. In such instances, you may earn only the minimum contractually-guaranteed interest rate in association with those blocks. You may wish to consider delaying Surrender until the index credit(s) is/are applied on the block maturity date(s). Alternatively, your policy may offer options allowing access to the funds in your policy which may minimize or avoid the loss of such index credits, such as a policy loan or partial withdrawal, if available.

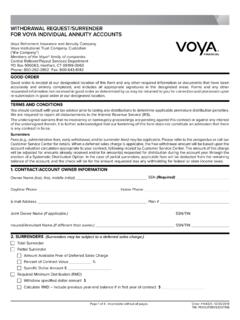

2 For additional information regarding available options, refer to your individual policy s black or blue ink and be sure to complete the Federal and State Withholding Election section on the next Code Number Owner SSN/TIN A. OWNER INFORMATIONSURRENDER APPLICATIONI nsured Name (First) (Middle Initial) (Last) Owner Name (First) (Middle Initial) (Last) Reminder to Producer regarding New York Issued Contracts: Before making any recommendation, you must have adequate knowledge of the transaction you re recommending and provide your client with the relevant features of the contract and potential consequences of the transaction, both favorable and unfavorable. If you have any questions about the contract or transaction prior to making a recommendation, contact the Life of Denver Insurance Company (SLD), Denver, COMidwestern United Life Insurance Company (MULIC), Indianapolis, INSLD and MULIC ( SLD/MULIC ) affiliatedReliaStar Life Insurance Company (RLIC), Minneapolis, MNReliaStar Life Insurance Company of New York (RLNY), Woodbury, NYRLIC and RLNY ( RLSTR ) affiliatedVenerable Insurance and Annuity Company (Venerable), Des Moines, IA(the Company )Customer Service, 2000 21st Ave.

3 , NW, Minot, ND 58703 Fax: 877-788-6303; Website: ; Completed forms can be emailed to: RLSTR and Venerable may provide administrative services to each other, but are otherwise unaffiliated. All contractual obligations under each insurance policy or contract are the sole responsibility of the issuing insurance To assist the Company in providing quality customer service, provide the reason for surrendering your policy: c No longer need coverage c Less expensive coverage elsewhere c Need access to Cash Value in policy c Other 1. I hereby Surrender to the Company the above numbered policy; all rights, title and interest in and to said policy, and any benefits provided therein; and all agreements, amendments, endorsements, and riders attached thereto and made a part The Surrender of said policy shall be effective on the date specified in your policy s contractual provisions or, if the policy is silent, the date of our receipt of the properly executed Surrender Application at Customer Will any of the proceeds of this Surrender be used to fund any new life insurance or annuity?

4 C Yes c No If yes, list the company providing the new policy: Note: Your agent must comply with the replacement regulations in your state. 4. I hereby certify that I am of legal age, that said policy is not assigned or pledged, and that said policy is not subject to any bankruptcy proceedings, attachment, or other lien or claim, except as follows: 5. If more than one policy number is listed above, the word policy shall mean policies. c Optional Overnight: By checking this box, you agree to a $25 deduction from the net disbursement amount. Overnight delivery is only available to the current physical address on record and may not be available in all locations.

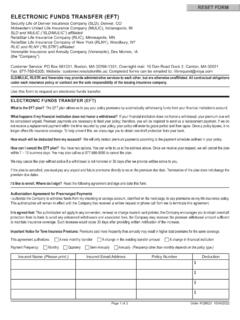

5 Note: selection of the overnight delivery option does not change the standard processing time and does not include Saturday delivery. Page 2 of 3 - Incomplete without all pages. Order #131394 07/01/2020C. WITHHOLDING ELECTIONSIf this contract is under a plan which is subject to ERISA, complete the information in this section. If I am married, my spouse must sign the spousal consent. If I do not complete the information in this Section, my signature below is certification that the contract is not subject to ERISA and/or that I am not undersigned verifies that the payment requested is in accordance with the terms of the plan, applicable law and Phone ( ) B. ERISA PLANSE mployer Name Employer or Plan Administrator Signature Date Participant s Spouse Signature Date Regardless of whether or not federal or state income tax is withheld, you are liable for taxes on the taxable portion of the payment.

