Transcription of STATEMENT OF FINANCIAL CONDITION AND ... - TD …

1 STATEMENT OF FINANCIAL CONDITION AND SUPPLEMENTAL INFORMATIONTD ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation)September 30, 2019 With Report of Independent Registered Public Accounting FirmTD ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation) STATEMENT of FINANCIAL CONDITION and Supplemental InformationSeptember 30, 2019 ContentsReport of Independent Registered Public Accounting Firm.. STATEMENT of FINANCIAL CONDITION ..Notes to the STATEMENT of FINANCIAL CONDITION ..Supplemental InformationSchedule I - STATEMENT of Segregation Requirements and Funds in Segregation ForCustomers Trading on Commodity Exchanges Pursuant to Regulation 4(d)(2)Under the Commodity Exchange Act..12317A member firm of Ernst & Young Global Limited Ernst & Young LLP 5 Times Square New York, NY 10036-6530 Tel: +1 212 773 3000 Fax: +1 212 773 6350 1 Report of Independent Registered Public Accounting Firm To the Board of Directors and Member of TD ameritrade Futures & Forex LLC Opinion on the FINANCIAL STATEMENT We have audited the accompanying STATEMENT of FINANCIAL CONDITION of TD ameritrade Futures & Forex LLC (the Company) as of September 30, 2019 and the related notes (the FINANCIAL STATEMENT ).

2 In our opinion, the FINANCIAL STATEMENT presents fairly, in all material respects, the FINANCIAL position of the Company at September 30, 2019, in conformity with the generally accepted accounting principles. Basis for Opinion This FINANCIAL STATEMENT is the responsibility of the Company s management. Our responsibility is to express an opinion on the Company s FINANCIAL STATEMENT based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB and in accordance with auditing standards generally accepted in the United States of America.

3 Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the FINANCIAL STATEMENT is free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the FINANCIAL STATEMENT , whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the FINANCIAL STATEMENT . Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall FINANCIAL STATEMENT presentation. We believe that our audit provides a reasonable basis for our opinion. Supplemental Information The accompanying information contained in Schedule I has been subjected to audit procedures performed in conjunction with the audit of the Company s FINANCIAL STATEMENT .

4 Such information is the responsibility of the Company s management. Our audit procedures included determining whether the information reconciles to the FINANCIAL STATEMENT or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with Regulation under the Commodity Exchange Act. In our opinion, the information is fairly stated, in all material respects, in relation to the FINANCIAL STATEMENT as a whole. We have served as the Company's auditor since 2015. November 22, 2019 2TD ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation) STATEMENT of FINANCIAL CONDITION (In Thousands)September 30, 2019 AssetsCash and cash equivalents.

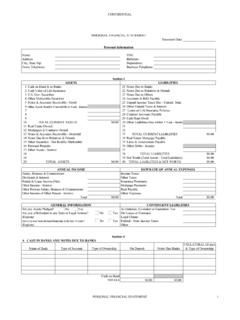

5 $94,276 Cash and investments segregated and on deposit for regulatory purposes..271,333 Receivable from brokers, dealers and clearing organizations..14,265 Receivable from clients..1,944 Receivable from nonclients..1 Receivable from affiliates..1,899 Other receivables..665 Goodwill..63,329 Acquired intangible assets, net..1,195 Other assets..273 Total assets..$449,180 Liabilities and member's equityLiabilities: Payable to clients..$235,741 Payable to nonclients..666 Payable to affiliates..4,277 Accounts payable and accrued liabilities..485 Deferred income taxes, net..184 Total liabilities..241,353 Member's equity..207,827 Total liabilities and member's equity..$449,180 See accompanying ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation)Notes to the STATEMENT of FINANCIAL CONDITION (Dollars In Thousands)September 30, 201931. Organization and Nature of OperationsTD ameritrade Futures & Forex LLC (the "Company") is an indirect wholly-owned subsidiary of TD ameritrade Holding Corporation (the "Parent") through the Company's immediate parent, TD ameritrade Online Holdings Corp.

