Search results with tag "Tax exempt"

Applying for Tax Exempt Status Overview - IRS tax forms

www.stayexempt.irs.govApplying for Tax-Exempt Status Overview Course Page 1 – Welcome to the Applying for Tax-Exempt Status Course This course is presented by the Tax Exempt & Government Entities division’s Exempt Organizations office. Page 2 – Introduction . Leagle: I’m Leagle, the EO Eagle, and I’ll guide you through the courses here at StayExempt.

Form ST-4, Exempt Use Certificate

www.myfoleyinc.comTitle: Form ST-4, Exempt Use Certificate Author: NJ Taxation Subject: Form ST-4, Exempt Use Certificate Keywords: Form ST-4 Sales Tax Sales Tax Exempt Use Certificate,ST4,Exempt,Certificate

Form ST-10, Sales and Use Tax Certificate of Exemption

www.tax.virginia.govThe Virginia Retail Sales and Use Tax Act provides that the Virginia Sales and use tax shall not apply to tangible personal ... This Certificate of Exemption may not be used by a using or consuming construction contractor as defined in the Regulations. ... dealer who buys tax exempt tangible personal property for the purpose indicated hereon.

Application for S T E C

www.ksrevenue.org1 Application for Sales Tax Exemption Certificates KDOR (Kansas Department of Revenue) issues exemption certificates containing exempt numbers. This publication explains the use of Tax Exempt Entity Exemption Certificates, Project

Publication 3833 (Rev. 12-2014) - IRS tax forms

www.irs.govAPPLYING FOR TAX-EXEMPT STATUS, Generally, a new charitable organization with actual or anticipated annual gross receipts in excess of $5,000 must submit an application for exemption and be recognized as tax exempt by . the IRS. There are exceptions to this general rule. Churches, synagogues, temples, and mosques

Tell the IRS about Suspected Tax Exempt Status Abuses

www.irs.govalleging a tax-exempt organization is in potential noncompliance with the tax law. Every year, the IRS receives complaints from the general public, members of Congress, federal and state government agencies, and internal sources. Referrals are sent to analysts at the Exempt Organizations Classifications Office in Dallas, TX.

Sales Tax Exempt Status Application

www.state.sd.us2. South Dakota Department of Revenue Sales Tax Exempt Status Application. To apply for a South Dakota Tax Exempt number: A. Complete the information in …

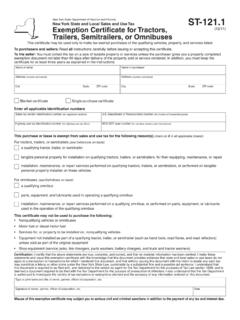

New York State and Local Sales and Use Tax ST-121.1 ...

www.tax.ny.govproperty tax exempt only when you know at the time of purchase that the property is going to be used on a qualifying vehicle. To the seller Only qualifying vehicles, property, and services described on the front of this certificate may be sold exempt from sales tax by use of

Revenue and taxation code 23701 tax exempt orgs

oag.ca.govexempt purposes if the articles of organization provide that upon dissolution the assets will be distributed to an organization which is exempt under this section or Section 501(c)(3) of the Internal Revenue Code or to the federal government, or to a state or local government for public purposes; or by a provision in the articles of

THE TAX SYSTEM OF CHINA - IRET

iret.orgInstitute for Research on the Economics of Taxation IRET is a non-profit, tax exempt 501(c)3 economic policy research and educational organization devoted to …

Form ST-105 Indiana Department of Revenue General Sales ...

www.in.govb) Tax Exempt Identification Number c) Sales Tax Identification Number d) Withholding Tax Identification Number The Registered Retail Merchant Certificate issued by the Indiana Department of Revenue shows the TID# (10 digits) and …

Fiscal Sponsorship

www.fiscalsponsorship.comPRESENTATION on Fiscal Sponsorship Western Conference on Tax Exempt Organizations November 17, 2006 Los Angeles Gregory L. Colvin, Esq. Silk, Adler & Colvin

Tax Exempt and Government Entities 501 EXEMPT ...

www.irs.govApplying for 501(c)(3) Tax-Exempt Status, F. ederal tax law provides tax benefits to nonprofit organizations recognized as exempt from federal income tax under Section 501(c)(3) of the Inter nal Revenue Code (IRC). It requires that most organizations apply to the Internal Revenue Service (IRS) for that status.

Tax Exempt and Government Entities EXEMPT …

www.irs.govTax Exempt and Government Entities EXEMPT ORGANIZATIONS. 501 (Compliance Guide . a) for Tax-Exempt . Organizations,,, (Other than 501(c)(3) Public . Charities and Private Foundations), ... is in a position to act on the public policy issue in connection with the specific event (such as a legislator who is eligible to vote on the legislation ...

Tax-Exempt Obligations for Pennsylvania Personal Income ...

www.revenue.pa.govINTEREST - Tax-ExEmpT Interest derived from obligations not statutorily free from state or local taxation under any other act of the general assembly or under the laws of the u.s. is subject to Pa personal income tax. Interest on obligations issued by or on behalf of the u.s. government is not subject to Pa personal income tax. 61 Pa. Code ...

Tax Exempt and Government Entities EXEMPT …

www.irs.govTax Exempt and Government Entities 501EXEMPT ORGANIZATIONS c)(3) 501 (c)(3) 501 (c)(3) 501 (c)(3) 501 (c)(3) 501 (c)(3) Inside: Activities that may jeopardize a charity’s exempt …

Tax Guide for Churches & Religious Organizations

www.irs.govTax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches & Religious Organizations 501(c)(3) Publication 1828 (Rev. 8-2015) Catalog Number 21096G Department of the Treasury Internal Revenue Service www.irs.gov

Tax Exempt and Government Entities EXEMPT ... - irs.gov

www.irs.gov2 Selecting a Charity, If you are eligible to deduct charitable contributions for federal income tax purposes (see Qualifying for a Tax Deduction, below) and you want to claim a deduction for donating your vehicle to charity, then you should make certain that the charity is a qualified organization.

Tax Exempt Housing Bond Basics - IPED

www.ipedconference.comtax-exempt bonds, the partnership needs another entity to issue the bonds on its behalf. So, the partnership approaches a potential Issuer (typically a city, or a county, or a housing authority) to petition the state authority to issue a portion of the state’s volume cap of Private Activity Bonds. A

Similar queries

Applying for Tax Exempt Status Overview, Applying for Tax-Exempt Status Overview, APPLYING FOR TAX-EXEMPT STATUS, Tax Exempt, EXEMPT, ST-4, Exempt Use Certificate, Use Tax Certificate of Exemption, Virginia, Contractor, Application for S T E, Application for, Kansas Department of Revenue, IRS tax forms, Government, Sales Tax Exempt Status Application, Section, THE TAX SYSTEM OF CHINA, Organization, Indiana, Sales, Sales Tax, Fiscal Sponsorship, Nonprofit organizations, Organizations, Tax Exempt and Government Entities EXEMPT, Tax Exempt and Government Entities EXEMPT ORGANIZATIONS, Tax-Exempt . Organizations, Tax-exempt, Tax Guide for Churches, Service www.irs.gov