09 Application For Partial Tax

Found 10 free book(s)Form RP459-c:9/09:Application for Partial Tax Exemption ...

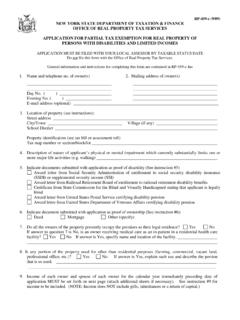

www.tax.ny.govrp -459 c (9/09) new york state department of taxation & finance . office of real property tax services . application for partial tax exemption for real property of persons with disabilities and limited incomes. application must be filed with your local assessor by taxable status date do not file this form with the office of real property tax ...

Form RP-459-c-Ins:8/11:General Information and ...

www.tax.ny.govtax purpose. However, where one or more owners qualifies for exemption under this section, and the other owner qualified for exemption under section 467, the owners may choose the more beneficial exemption. Where to File the Application . The application form (RP-459-c), should be filed with the city, town or village assessor for partial

Acord Homeowner Application - Abram Interstate

www.abraminterstate.compartial sprinkler tax code grade bldg code inspected? yes no condition of roof rating/underwriting if replacement cost applies, acord 42 attached: basement sq ft breezeway sq ft sq ft garage features windstorm loss mitigation * not applicable in nc dwelling other structures personal property loss of use personal liability medical payments ...

BUSINESS COMBINATIONS: IFRS 3 (REVISED)

www.accaglobal.comapplication to earlier business combinations is not allowed. ... this is a ‘partial goodwill’ ... for deferred tax assets or changes in the amount of contingent consideration. The revised standard will only allow adjustments against goodwill within this one-year period.

How to File for a Fee Waiver - All Courts

www.njcourts.govRevised 09/25/2018, CN 11208 page 1 of 8 General- Fee Waiver How to File a Fee Waiver ... the filing fee or application to waive filing fee should accompany any filing that requires a fee. This packet explains how to file this ... requesting a waiver of the partial filing fee requirement set forth in ; N.J.S.A. 30:4-16.3, you ...

Outgoing Partial Asset/Gifting Transfer Authorization Letter

olui2.fs.ml.comOutgoing Partial Asset/Gifting Transfer Authorization Letter Please use this form to complete a partial or gifting transfer of assets from Merrill to your receiving financial institutional account. This form is to be used for non-retirement brokerage accounts, e.g., a Cash Management Account (CMA) or Individual Investor Account (IIA).

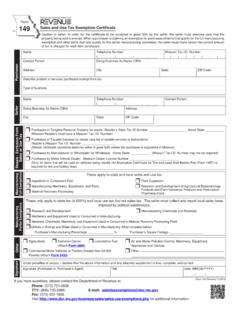

149 - Sales and Use Tax Exemption Certificate

dor.mo.govThese apply to state and local sales and use tax. Full Exemptions. Manufacturing. Partial Exemptions. Other. Seller. Name Telephone Number Contact Person Doing Business As Name (DBA) Address City State ZIP Code These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes

TILA RESPA Integrated Disclosure

files.consumerfinance.gov02 Application Fee $250.00 03 Origination Fee $450.00 04 Underwriting Fee $500.00 05 06 ... 09 10 C. Services Borrower Did Shop For $935.50 01 Pest Inspection Fee to Pests Co. $85.00 ... place a tax lien on this property. If you fail to pay any of …

Combine your super into AustralianSuper

www.australiansuper.com1266.8 09/21 ISS8 page 1 of 2 ... Request to transfer whole or partial balance of super account to AustralianSuper ... Telephone 1300 300 273 Web australiansuper.com 1266.8 09/21 ISS8 page 2 of 2 STEP 4. YOUR TAX FILE NUMBER Use my Tax …

Group Benefits Life Conversion Option - Manulife

www.manulife.caThe minimum partial conversion amount is $10,000. Calculating your premiums for . Permanent Life: Example #1. Example #2. Male, residing in Labrador, age 60 (within six months of new issue date) converting $30,000 to Permanent Life: Annually before tax: $46.26 x 30 = $1,387.80 annual premium before tax. Annually after tax: