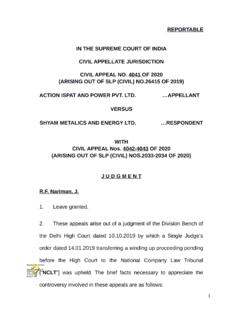

Transcription of Reportable IN THE SUPREME COURT OF INDIA CIVIL …

1 Reportable IN THE SUPREME COURT OF INDIA . CIVIL APPELLATE JURISDICTION. CIVIL Appeal No 1155 of 2021. (Arising out of SLP(C) No 1688 of 2021). M/s Radha Krishan Industries ..Appellant Versus State of Himachal Pradesh & Ors.. Respondents JUDGMENT. Dr Dhananjaya Y Chandrachud, J. A Factual Background B Submissions Maintainability of the writ petition before the High COURT Challenge on merits: improper invocation of Section 83. C Legal Position Maintainability of writ petition before the High COURT Provisional Attachment Delegation of authority under CGST Act D Analysis Signature Not Verified Digitally signed by E Summary of findings Chetan Kumar Date: 12:52:57 IST. Reason: 1. PART A. A Factual Background 1 This appeal raises significant issues of public importance, engaging as it does, the interface between citizens and their businesses with the fiscal administration.

2 Legislation enacted for the levy of goods and services tax confers a power on the taxation authorities to impose a provisional attachment on the properties of the assessee, including bank accounts. The legislation in Himachal Pradesh, which comes up for interpretation in the present case, has conferred the power on the Commissioner to order provisional attachment of the property of the assessee, subject to the formation of an opinion that such attachment is necessary in the interest of protecting the government revenue. What specifically, is the ambit of this power? What are the safeguards available to the citizen? In interpreting the law, the COURT has to chart a course which will ensure a fair exercise of statutory powers.

3 The legitimate concerns of citizens over arbitrary exercises of power have to be protected while ensuring that the legislative purpose in entrusting the authority to order a provisional attachment is fulfilled. The rule of law in a constitutional framework is fulfilled when law is substantively fair, procedurally fair and applied in a fair manner. Each of these three components will need to be addressed in the course of interpreting the tax statute in the present case. 2 This appeal arises from a judgment and order dated 1 January 2021 of a Division Bench of the High COURT of Himachal Pradesh. The High COURT dismissed the writ petition instituted under Article 226 of the Constitution challenging orders of provisional attachment on the ground that an alternate remedy is available.

4 2. PART A. The appellant challenged the orders issued on 28 October 2020 by the Joint Commissioner of State Taxes and excise , Parwanoo1 provisionally attaching the appellant's receivables from its customers. The provisional attachment was ordered while invoking Section 83 of the Himachal Pradesh Goods and Service Tax Act, 20172 and Rule 159 of Himachal Pradesh Goods and Service Tax Rules, 20173. While dismissing the writ petition on grounds of maintainability the High COURT was of the view that the appellant had an alternative and efficacious remedy' of an appeal under Section 107 of the HPGST Act. 3 At issue in this case is whether the orders of provisional attachment issued by the third respondent against the appellant on 28 October 2020 are in consonance with the conditions stipulated in Section 83 of the HPGST Act.

5 The answer to this will require the COURT to embark on an interpretative journey of unravelling the substantive and procedural content of the power. The preliminary issue is whether the High COURT was right in concluding that the provisional attachment could not be challenged in a petition under Article 226. 4 The facts in the context of which this case arises are thus: the appellant manufactures lead according to the specific requirements of its clients, and has a factory at village Meerpur Gurudwara, Kala-Amb in the District of Sirmaur of Himachal Pradesh. The appellant has been in the same line of business since 2008. Upon the introduction of the Goods and Services tax4, the appellant 1. third respondent . 2. HPGST Act.

