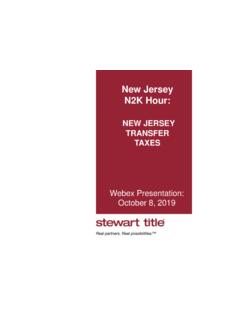

Transcription of STATE LAWS AND CUSTOMS - Stewart

1 STATE Laws and CUSTOMS ToolkitStewart title Stewart Title1980 Post Oak , TX 77056 (800) Post Oak Boulevard Houston, TX 77056 (800) Stewart SISCO-1414-89-8 10/14 2K STATE LAWS AND CUSTOMSI nformation for the STATE Laws and CUSTOMS Toolkit has been obtained by Stewart title from sources believed to be reliable. However, because of the possibility of human or mechanical error, whether by our sources or by others, Stewart title does not guarantee the accuracy, adequacy or completeness of any information contained herein. Stewart title does not make any express or implied warranties with regard to the use or freedom from error of any of the information and shall not be responsible for any errors or omissions or for the results obtained from the use of such information.

2 Additionally this information is provided with the understanding that Stewart title is not engaged in rendering legal, accounting, or other professional advice or services. If legal advice or services or other expert assistance is required, the services of a competent professional person should be sought. Issued: 05/15 title Guaranty Company is a subsidiary of Stewart Information Services Corporation. 2014 no. SW-COC-002805 title Insurance RatesState Encumbrance FormsCustomary Closing EntityCommitment Issued?Duration of CommitmentWhen is Bill Issued?

3 Deed Transfer Tax?Mortgage Tax?Leasehold Tax?Owner s Policy PremiumLoan Policy PremiumTitle Search & ExamSurvey ChargesDeed Transfer Ta xClosing FeesRecording FeesNEVADAF iledDeed of TrustTitle or escrow company; OthersUpon request6 monthsWhen policy issuesY, Real Property Transfer Ta xNNNegotiable;Usually included, additional charges for additional work, multiple parcels, equally, can be negotiatedNegotiable; Seller usually pays in the NorthNVNEW HAMPSHIREF iledMortgageTitle or escrow company; AttorneyUpon request6 monthsAt closing Y, Deed Transfer TaxNN;;;;Divided equally.

4 KNHNEW JERSEYF iledMortgageAttorney: North NJ; title company: South NJY6 monthsInvoice with commitmentYNN, If lease is less than 99 years;;;;1 million or less paid by Seller; 1 million or more Seller pays Transfer Tax and Buyer pays Mansion TaxParties sometimes agree to split; Usually Buyer in North Jersey;NJNEW MEXICOP romulgated rates set biennially by superintendant of insuranceMortgage; Deed of Trust (rare) title companyY6 months (renewable for 3 successive 6-mo. periods)At closingNNN; Negotiable; NegotiableIncluded in premium; separate title commitment fee usually paid by Seller; NegotiableN/AResidential: Seller usually pays.

5 Commercial: usually divided equallyKNMNEW YORKF iledMortgageAttorneyNN/AInvoice with title reportY, Deed Excise Tax YY, Subject to type of transactionNew York-style closing requires simultaneous transfer of documents and consideration at meeting of parties. Recording takes place later. Most closing costs, including title insurance, are paid by Buyer. NYC Transfer Tax usually paid by Seller; STATE Real Estate Transfer Tax paid by Seller unless contractually negotiated to CAROLINAF iledDeed of Trust; Mortgage (rare)Attorney; Non-attorney closing/settlement officeY6 monthsInvoice with commitmentY, Deed Excise Tax NN;;;; uNegotiable;NCNORTH DAKOTAF iledMortgage; Deed of Trust (rare) title or escrow company; OthersY6 monthsInvoice with commitmentNNN;;Exam paid by Buyer; Search is paid for by Seller Typically paid by Seller, if neededN/A;KNDOHIOF iledMortgage title or escrow company.

6 OthersY6 monthsInvoice with commitmentY, Conveyance Fee Seller paysNNNegotiable; Usually divided equally;u; Sometimes negotiableuNegotiable; Usually divided equallyKOHOKLAHOMANot filedMortgageTitle or escrow company; OthersY6 monthsInvoice with commitment or at closingY, Documentary Stamp Ta xYN;;uu Sometimes negotiableuNegotiable; Usually divided equallyKOKOREGONF iledDeed of Trust; Mortgage (rare) title or escrow company; OthersUpon request; Rarely issued6 monthsAt closingN, Except Washington CountyNNu;Included in premium;Washington County only; Divided equallyNegotiable; Usually divided equallyKORPENNSYLVANIAF iledMortgage; Deed of Trust (rare) title or escrow company; AttorneyY6 monthsInvoice with commitmentY, STATE and MunicipalNY, If lease term is 30 years or more;;Included in premium;Divided equallyIncluded in premiumKPARHODE ISLANDF iledMortgageTitle company; AttorneyY6 monthsWhen policy issuedY, STATE Transfer TaxNN;;; Not included in premium;u; Except Seller settlement fees;RISOUTH CAROLINAF iledMortgageAttorneyY6 monthsAt closingY, Transfer FeeNN;;;; Sometimes negotiableu.

