Transcription of JPMorgan Investment Account Agreements and Disclosures …

1 Investment Account Agreements and Disclosures booklet Investment AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMorgan CHASE BANK, OR ANY OF ITS AFFILIATES. SUBJECT TO Investment RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. CONTENTS. How this booklet Works Agreements . General Terms and Conditions Brokerage Account Agreement Investment Advisory Services Account Agreement Individual Retirement Account Agreements Morgan Securities LLC Traditional IRA Custodial Agreement Morgan Securities LLC Roth IRA Custodial Agreement Disclosures . Individual Retirement Account Disclosures Traditional Roth Nonbank Custodian Approval Letter SIPC Protection Business Continuity Disclosure Privacy Notice JPMorgan Chase Deposit Account Fees and Commissions Schedules HOW this booklet WORKS.

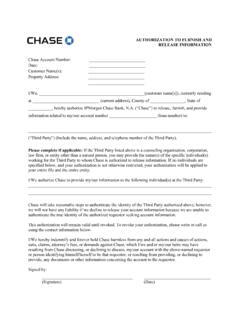

2 The Morgan Investment Account Agreements and Disclosures booklet ( booklet ) is for clients of Morgan Wealth Management (JPMWM). It contains the general terms and conditions, Account Agreements and Disclosures that apply to the accounts offered by JPMWM. through Morgan Securities LLC (JPMS), a broker-dealer and Investment adviser registered with the Securities and Exchange Commission. this booklet applies to accounts and services provided through a Morgan Private Client Advisor (PCA) or through a Morgan Financial Advisor (FA). Product offerings fees, commissions, and other expenses may vary depending on whether you opened your Account with a PCA or FA. By signing the Application, you're agreeing to the Agreements and acknowledging receipt of the Disclosures contained in the booklet , which will apply to any Investment Account and services referenced in the Application and to any like-titled Account you open or services you receive in the future.

3 For any like-titled accounts you open in the future, you'll need to sign an Additional Account Acknowledgement (Acknowledgement) where you will confirm that the most current version of the booklet applies to these additional accounts, as well as other JPMS accounts you currently maintain. The booklet applies to JPMS and its respective successors or assigns and binds you and your estate, heirs, executors, administrators, trustees, personal representatives, receivers, successors and assigns. In the event any material changes are made to the booklet , we will let you know. The most current version of the booklet will be posted in the Agreements and Disclosures section of the website you use to access your JPMS accounts or is available from your PCA or FA. By continuing to maintain your JPMS accounts, you are agreeing to the amended terms. You should review the booklet and keep a copy for your records.

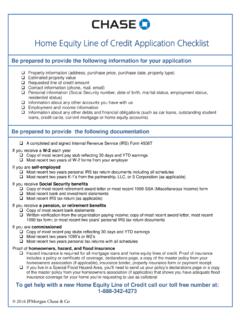

4 If you have any questions, contact your advisor to discuss. The booklet is broken down into two main parts. The first part is entitled Agreements and is made up of the General Terms and Conditions, which apply to all your accounts with JPMS, and the specific Account Agreements applicable to your brokerage and/or advisory accounts (including Individual Retirement Accounts (IRAs)). The second part is entitled Disclosures and contains important information related to your IRAs; information about SIPC protection; the JPMorgan Chase Deposit Account , which you may use for your sweep option;. how your personal information is handled by the firm; business continuity; and brokerage fees and commissions. Thank you for your trust. We look forward to helping you with your financial goals. 33000i_CWM 1 CLIENT COPY RETAIN FORM YOUR RECORDS. GENERAL TERMS AND CONDITIONS.

5 1. The Parties You You refers to a client of JPMWM, whether individual, joint or entity/trust and any person authorized to act on a client's behalf. Certain Agreements may use other terms to describe you as the Account owner. If that occurs, these other terms will apply. JPMS JPMS means Morgan Securities LLC, which is the broker-dealer and registered Investment advisor for your Morgan Wealth Management accounts. JPMS is also the non-bank custodian for your traditional and IRAs. References to us , we and our shall mean JPMS. 2. Definitions The following terms have the following meanings throughout this booklet : Accounts Accounts mean the JPMS accounts you have opened through a PCA or FA that are subject to the terms, conditions and Agreements in this booklet regardless of when you opened them. Applicable Law Applicable law includes constitutions, rules, regulations, customs and usages of the exchange or market and its clearinghouse where securities transactions are settled by JPMS, and all applicable laws, rules and regulations of federal and state authorities and self-regulatory agencies including, but not limited to, the Securities and Exchange Commission, the Board of Governors of the Federal Reserve System, and the Financial Industry Regulatory Authority.

