Transcription of YEAR Tax Transcript Decoder©

1 Tax Transcript Decoder COMPARISON OF 2020 TAX RETURN AND TAX Transcript DATA 2022-23 Award Year 10 YEAR ANNIVERSARY 2021 NASFAA. All rights reserved. 2021 by National Association of Student Financial Aid Administrators (NASFAA). All rights reserved. NASFAA has prepared this document for use only by personnel, licensees, and members. The information contained herein is protected by copyright. No part of this document may be reproduced, translated, or transmitted in any form or by any means, electronically or mechanically, without prior written permission from NASFAA. NASFAA SHALL NOT BE LIABLE FOR TECHNICAL OR EDITORIAL ERRORS OR OMISSIONS CONTAINED HEREIN; NOR FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES RESULTING FROM THE FURNISHING, PERFORMANCE, OR USE OF THIS MATERIAL. This publication contains material related to t he federal student aid programs under Titl e IV of the Higher Education Act and/or Title VII or Title VIII of the Public Health Service Act.

2 While we believe that the information contained herein is accurate and factual, this publication has not been reviewed or approved by the Department of Education, the Department of Health and Human Services, or the Department of t he Interior. The Free Application for Federal Student Aid (FAFSA ) is a registered trademark of the Department of Education. September 2021 Information in this publication is current as of September 23, 2021. 2 Tax Transcript Decoder Comparison of 2020 Tax Return and Tax Transcript Data FAFSA instructions direct applicants to obtain information from certain lines on IRS income tax returns and schedules. For the most part, the instructions identify the relevant lines on the tax form by line number. These line item numbers do not appear on IRS tax transcripts. Instead, each item is identified by name.

3 When verifying FAFSA data using tax transcripts, it is important to identify the correct answer. The following pages contain a sample tax return and corresponding tax return Transcript . Relevant line items have been highlighted as follows: Red: information to help cross-reference tax return line items with corresponding data on the tax return Transcript . Yellow: tax return line items that are required verification data elements for the 2022-23 award year. Blue: tax return line items listed in the FAFSA instructions, which should be reviewed for potential conflicting information. 2020 Tax Return Line Items for 2022-23 Verification 1040 and Schedules 2022-23 FAFSA Question AGI 1040 Line 11 36 (S) and 84 (P) Income tax paid* 1040 Line 22 minus Schedule 2, Line 2 37 (S) and 85 (P) Education credits 1040 Schedule 3, Line 3 43a (S) and 91a (P) IRA deductions and payments 1040 Schedule 1, Line 15 + Line 19 44b (S) and 92b (P) Tax-exempt interest income 1040 Line 2a 44d (S) and 92d (P) Untaxed portions of IRA, pension, and annuity distributions (withdrawals)* 1040 Lines (4a + 5a) minus (4b + 5b) (exclude rollovers) 44e (S) and 92e (P) 2020 Tax Return Transcript Line Items for 2022-23 Verification Tax Transcript 2022-23 FAFSA Question AGI ADJUSTED GROSS INCOME PER COMPUTER 36 (S) and 84 (P)

4 Income tax paid* INCOME TAX AFTER CREDITS PER COMPUTER minus EXCESS ADVANCE PREMIUM TAX CREDIT REPAYMENT AMOUNT 37 (S) and 85 (P) Education credits EDUCATION CREDIT PER COMPUTER 43a (S) and 91a (P) IRA deductions and payments KEOGH/SEP CONTRIBUTION DEDUCTION plus IRA DEDUCTION PER COMPUTER 44b (S) and 92b (P) Tax-exempt interest income TAX-EXEMPT INTEREST 44d (S) and 92d (P) Untaxed portions of IRA, pension, and annuity distributions (withdrawals)* TOTAL IRA DISTRIBUTIONS plus TOTAL PENSIONS AND ANNUITIES minus TAXABLE IRA DISTRIBUTIONS plus TAXABLE PENSION/ANNUITY AMOUNT (exclude rollovers) 44e (S) and 92e (P) 3* If negative, enter zero. 2021 NASFAA. All rights Individual Income Tax ReturnDepartment of the Treasury Internal Revenue Service (99)OMB No. 1545-0074 IRS Use Only Do not write or staple in this space.

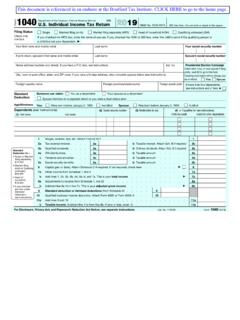

5 Filing Status Check only one filing jointlyMarried filing separately (MFS)Head of household (HOH)Qualifying widow(er) (QW)If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child s name if the qualifying person is a child but not your dependent aYour first name and middle initial Last name Your social security number Last name Spouse s social security numberHome address (number and street). If you have a box, see instructions. Apt. no. City, town, or post office. If you have a foreign address, also complete spaces below. StateZIP codeForeign country nameForeign province/state/countyForeign postal code Presidential Election CampaignCheck here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund.

