Applying For Tax Exempt Status

Found 3 free book(s)Publication 3833 (Rev. 12-2014) - IRS tax forms

www.irs.govAPPLYING FOR TAX-EXEMPT STATUS, Generally, a new charitable organization with actual or anticipated annual gross receipts in excess of $5,000 must submit an application for exemption and be recognized as tax exempt by . the IRS. There are exceptions to this general rule. Churches, synagogues, temples, and mosques

Part One Chapter 4 Property Tax Exemptions - AZDOR

azdor.govforfeiting the tax-exempt status of the property. The nonprofit status of, and the use of the property by, both the owner and tenant must be considered. “[A.R.S.] 42-11154 and 42-11155 specifically require us to consider the status of both owners and users of property in evaluating whether the property is ‘being used or held for profit.’

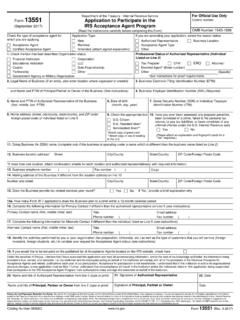

For Official Use Only Form 13551 ... - IRS tax forms

www.irs.govmust be listed as a Responsible Official on the EFIN to be exempt from the fingerprint requirement. If the authorized representative is an attorney, CPA or enrolled agent, but not an ERO, evidence of U.S. professional status may be submitted instead of the fingerprint card. If an ERO, include your EFIN on Line 3.