7 SCSOUTH DAKOTAF iledMortgageTitle or escrow company; OthersY6 monthsInvoice with commitmentY, Real Estate Transfer TaxNNDivided equally;; Not included in premium; Sometimes negotiableuDivided equally;SDTENNESSEEF iledDeed of TrustTitle company; AttorneyY6 monthsInvoice with commitmentY, Deed Transfer TaxYNVaries;Varies Negotiable;Divided equally;TNTEXASP romulgated rate by STATE insurance departmentDeed of Trust and Vendor s LiensTitle or escrow company; Lender; OthersY90 daysAt closingNNNu;Included in premiumFree to lender; Optional on OTP (5% to 15%)N/ASet by escrow agentKTXUTAHF iledDeed of TrustTitle companyY6 monthsAt closing; Sometimes when policy issuesNNNu;Included in premiumNegotiatedN/ADivided equally;UTVERMONTF iledMortgageAttorneyY6 monthsAt closing YNN;;; Not included in premiumN/A;; Except Seller's attorney's fees, wire fee, Zoning Compliance letter and real estate professional commissionsBuyer, $10 per page, $10 flat fee to record Property Transfer Tax ReturnsVTVIRGINIANot filedDeed of Trust; Mortgage (rare) title or escrow company; Attorney.

8 OthersY6 monthsAt closingY Y, STATE , local may applyY, STATE , local may apply;;;;Buyer pays grantee taxes ( STATE and local); Seller usually pays grantor s taxBuyer pays most closing fees except Seller s settlement feeBuyer: Pays everything else; Seller: Pays for releases and grantor s tax VAWASHINGTONF iled; Subject to sales taxDeed of Trust; MortgageTitle company or independent escrow company that must employ limited practice officer to conduct closing; AttorneyY6 monthsAt closingY, Real Estate Excise TaxNNu;Included in premium; Sometimes negotiableuSplit evenly between the partiesKWAWEST VIRGINIAF iledDeed of Trust; MortgageAttorneyY6 monthsAt closingY, STATE and County Excise TaxesNN;;;;uBuyer pays most closing fees except Seller s settlement feeKWVWISCONSINF iledMortgage and Security AgreementTitle or escrow company; OthersY6 monthsInvoice with commitmentY, Real Estate Transfer FeeNNu;Sometimes included in premium but negotiable if not includedNegotiableuBuyer: All recording fees.

9 Seller: Document preparation feesKWIWYOMINGF iledMortgageTitle companyY6 monthsPaid at closingNNNu;Included in premiumNegotiableN/ADivided equally unless there is an out of STATE lender; Buyer pays an additional loan closing feeKWYLEGENDSTATE LAWS AND CUSTOMSC ustomary Fee Splits:; Buyer/Borroweru SellerK Buyer/Borrower pays to record deed and mortgage; Seller pays to record documents to remove encumbrancesTitle Insurance RatesState Encumbrance FormsCustomary Closing EntityCommitment Issued?Duration of CommitmentWhen is Bill Issued?Deed Transfer Tax?Mortgage Tax?

10 Leasehold Tax?Owner s Policy PremiumLoan Policy PremiumTitle Search & ExamSurvey ChargesDeed Transfer TaxClosing FeesRecording FeesALABAMAF iledMortgageTitle or escrow company/AttorneyY6 monthsInvoice with commitmentY, Deed TaxYYNegotiable;NegotiableNegotiableNego tiable, but usually paid by purchaserNegotiableNegotiable, but usually paid by purchaserALALASKAF iledDeed of TrustTitle or escrow company; OthersY6 monthsAt closingNNNu Sometimes negotiable;Included in premiumu Sometimes negotiableN/ANegotiable; Usually divided equallyNegotiable; Usually divided equallyAKARIZONAF iledDeed of Trust; MortgageTitle or escrow company; OthersY6 monthsAt closingNNNu;Included in premiumNegotiableN/ADivided equallyNegotiableAZARKANSASNot filedDeed of Trust; MortgageAbstract/ title companyY6 monthsInvoice with commitmentY, Deed Transfer TaxNNu;Sometimes included in premium depends on local customNegotiableu Affidavit of valueDivided equally;ARCALIFORNIAF iledDeed of TrustTitle or escrow company.