6 Chase Bank Chase Bank means JPMorgan Chase Bank, , which is an affiliate of JPMS. Important Account Important Account Documents include your Application, the booklet (as amended from time to time) and Documents the Welcome Package you received confirming your Account information, as well as the Client Relationship Summary and Guide to Investment Services and Brokerage Products. 3. Additional Information for Certain Accounts Please read this section carefully. You should discuss how to structure your Accounts with your legal and tax advisors. The type, title and form of Account you choose may have consequences for taxes, ownership, and estate planning. JPMS and its affiliates do not provide accounting, legal, and estate planning or tax advice. Accounts for Minors If you open a Uniform Transfers or Gifts to Minors Act (UTMA/UGMA) Account , the minor is the owner and the client of JPMS.

7 The person opening the Account is custodian where decisions have to be made for the benefit of the minor. The custodian's authority, rights and obligations are based on state law. When the minor reaches the age of majority, the custodial relationship ends and the custodian is required to turn over the assets to the control of the owner. Transfer on Death If you add a Transfer on Death (TOD) Designation, the Account will be held for the benefit of the Designation beneficiaries you designate. Upon the death of the last surviving Account owner, ownership of the assets in the Account will pass to the surviving beneficiaries rather than your estate in accordance with the terms of your TOD agreement. TOD Accounts may not be available in all states and are available only for Accounts eligible to hold securities. Individual Retirement If you specify that your Account be opened as an IRA, any language in these General Terms and Conditions Accounts or related Agreements that may conflict or be inconsistent with the applicable IRA custodial agreement or the provisions of the Internal Revenue Code of 1986, as amended (Code) and the regulations thereunder that govern IRAs shall be interpreted to be consistent and in compliance with the IRA custodial agreement and those provisions of the Code and regulations thereunder.

8 To the extent it is not possible to interpret such language to be consistent and compliant with such IRA custodial agreement or those Code provisions and regulations, then such language shall be of no force or effect to the extent of such inconsistency or noncompliance. Qualified Retirement If you open a Qualified Retirement Plan, you will be required to sign a Trustee and Plan Certification (and Plan Accounts potentially other documentation). You will be the fiduciary of the plan, and the Account must be opened under the tax identification number of the plan (as opposed to any individual or entity on behalf of or for which the plan is established). You are responsible for ensuring that opening the Account for the plan is consistent with, and will not violate any provision of, any plan document or Applicable Law. 33000gtc_CWM 1 CLIENT COPY RETAIN FORM YOUR RECORDS.

9 GENERAL TERMS AND CONDITIONS. 4. Cost Basis Information and Reporting The Code requires JPMS to report to you and the IRS cost basis and other relevant information (collectively Cost Basis Information). concerning your non-retirement Accounts. The Cost Basis Information reported can vary depending on the cost basis method applicable to the investments within your Account . The cost basis method applied to your Account determines the order in which shares are redeemed when you sell your investments. JPMS' default cost basis method is First In, First Out (FIFO) for all Investment types. You can pick your cost basis method at Account opening and change it after your Account is opened so long as your selections comply with the Code. In addition, JPMS or your portfolio manager, as applicable, may select your cost basis method for certain discretionary managed Account programs.

10 Please refer to the section titled Cost Basis Method in Discretionary Managed Account Programs in the Advisory Agreement for more detail. Please note that if your Account was opened prior to September 14, 2020, the default cost basis method for investments held in your Account is FIFO for individual securities and Average Cost for Regulated Investment Companies ( , mutual funds, ETFs). You are solely responsible for determining the cost basis method for your Account and you should consult with your own tax and accounting advisors to determine which cost basis method is best for you. 5. Your Representations and Warranties By signing the Application or Acknowledgement, you are telling us that the information you provide us is accurate, true and complete and that we may rely on it in opening Accounts and providing you with services. this information includes: If each Account Owner is You are of the age of majority according to the law of your state of residence and are able to enter into an individual and perform the obligations contained in this booklet on your behalf or, in the case of a custodial Account , on behalf of the Account Owner.