Search results with tag "Fiscal"

Effectiveness of Monetary and Fiscal Policy under IS/LM ...

magadhuniversity.ac.inThe opposite happens in a contractionary fiscal policy. The relative effectiveness of fiscal policy depends on the slope of the LM curve and the IS curve. Fiscal policy is more effective, the flatter is the LM curve, and is less effective when the LM curve is steeper. When the IS curve shifts upwards to IS. 1. with the increase in gov-

South Africa Economic Outlook

www.pwc.co.zaFiscal policy: A tale of two budgets –after 2021, fiscal austerity will be the name of the game. economic growth. Years of over-optimistic economic growth forecasts have resulted in fiscal revenue projections above what the economy could deliver. This, in turn, resulted in greater fiscal deficits and rising public debt ratios.

FEBRUARY 24, 2022 Introduction

www.moodysanalytics.commoodys analytics Global Fiscal Policy in the Pandemic 5 than 18% of GDP in the U.K., the country that provided the next most fiscal support, and the ap-proximately 10% of GDP provided by all countries across the globe on average. The unrivaled U.S. fiscal response was motivated in part by the nation’s meaningfully weaker

R E P O R T - congress.gov

www.congress.govThe Committee recommendation for fiscal year (FY) 2022 for the activities under the jurisdiction of the Subcommittee on State, For-eign Operations, and Related Programs totals $62,242,000,000 in new discretionary budget authority, which is $6,737,000 above the fiscal year 2021 enacted level and $62,592,000 below the fiscal year 2022 request.

2021 Target Corporate Responsibility Report

corporate.target.comfiscal year 2020 (February 2, 2020–January 30, 2021), as well as certain subsequent events and initiatives that occurred after the end of fiscal year 2020, which we have endeavored to note as such. All quantitative company data, unless otherwise stated, reflect fiscal year 2020. Unless noted, goals and other data in the report reflect our U.S.

Visa Inc. Reports Fiscal First Quarter 2022 Results

s1.q4cdn.comFiscal First Quarter 2022 — Financial Highlights GAAP net income in the fiscal first quarter was $4.0 billion or $1.83 per share, an increase of 27% and 29%, respectively, over prior year’s results. Current year’s results included a special item of $145 million for a …

FOR IMMEDIATE RELEASE February 9, 2022 FIRST QUARTER ...

thewaltdisneycompany.comcontent, including the delay of key live sports programming during fiscal 2020 and fiscal 2021. In fiscal 2022, our domestic parks and experiences are generally operating without significant mandatory COVID-19-related capacity restrictions, such as …

Ley 20/1990, de 19 de diciembre, sobre Régimen Fiscal de ...

www.boe.esLey 20/1990, de 19 de diciembre, sobre Régimen Fiscal de las Cooperativas. Jefatura del Estado «BOE» núm. 304, de 20 de diciembre de 1990 Referencia: BOE-A-1990-30735

Budget and Fiscal Plan 2021/22 - 2023/24

www.bcbudget.gov.bc.caTo the best of my knowledge, the three-year fiscal plan contained in . Budget 2021. conforms to the standards and guidelines of generally accepted accounting principles for senior governments as outlined in Note 1 of the 2019/20 . Public Accounts.

RULES COMMITTEE PRINT 117–35

rules.house.gov15 for the fiscal year ending September 30, 2022. 16 SEC. 6. ADJUSTMENTS TO COMPENSATION. 17 Notwithstanding any other provision of law, no ad-18 justment shall be made under section 601(a) of the Legis-19 lative Reorganization Act of 1946 (2 U.S.C. 4501) (relat-20 ing to cost of living adjustments for Members of Congress) 21 during fiscal year ...

ESSER Reporting Update State Fiscal and USDE Annual ESSER ...

content.govdelivery.comFeb 17, 2022 · State Fiscal and USDE Annual ESSER Reports. Combined Slides for January 24th and 26th Statewide Trainings *Please note that these slides and guidance have been revised since previous live and recorded trainings. Cory Green, Associate Commissioner and Chief Grants Officer. Department of Grant Compliance and Administration. Texas Education Agency

Generacion de Certificados para Produccion

www.afip.gob.arDeberá ubicar el enlace “Acceso con Clave Fiscal””. 2.En la pantalla de autenticación con Clave Fiscal, deberá ingresar la CUIT/CUIL/CDI de su usuario (sin guiones ni separadores de ningún tipo) y a continuación la contraseña en el campo Clave. 3.

