Transcription of NALSAR PROXIMATE EDUCATION NALSAR …

1 NALSAR PROXIMATE EDUCATION . NALSAR university OF LAW, HYDERABAD. IN CYBER LAWS. 2001-02. PAPER 3- E-COMMERCE & taxation . TIME: 2 HOURS MARKS: 60. INSTRUCTIONS TO CANDIDATES. questions to be interpreted as given and no clarification can be sought from the invigilator. 2. All questions carry equal marks 3. Clearly indicate the Question numbers ANSWER ANY FOUR OF THE FOLLOWING QUESTIONS. 1. Write Short Notes on: (a) Legal Recognition of Digital Signatures (b) Certification Authorities (c) Privity of Contracts 2. Write Short Notes on: (a) Electronic Data Interchange EDI. (b) E-Money (c) Electronic Fund Transfers 3. Discuss the UNCITRAL Model Law for Electronic Commerce. What is the Indian Legal Position on Electronic Commerce? 4. Discuss the broad structure for taxation in India for Individuals & Corporates 5. Intangibles form an important part of the goods traded over the Internet.

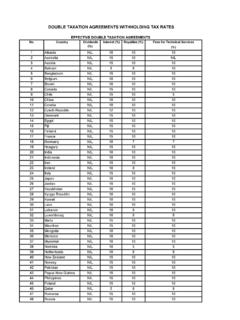

2 What is the tax treatment of such intangibles and what are the problems National Tax Agencies face in taxing Internet-based commerce? With the evolution of Information goods what are the challenges that present tax regimes are bound face? 6. International taxation presently is governed largely by Double taxation Treaties. In light of this statement: (a) What is Double taxation ? How is it remedied? (b) Discuss briefly the OECD & UN Model Conventions on Double taxation (c) Is there a need for a Global Structure for International taxation for E-Commerce?