Application For Partial Tax Exemption

Found 8 free book(s)Form RP-467:9/19:Application for Partial Tax Exemption for ...

www.tax.ny.govFor help completing this application, see Form RP-467-I, Instructions for Form RP-467. You must file this application with your local assessor by the taxable status date. Do not file this form with the Office of Real Property Tax Services. This form may only be used to apply for the partial tax exemption for real property of senior citizens.

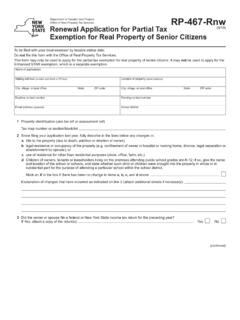

Form RP-467-Rnw:9/19:Renewal Application for Partial Tax ...

www.tax.ny.govRenewal Application for Partial Tax Exemption for Real Property of Senior Citizens To be filed with your local assessor by taxable status date. Do not file this form with the Office of Real Property Tax Services. This form may only be used to apply for the partial tax exemption for real property of senior citizens.

MARYLAND Application for Certificate of FORM Full or ...

www.marylandtaxes.govPartial Exemption. Applications with no closing date will not be processed. The Comptroller’s decision to issue or deny a Certificate of Full or Partial Exemption and the determination of the amount of tax to be withheld if a partial exemption is granted are final and not subject to appeal. SPECIFIC INSTRUCTIONS Transferor/Seller’s Information

VAT partial exemption toolkit - GOV.UK

assets.publishing.service.gov.ukthe current partial exemption tax year. A business may alternatively choose to carry out a separate partial exemption calculation for each monthly or quarterly VAT Return period. Whichever approach is adopted, the amount of input tax claimed as a result of each period

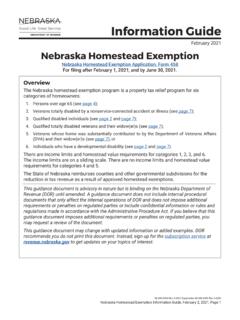

Nebraska Homestead Exemption Application • Application …

revenue.nebraska.govIf the application for homestead exemption is rejected by the Tax Commissioner, the applicant may request a hearing with the Tax Commissioner by filing an appeal. All appeals must be in writing and filed within 30 days from receipt of the rejection notice. A homestead exemption appeal cannot be used to protest property valuations.

February 2021 Nebraska Homestead Exemption

revenue.nebraska.govExemption Application was filed, which renders the residence or mobile home uninhabitable, the displaced applicant is still eligible if the applicant intends to rebuild or repair the homestead. Directive 15-3, Homestead Exemption Applications Following a …

MCL 211.7b: Disabled Veterans Exemption Frequently Asked ...

www.michigan.govIn order to apply for the exemption, the disabled veteran, their unremarried surviving spouse or their legal designee must file an affidavit with the local unit where the property is annually located. The State Tax Commission has adopted Form 5107, Affidavit for Disabled Veterans Exemption as a sample application.

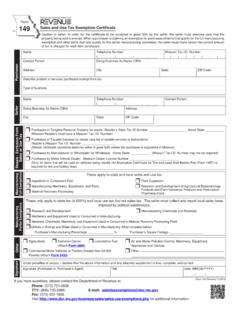

149 - Sales and Use Tax Exemption Certificate

dor.mo.govCheck the appropriate box for the type of exemption to be claimed according to . Section 144.054, RSMo. All items in this section are exempt . from state sales and use tax and local use tax, but are still subject to local sales tax. Section 144.054, RSMo, exempts electrical energy and …

Similar queries

Application for Partial Tax Exemption, Application, Partial tax exemption for real property of senior citizens, Renewal Application for Partial Tax, Renewal Application for Partial Tax Exemption, Partial tax exemption, Partial exemption, VAT partial exemption toolkit, Partial exemption tax, Homestead Exemption Application, Homestead Exemption, Exemption Application, Disabled Veterans Exemption, Exemption, Tax Exemption