General Explanations of the

home.treasury.govIn the Administration’s Fiscal Year 2023 Budget, the President proposes a number of reforms ... The Tax Cuts and Jobs Act of 2017 replaced a graduated tax schedule (with most corporate income taxed at a marginal and average rate of 35 ... for the Administration’s infrastructure proposals and other longstanding fiscal priorities. A

The Florida Senate BILL ANALYSIS AND FISCAL IMPACT …

www.flsenate.govBILL ANALYSIS AND FISCAL IMPACT STATEMENT (This document is based on the provisions contained in the legislation as of the latest date listed below.) Prepared By: The Professional Staff of the Committee on Community Affairs BILL: SB 4-C INTRODUCER: Senator Bradley SUBJECT: Independent Special Districts DATE: April 19, 2022

2021 Community Grant Guidelines

www.umpquabank.comUpdated January 2022 . 2022 Community Grant Guidelines . Umpqua Bank, through the Umpqua Bank Charitable Foundation, continues to believe in the power of ... There will be an opportunity later to elaborate on the income and diversity demographics of your clients. ... Example: “We served 50 students in fiscal year 2020-2021. Approximately 73%

2021 Virginia Form 763 Nonresident Individual Income Tax ...

www.tax.virginia.govto taxpayers based on income and other eligibility requirements. ... $7.7 million per fiscal year. The annual cap for the Major ... year beginning before January 1, 2022 to claim more credits than the amount included on such return before amending it. 2

Approved for Public Release 22-MDA-11041 (12 Jan 22)

www.mda.milJanuary is the beginning of a new calendar year, and as we so often do, we make New Year’s resolutions. I have a few resolution suggestions to help you prepare for Fiscal Year (FY) 2022. First, I would encourage you to look at the Missile Defense Agency FY 2022 Budget Estimates Overview which can be found on www.mda.mil. This

NATIONAL DEFENSE AUTHORIZATION ACT FOR FISCAL …

www.congress.govSec. 106. Mine Resistant Ambush Protected Vehicle Fund. Sec. 107. Relation to funding table. Subtitle B—Army Programs Sec. 111. Procurement of Future Combat Systems spin out early-infantry brigade combat team equipment. Subtitle C—Navy Programs Sec. 121. Littoral Combat Ship program. Sec. 122.

FY 2022 Executive Budget Briefing Book - New York State ...

www.budget.ny.govIt’s not just New York’s recovery that’s at stake, but also the nation’s. New York State produces ... This was made worse by the imposition of the cap on state and local taxes, or SALT, that was part of the Federal tax plan enacted in 2017, raising taxes on New Yorkers by ... prudent fiscal actions have made State finances more reliable ...

The IS-LM Model - Massachusetts Institute of Technology

web.mit.edu– Policy: fiscal and monetary. Investment demand • Investment demand: I = I(Y,i) +,-– As output rises, investment demand increases. – As interest rates rise, investment demand falls. • Intuition: – Firms borrow to pay for investment project. With higher cost of

2021 Annual Report

www.dol.govSection 1 presents key fiscal year (FY) 2021 criminal enforcement and performance results pursuant to LMRDA Title V (financial safeguards for labor organizations) together with noteworthy criminal enforcement actions. A complete listing of the calendar year (CY) 2021

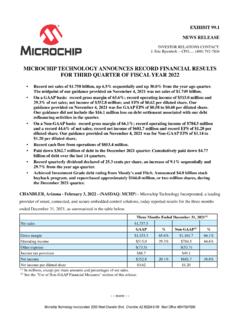

MICROCHIP TECHNOLOGY ANNOUNCES RECORD FINANCIAL …

ww1.microchip.comMICROCHIP TECHNOLOGY ANNOUNCES RECORD FINANCIAL RESULTS . FOR THIRD QUARTER OF FISCAL YEAR 2022 • Record net sales of $1.758 billion, up 6.5% sequentially and up 30.0% from the year ago quarter. The midpoint of our guidance provided on November 4, 2021 was net sales of $1.749 billion.

2019 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.govFOR CALENDAR YEAR 2019 AND FISCAL YEARS BEGINNING IN 2019 PLEASE CAREFULLY REVIEW HIGHLIGHTS BEFORE COMPLETING ANY TAX REPORTS OR SCHEDULES. HIGHLIGHTS 1. IMPORTANT: The RCT-101, PA Corporate Net Income Tax Report MUST include a Revenue ID number. Failure to provide a Revenue ID number may result in a delay …

S The Budget

www.tn.govSTATE OF TENNESSEE The Budget FISCAL YEAR 2022-2023 Volume 1 Bill Lee, Governor

Annual Report 2020-2021

www.tn.govDuring the 20 20-2021 fiscal year, the department collected nearly $18.4 billion in state taxes and fees. The department also collected more than $3.7 billion in taxes for local, county, and municipal governments.