6 3. HPGST Rules . 4. GST . 3. PART A. migrated to and was registered under GST - GSTIN No. O2 AAKFR7402H2ZE - with effect from 1 July 2017. 5 On 3 October 2018, a notice5 was issued to the appellant under Section 74 of the HPGST Act and the Central Goods and Services Tax Act6 by the third respondent requiring it to appear on 9 October 2018 and produce (i) invoices pertaining to inward and outward supplies for the years 2017-18 and 2018-19; (ii). party-wise summary/ledger of inward supplies; (iii) proof of payment of GST with a commodity-wise breakup; and (iv) copies of GSTR-1, GSTR-2 and GSTR-3. returns from July 2017 to July 2018. The appellant appeared before the third respondent and submitted original tax invoices pertaining to inward and outward supplies for 2017-18 and 2018-19 by a letter dated 15 October 2018.

7 6 On 10 October 2018, a detection case' was registered against GM. Powertech, Kala-Amb7, one of the suppliers of the appellant, under Section 74 of the HPGST Act and the CGST Act read with Section 20 of the Integrated Goods and Services Tax Act, 20178. This was through a search and seizure under Section 67 of the HPGST Act and CGST Act. The partners of GM Powertech were arrested on 3 December 2018 on the ground of raising fraudulent claims of input tax credit9 from fake/fictitious firms in Delhi and Kanpur. 7 The appellant received a memo by an e-mail dated 15 December 2018. from the third respondent directing it to be present on 17 December 2018 for 5. The respondents before this COURT have stated that the said document was in fact a memo under Section 70 of HPGST Act and not a show cause notice, and it was inadvertently mentioned that it was a notice issued under Section 74 of the HPGST Act.

8 6. CGST Act . 7. GM Powertech . 8. IGST Act . 9. ITC . 4. PART A. explaining the allegedly illegal claim of ITC made during 2017-18 and 2018-19. By its letter dated 17 December 2018, the appellant contended that it had validly claimed ITC as it fulfilled the conditions under Section 16 and other provisions of the HPGST Act and the CGST Act. 8 On 9 January 2019, a notice10 was issued to Fujikawa Power, Bagbania, BBN Baddi, one of the customers of the appellant, for provisionally attaching an amount of Rs. 5 crores due to the appellant, under Section 83 of the HPGST Act. On 19 January 2019, the third respondent passed an order of provisional attachment in respect of receivables worth Rs. 5 crores due from Fujikawa Power.

9 This order inadvertently referred to Sarika Industries instead of the appellant. The appellant responded by a representation dated 29 January 2019, claiming inter alia, that the order of attachment was without affording a hearing. The appellant also claimed that on 26 December 2018, they had noticed that the ITC had been blocked without prior notice. On 30 January 2019, the notice of attachment was withdrawn by the third respondent. 9 According to the respondents, after the case of GM Powertech was investigated, tax evasion was detected. GM Powertech was found to have claimed and utilized ITC against invoices issued by fake fictitious firms without actual movement of goods GM Powertech had issued invoices to various recipients in Himachal Pradesh including the appellant.

10 On 4 July 2020, the third respondent issued an intimation to the appellant under Section 74(5) of the HPGST Act of tax ascertained as being payable11, advising it to pay tax, interest 10. SCN . 11. Form GST DRC-01A. 5. PART A. and penalty of Rs. crores. The appellant was given an opportunity to file its submissions against the ascertainment of the amount by 4 August 2020. 10 A tax liability of Rs crores was confirmed against GM Powertech on the conclusion of the proceedings against it. GM Powertech was found to have no business establishment or property in Himachal Pradesh and the case was considered to fall into the category of a serious tax fraud. 11 On 21 October 2020, the Commissioner of State Taxes and excise , Himachal Pradesh12 delegated his powers under Section 83 of the HPGST Act to the third respondent.

![[DEFAULT / OTHER MATTERS] [SERVICE/COMPLIANCE] …](/cache/preview/4/8/a/c/d/7/0/e/thumb-48acd70e206083f8f3d37421a64ec859.jpg)