Search results with tag "Application for partial tax"

Instructions for Form RP-467 Application for Partial Tax ...

www.tax.ny.govRenewal application You must timely file an annual renewal application (Form RP-467-Rnw) in the assessor’s office to continue the exemption. Although some assessing units may accept renewal applications to be filed after the taxable status date, you should file the renewal application on or before such date. Some

Form RP459-c:9/09:Application for Partial Tax Exemption ...

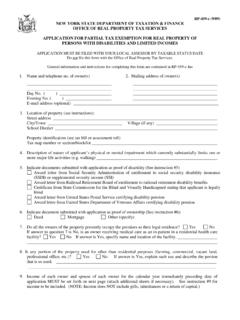

www.tax.ny.govrp -459 c (9/09) new york state department of taxation & finance . office of real property tax services . application for partial tax exemption for real property of persons with disabilities and limited incomes. application must be filed with your local assessor by taxable status date do not file this form with the office of real property tax ...

Form RP459-c:9/09:Application for Partial Tax Exemption ...

tax.ny.govrp -459 c (9/09) new york state department of taxation & finance . office of real property tax services . application for partial tax exemption for real property of

Form RP-467:7/18:Application for Partial Tax …

www.tax.ny.govRP-467 (7/18) Department of Taxation and Finance Office of Real Property Tax Services Application for Partial Tax Exemption for Real Property of Senior Citizens