Allowable Working

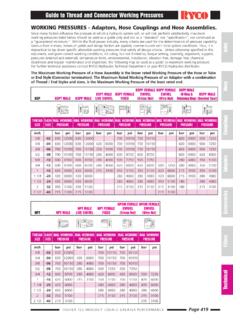

Found 8 free book(s)Guide to Thread and Connector Working Pressures

www.gerrardhydraulics.com.auimpractical to lay down specific allowable working pressures that satisfy all design criteria. Unless otherwise specified in this document, and given correct working conditions, including, but not limited to, torque setting, assembly, alignment, support,

e-Working and Tax - Revenue

www.revenue.ieTo claim an allowable e-working expense, the employee must have incurred the cost and it is the responsibility of the employee to retain proof of payment. If an expense is shared between two or more people, the cost can be apportioned based on the amount paid by each individual. Any reimbursement of expenses by the

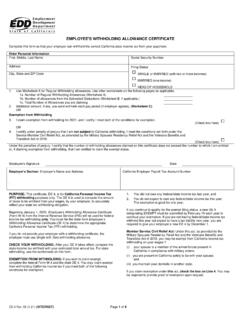

Employee's Withholding Allowance Certificate (DE 4)

media.icims.com4 that results in less tax being withheld than is properly allowable. In addition, ... If you have a working spouse or more than one job, it is best to check the box “SINGLE or MARRIED (with two or more incomes).” Figure the total number of allowances you are entitled to claim on all jobs using only one DE 4 form. Claim

Supplemental Nutrition Assistance Program (SNAP)

otda.ny.govallowable deductions) can be considered. To qualify: • ... Example: A single adult who lives alone is working 25 hours per week, earning $12/hour. Weekly, the individual earns $12 x 25 hours = $300 gross income. Monthly, the individual earns $300 x 4.333333

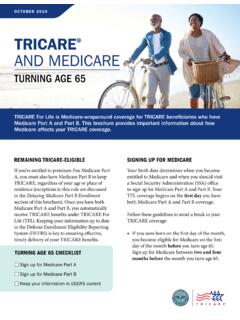

TRICARE AND MEDICARE

milconnect.dmdc.osd.mil20% of the TRICARE-allowable charge) if Medicare had processed the claim. You’re then responsible for paying the remainder of the billed charges. The Department of Veterans Affairs (VA) providers can’t bill Medicare, and Medicare can’t pay for services received from the VA. If you’re eligible for both TFL and VA

2. Issuance Date: INFORMATION MEMORANDUM

www.acf.hhs.govAs with the other allowable uses of the administrative, supply-building, and technical assistance set-aside, funds used to carry out activities to increase the supply of child care may not be used to fund direct child care services. Rather, are: 10 .

Reflection paper on laboratories that perform the analysis ...

www.ema.europa.euWorking Group. The paper is intended to cover the conduct of analysis or evaluation of clinical samples collected as part of a human clinical trial. It is applicable to all clinical trials that are conducted as part of a Marketing Authorisation Application which will be submitted to EU/EEA regulatory authorities. The

Taxable Fringe Benefit Guide - IRS tax forms

www.irs.govrate at or below the allowable maximum, under an accountable plan. 2. Individual expenditures (except for lodging) of less than $75. 3. Expenditures for transportation expense for which a receipt is not readily available. Reg. §1.274-5(c)(2) Timely Return of Excess Reimbursements