Transcription of US Imported Beef Market

1 The near term securing supply remains the primary focus and a number of Market participants noted that higher prices are being paid for product deliv-ering further out in the future. Chinese demand remains the key driver of global demand although in the near term that demand has been uneven, dis-torted by COVID outbreaks and severe restrictions in China. New Zealand supply is also highly un-certain and packers there reportedly are reluctant to show any significant volumes forward. Dairy Imported Market Activity for the Week Imported beef trade remains difficult given ongoing supply chain challenges and uncertainty about supply availability in Q1.

2 Large end users are gearing up for significant price inflation across many protein categories in 2022 but they remain highly uncertain about the consumer response to inflation in the coming months. In the next page we highlight some of the latest inflation data. In Market Highlights for the Week: US beef imports surged 17% in October, with the bulk of the increase coming from Mexico and Canada. Imports from Oceania remain limited but Brazil shipped the largest amount of fresh beef in more than a decade.

3 Brazilian share of US Imported beef Market through October was 8%, 3 points higher than the previous year while the share of Australian beef was only 12%, 8 points lower than the previous year. US beef price inflation was scorching hot in November again even as wholesale beef prices were lower. Overall retail beef prices were 24% higher than the previous year due to sharply higher prices for high value cuts. Retail ground beef prices were 14% higher than a year ago. A combination of high input costs and tight labor Market continues to drive menu inflation at foodservice.

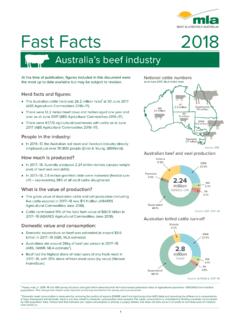

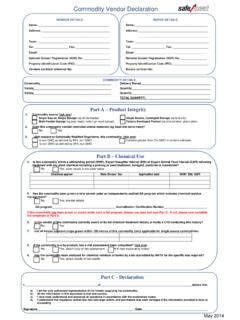

4 Food cost in-flation at fast food is far outpacing inflation at full service restaurants, up in November. Prepared by: Steiner Consulting Group | |800-526-4612 Volume Issue December 10, 2021 US Imported Beef Market A Weekly Update Prepared Exclusively for Meat & Livestock Australia - Sydney TOP Imported BEEF SUPPLIERS IN 2021 TOP Imported BEEF SUPPLIERS IN 2020 Total Volume and Country Shares for Period Jan - Oct 2021, MTTotal Volume and Country Shares for Period Jan - Oct 2020, MTCanada30%Aus tr a l i a12%Mexi co22%N. Zealand16%Brazi l8%Ni ca ra gua5%Uruguay4%ROW3%Canada24%Aus tr a l i a20%Mexi co22%N.

5 Zealand16%Brazi l5%Ni c a r a gua5%Uruguay4%ROW4%940K983 KMe tri c TonsMe tri c Tons production in New Zealand was lower in Septem-ber and October, resulting in significant premiums for New Zealand dairy prices in the world Market . Weather is always a major factor for dairy slaugh-ter during Mar May but current strong dairy mar-kets should induce producers to limit dairy slaugh-ter is feed conditions are favorable. Market notes for the past week Firm Imported beef prices and lack of domestic product encouraged higher beef imports in Oc-tober, with most of the increase in imports coming from Canada and Mexico.

6 High prices for fed beef cuts clearly encouraged both retail-ers and foodservice operators to look for less expensive alternatives in these markets and the strong US dollar helped the buying spree. However, this did little to bolster the supply of lean grinding beef in the US Market . Total imports of fresh/frozen and cooked beef in Oc-tober were 99,271 MT, 14,632 MT or 17% higher than a year ago. Beef imports from Mexico and Canada were a combined 53,574 MT, 11,109 MT or 26% higher than a year ago.

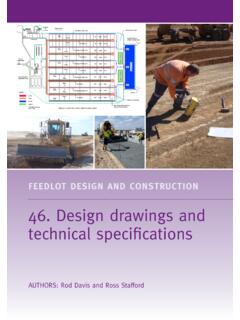

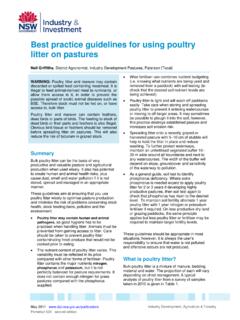

7 Brazil helped bolster the supply of grinding beef available, with total imports in October pegged at 10,928 MT, 275 higher than a year ago and the highest in more than a decade. Imports of fresh/frozen beef from Brazil in Oc-tober were 6,396 MT, surpassing the record volume Imported in October. For Jan-Oct peri-od, US beef imports of Brazilian fresh/frozen beef were 35,257 MT, about 20,000 MT higher than the previous year. We do not see the 6k MT/month figure as sustainable, however as that would cause Brazil to bump up against TRQ constraints.

8 In the last two months Bra-zilian packers have been constrained by the lin-gering ban on their product in China. This like-ly helped push a bit more product towards the US and contributed to the widening spread be-tween Brazilian and Australian product. Ex-pectations are that the ban will be lifted soon although we have heard much of this before. Our guess is that trade will resume once some of the port restrictions and backlogs have been cleaned up. Inflation data for November was released on Friday, with topline inflation up vs.

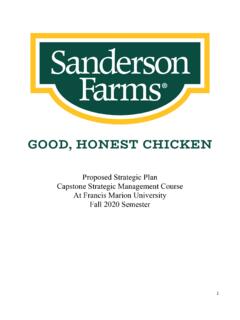

9 A year ago. Food cost inflation in November was higher than the previous year although the pace of price increases was slightly lower, US Imported BEEF Market PAGE 2 increasing at from the previous month compared to a m/m increase registered in October. Meat price inflation continues to far outpace overall food price inflation, which in turn we think will continue to drive inflation at Monthly Beef Imports from BrazilMetric ton. Product Weight Basis. Source: USDA-FAS. Analysis by Steiner Consulting - 2,000 4,000 6,000 8,000 10,000 12,000201620172018201920202021 Fresh/FrozenProcessedRetail Choice Beef Prices vs.

10 Wholesale Choice Beef CutoutData Source: USDA Monthly Retail Price Series and Daily Mandatory Price Reporting ChoiceBeef Cutout Retail Choice Beef Prices foodservice especially. Retail beef prices in November were slightly lower than the previ-ous month, reflecting some of the pullback in wholesale beef prices but they remained 24% higher than the previous year. Retail pork pric-es were 18% higher than the previous year while chicken price inflation accelerated and was 10% higher y/y in November.