6 ("TDAOH"). The Company evaluated subsequent events through November 22, 2019, the date on which the STATEMENT of FINANCIAL CONDITION was available to be Company provides futures and foreign exchange trade execution services to its clients and clients of other entities related by common ownership, all of which are indirect wholly-owned subsidiaries of the Parent. The Company is registered as a futures commission merchant ("FCM") and forex dealer member ("FDM") with the Commodity Futures Trading Commission ("CFTC") and is a member of, and the corresponding services functions are regulated by, the National Futures Association ("NFA"). The Company is required to comply with all applicable regulations of the CFTC and Company contracts with external providers for futures clearing and to facilitate foreign exchange trading for its clients on an omnibus basis. 2. Significant Accounting PoliciesUse of EstimatesThe preparation of the STATEMENT of FINANCIAL CONDITION in conformity with generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the STATEMENT of FINANCIAL CONDITION .

7 Actual results could differ from those and Cash EquivalentsThe Company considers temporary, highly-liquid investments with an original maturity of three months or less to be cash and Investments Segregated and on Deposit for Regulatory PurposesCash and investments segregated and on deposit for regulatory purposes consists primarily of cash deposits and Treasury securities that have been segregated or secured for the benefit of futures clients according to the regulations of the CFTC governing futures commission from Brokers, Dealers and Clearing OrganizationsReceivable from brokers, dealers and clearing organizations primarily arise in connection with foreign exchange transactions and includes client cash held by an unaffiliated service provider. TD ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation)Notes to the STATEMENT of FINANCIAL CONDITION (continued)(Dollars In Thousands)4 Receivable from/Payable to ClientsReceivable from clients arise primarily in connection with futures transactions.

8 Payable to clients arise primarily in connection with futures and foreign exchange transactions and include client cash held in futures and forex accounts and the fair value of any net unrealized gains/losses on open client futures and foreign exchange contracts. The value of client options on futures is not reflected in the accompanying STATEMENT of FINANCIAL from/Payable to NonclientsCertain employee futures accounts are considered "nonclient" for regulatory Parent and TDAOH have recorded goodwill for purchase business combinations to the extent the purchase price of each completed acquisition exceeded the fair value of the net identifiable assets of the acquired company. Goodwill resulting from certain business combinations has been pushed down to the Company. The Company tests goodwill for impairment on at least an annual basis and more frequently as events occur or changes in circumstances indicate that the carrying amount of such assets may not be recoverable.

9 In performing the impairment tests, the Company performs an assessment utilizing qualitative factors to determine whether it is more likely than not that the fair value of the reporting unit is less than its carrying amount, including goodwill. No impairment charges have resulted from the impairment of Acquired Intangible AssetsAcquired intangible assets pushed down to the Company are amortized on a straight-line basis over their estimated useful life of 11 years. Long-Lived Assets and Acquired Intangible AssetsThe Company reviews its long-lived assets and finite-lived acquired intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. If based on that review, changes in circumstances indicate that the carrying amount of such assets may not be recoverable, the Company evaluates recoverability by comparing the undiscounted cash flows associated with the asset to the asset's carrying amount.

10 The Company also evaluates the remaining useful lives of intangible assets to determine if events or trends warrant a revision to the remaining period of TaxesThe Company has elected to be treated as a corporation for income tax purposes. The Company files a consolidated income tax return with the Parent on a calendar year basis, combined returns for state tax purposes where required and separate state income tax returns where required. TD ameritrade Futures & Forex LLC(An Indirect Wholly-Owned Subsidiary of TD ameritrade Holding Corporation)Notes to the STATEMENT of FINANCIAL CONDITION (continued)(Dollars In Thousands)5 The tax provision is computed in accordance with a tax sharing agreement with the Parent that is primarily based on a separate company method of reporting. Deferred tax assets and liabilities are determined based on the differences between the STATEMENT of FINANCIAL CONDITION carrying amounts and tax bases of assets and liabilities using enacted tax rates expected to apply to taxable income in the periods in which the deferred tax asset or liability is expected to be settled or realized.