6 You Spouse Yes NoStandard DeductionSomeone can claim:You as a dependentYour spouse as a dependentSpouse itemizes on a separate return or you were a dual-status alienAge/BlindnessYou:Were born before January 2, 1956 Are blindSpouse:Was born before January 2, 1956Is blindDependents(see instructions):If more than four dependents, see instructions and check here a(2) Social security number(3) Relationship to you(4) if qualifies for (see instructions):(1) First name Last nameChild tax creditCredit for other dependents1 Wages, salaries, tips, etc. Attach Form(s) W-2 ..1 Attach Sch. B if interest ..2a b Taxable interest ..2b 3aQualified dividends ..3a b Ordinary dividends ..3b 4aIRA distributions ..4a b Taxable amount ..4b 5aPensions and annuities ..5ab Taxable amount ..5b6aSocial security benefits.

7 6a b Taxable amount ..6b 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here ..a78 Other income from Schedule 1, line 9 ..89 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income ..a910 Adjustments to income:aFrom Schedule 1, line 22 ..10abCharitable contributions if you take the standard deduction. See instructions 10bcAdd lines 10a and 10b. These are your total adjustments to income ..a10c11 Subtract line 10c from line 9. This is your adjusted gross income ..a1112 Standard deduction or itemized deductions (from Schedule A) ..Standard Deduction for Single or Married filing separately,$12,400 Married filingjointly or Qualifying widow(er), $24,800 Head of household, $18,650 If you checked any box under Standard Deduction,see business income deduction.

8 Attach Form 8995 or Form 8995-A ..1314 Add lines 12 and 13 ..1415 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- ..15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2020)At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?BOSCH11111111111111111111111111 1 BOSCH1111111111111111111111111117203 WOODROW WILSON DRLOS ANGELESCA90068 MADDIE M BOSCH1111111111111111 COLTRANE B BOSCH111111111111111 DAUGHTERSON1111111111111161,567 XXX11XX11 XXX11XX116882 HARRY T1111111111111111111111114444 XXX11XX114285 XXX11XX115760 *4 2021 NASFAA. All rights reserved. 161,5671111111161,5671111111161,56711111 111111111111,8801111111162,4471111111162 ,4471111111137,3321111111125,11511111111 37,3321111111111,8801111111111,880If joint return, spouse's first name and middle initial ELEANOR W111111111111111111111 Sample IRS Form 1040, Page 1 Harry and Eleanor Bosch * Income earned from work: IRS Form 1040 Line 1 , Schedule 1 Lines 3 and 6 , Schedule K-1 (IRS Form 1065) Box 14 (Code A).

9 If any individual earning item is negative, do not include that item in your 216 Tax (see instructions). Check if any from Form(s): 18814 from Schedule 2, line 3 ..1718 Add lines 16 and 17 ..1819 Child tax credit or credit for other dependents ..1920 Amount from Schedule 3, line 7 ..2021 Add lines 19 and 20 ..2122 Subtract line 21 from line 18. If zero or less, enter -0- ..2223 Other taxes, including self-employment tax, from Schedule 2, line 10 ..2324 Add lines 22 and 23. This is your total tax .. income tax withheld from:aForm(s) W-2 ..25ab Form(s) 1099 ..25bcOther forms (see instructions) ..25cd Add lines 25a through 25c ..25d262020 estimated tax payments and amount applied from 2019 return ..2627 Earned income credit (EIC) .. If you have a qualifying child, attach Sch. EIC. If you have nontaxable combat pay, see child tax credit.

10 Attach Schedule 8812 ..2829 American opportunity credit from Form 8863, line 8 ..2930 Recovery rebate credit. See instructions ..3031 Amount from Schedule 3, line 13 ..3132 Add lines 27 through 31. These are your total other payments and refundable credits ..a 3233 Add lines 25d, 26, and 32. These are your total payments ..a33 Refund 34If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid ..3435aAmount of line 34 you want refunded to you. If Form 8888 is attached, check here ..a35aDirect deposit? See Routing number a c Type: Checking Savingsad Account number36 Amount of line 34 you want applied to your 2021 estimated tax ..a36 Amount You OweFor details on how to pay, see Subtract line 33 from line 24. This is the amount you owe now .. a37 Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020.