Partial Exemption Tax

Found 7 free book(s)Manufacturing and Research - California

www.cdtfa.ca.govA partial sales and use tax exemption allows certain manufacturers, researchers and developers to pay a lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW CHANGES. Beginning January 1, 2018, the partial tax exemption law changed to include: - Specified electric power generation or distribution

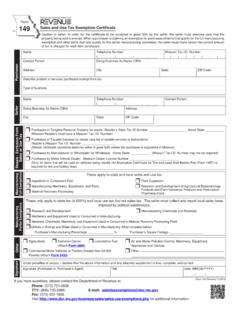

149 - Sales and Use Tax Exemption Certificate

dor.mo.govThese apply to state and local sales and use tax. Full Exemptions. Manufacturing. Partial Exemptions. Other. Seller. Name Telephone Number Contact Person Doing Business As Name (DBA) Address City State ZIP Code These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes

Am I Eligible? - Missouri

dor.mo.govqualify for a partial exemption. (Your exemption is decreased by the amount your income exceeds the limit.) You are allowed 100% of your taxable public pension, not to exceed your maximum social security benefit ($36,976).. Does your income

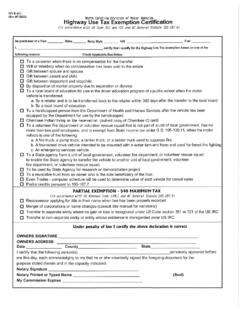

MVR-613 North Carolina Division of Motor Vehicles ... - NCDOT

www.ncdot.govPARTIAL EXEMPTION - $40 MAXIMUM TAX (In accordance with US Revenue Code (IRC) and NC General Statute 105-187.6) b. A four-wheel drive vehicle intended to be mounted with a water tank and hose and used for ... Highway Use Tax Exemption : Certification (In accordance with US Code 351 and 721 and NC General Statute 105-187.6) forest fire fighting ...

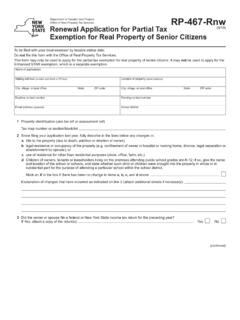

Form RP-467-Rnw Renewal Application for Partial Tax ...

www.tax.ny.govOffice of Real Property Tax Services Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens To be filed with your local assessor by taxable status date. Do not file this form with the Office of Real Property Tax Services. 1 Since filing your application last year, fully describe in the lines below any changes in:

Information Guide - Nebraska

revenue.nebraska.govto those qualifying for a 100% exemption (see December). v November 1. DOR must send approved and denied rosters to the county assessors. v December. All applicants, including those qualifying for a 100% exemption, will see tax and homestead exemption amounts reflected on the tax statements sent by county treasurers.

2368 Principal Residence Exemption (PRE) Affidavit

www.michigan.govGeneral Instructions Principal Residence Exemption (PRE) exempts a principal residence from the tax levied by a local school district for operating purposes, up to 18 mills. Principal residence means the dwelling that you own and occupy as your permanent home and any unoccupied adjoining or contiguous properties that are classified residential or timber-cut over.