6 If you do not have a sufficient amount withheld, you may be subject to tax penalties under the Estimated Tax Payment rules. An election made for a single non-recurring distribution applies only to the payment for which it is being made. For recurring payments, your withholding election will remain in effect until it is changed or revoked. You may change or revoke your election at any time prior to a payment being made by submitting IRS form W-4P. persons having their payment delivered outside the or its possessions may not make an election of NO withholding. In this case, if you choose no withholding, the default rate will be applied. Non-resident aliens are subject to a mandatory 30% withholding rate unless they are eligible for a reduced rate or exemption under a tax treaty and the required documentation is payments 10% withholding: Non-periodic, non-rollover eligible payments from pensions, annuities, IRA s and life insurance contracts are subject to a flat 10% federal withholding rate unless you choose not to have federal income tax withheld.

7 These include for example, required minimum distributions, hardship withdrawals, and distributions from IRA s that are payable on demand. You can choose not to have withholding applied to your non-periodic distribution by checking the applicable box below. You may also elect withholding in excess of the flat 10% Withholding Instructions:c I do not want to have federal income tax withheld from my I would like to have the following federal income tax withheld from my distribution:$ or %.Additional amount you want withheld from your payment(s) $ or % (Note: This amount is in addition to the standard federal withholding rate applicable to your distribution.)State Withholding Instructions:My residence state for tax purposes is _____ (If your current physical and/or mailing address is outside of your state of legal residence for tax purposes, enter your tax state here. If no state or territory is on record and one is not specified, we will presume this income is not reportable to any state or territory.)

8 C I do not want to have state income tax withheld from my I would like to have the following state income tax withheld from my distribution:$ or %.(If you make this election, a dollar amount or percentage must be specified and cannot be less than any required withholding.)If you make this election, a dollar amount or percentage must be specified and cannot be less than any required withholding. If you do not make an election or if your state requires a greater amount of withholding, we will withhold at the rate specified by your state of residence for the type of payment you are receiving. In some cases, your state specific withholding election form is required to opt out of withholding or to choose a rate other than the state s default rate. Refer to the attached State Income Tax Withholding Notification and/or your State Department of Taxation for details. Page 3 of 3 - Incomplete without all pages. Order #131394 07/01/20201 Completion of Section D or a Spouse signature is required if the owner lives in a community property state (AZ, CA, ID, LA, NM, NV, TX, WA or WI).

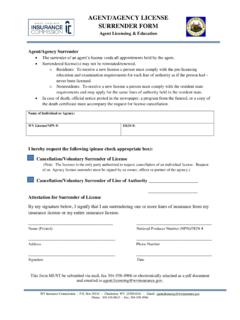

9 To avoid a delay in processing, verify that all required signatures are complete. By signing this form, I acknowledge that the information provided is complete and accurate. If this is a qualified policy, I also acknowledge receipt of the Special Tax Notice and waive the 30-day notice Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Owner Address (Provide full street address for tax purposes.) Agent Signature (optional) Date Spouse Signature 1 Date Irrevocable Beneficiary Signature (if applicable) Date Owner Signature Date City State ZIP Daytime Phone ( ) Owner Title (If the owner is a trust, partnership, or corporation, a signature is required from an officer, partner, corporate representative or authorized corporate representatives. If a trust, partnership or corporation, attach corporate resolution or Trust Certification.)

10 If entity has had a name change, include supporting documentation of successor in interest with listing of authorized signatories.)Irrevocable Beneficiary Title (If the owner is a trust, partnership, or corporation, a signature is required from an officer, partner, corporate representative or authorized corporate representatives. If a trust, partnership or corporation, attach corporate resolution or Trust Certification. If entity has had a name change, include supporting documentation of successor in interest with listing of authorized signatories.) Date Assignee Signature (if applicable) E. TAXPAYER CERTIFICATIONSD. COMMUNITY PROPERTY STATE REQUIREMENTS (If the owner currently lives in a community property state (AZ, CA, ID, LA, NM, NV, TX, WA or WI), a spouse signature is required unless one of the two areas are completed below. Failure to provide a spouse signature or the completion of this section will result in a delay in completing the requested change.