STATE AND LOCAL FISCAL RECOVERY FUND (SLFRF) …

nlihc.orghe American Rescue Plan Act provides $350 billion to help states, counties, cities, and tribal governments respond to the COVID-19 public health emergency, address its economic fallout, and lay the foundation for an equitable recovery. The …

Móvil - Código Fiscal de la Federación

www.diputados.gob.mxla fracción II, las contribuciones correspondientes tendrán la naturaleza de aportaciones de seguridad social. Los recargos, las sanciones, los gastos de ejecución y la indemnización a que se refiere el séptimo párrafo del Artículo 21 de este Código son accesorios de las contribuciones y participan de la naturaleza de éstas.

Facultades de comprobación de la autoridad fiscal

gc.scalahed.com199 oficinas de las propias autoridades, a efecto de llevar a cabo su revisión, la contabilidad, así como que proporcionen los datos, o tros documentos o informes que se les requieran. III. Practicar visitas a los contribuyentes, los responsables solidarios o terceros relacionados con ellos y revisar su contabilidad, bienes y mercancías."

d18rn0p25nwr6d.cloudfront.net

d18rn0p25nwr6d.cloudfront.netFor the fiscal year ended December 31, 2021 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File No. 000-22513 _____ AMAZON.COM, INC. (Exact name of registrant as specified in its charter)

Electronic Arts Reports Q3 FY22 Financial Results

s22.q4cdn.com• The Company estimates a share count of 286 million for purposes of calculating fiscal year 2022 diluted earnings per share. Total net revenue Operational metric: • Net bookings1 is expected to be approximately $7.525 billion. In addition, the following outlook for GAAP-based financial data2 and a long-term tax rate of 18%

Outline of Results Briefing held on February 4, 2022

www.hd.square-enix.comfiscal year, when it sustained significant impact from the temporary closure of amusement facilities in Japan, a move undertaken to combat the spread of COVID -19 in response to the Japanese government’s declaration of a state of emergency. The Publication segment booked net sales of ¥21 billion (up

LGU FISCAL AND FINANCIAL PROFILE - blgf.gov.ph

blgf.gov.phBureau of Local Government Finance – Department of Finance (Volume I) 1 Table of Contents (Volume 1) Message from Exec. Dir. Ma. Presentacion R. Montesa i Foreword ii Table of Contents 1 Definition of Terms 2-3 Historical Antecedent 4-5 BLGF Mission Statement 6 …

Procurement Policy for Bank Group Funded Operations

www.afdb.orglevel, good procurement leads to increased fiscal space and can facilitate, inter alia, realization of RMCs’ socio-economic and environmental sustainability policy objectives. At the project level, procurement efficiency and effectiveness directly affects the costs and time required for implementation and ultimate performance of

GENERAL INFORMATION - NC

files.nc.govYou can pay corporate estimated income tax payments online. Go to “File and Pay,” “eServices,” and select “Corporate Estimated CD-429.” Specific Instructions for Filing Form CD-405 Period Covered File the 2020 return for calendar year 2020 and fiscal years that begin in 2020. You must use the same taxable period on your North

National Defense Authorization Act for Fiscal Year 2021

www.padilla.senate.govMar 08, 2022 · March 8, 2022 The Honorable Charles E. Schumer Majority Leader United State Senate Washington, DC 20510 The Honorable Maria …

Q2 Fiscal Year 2022

s2.q4cdn.comThese presentation slides and the related conference call contain forward-looking statements, which are subject to the safe harbor provisions of the …

Denied Posttraumatic Stress Disorder Claims Related to ...

www.va.govDepartment of Defense Report on Sexual Assault in the Military, Fiscal Year 2017 2 VBA Training Letter 11-05, Adjudicating PTSD Claims Based on MST, December 2, 2011. (Historical) 3 VBA Training Letter, Adjudicating PTSD Claims Based on MST. (Historical) 4 M21-1 Adjudication Procedures Manual, Part IV, Subpart II, Chapter 1, Section D, Topic 5,

TEORÍA DEL DELITO - University of San Martín de Porres

derecho.usmp.edu.peProfesor en la Academia de la Magistratura Fiscal Superior Adjunto con estudios en Chile y Colombia ... DELITO MANUAL PRÁCTICO PARA SU APLICACIÓN EN LA TEORÍA DEL CASO Doctrina Casos prácticos Esquemas y gráficos Jurisprudencia sobre temas desarrollados en los capítulos. 4 ... 205 3. Concepto de culpabilidad en Zaffaroni.....

Homeless and Special Needs Housing Guidelines - Virginia

www.dhcd.virginia.govFunding Guidelines 2022 - 2024. HSNH 2022 – 2024 2 ... governments to provide housing and services that benefit low-income persons living with HIV/AIDS and their families. ... (CAMS) within nine (9) months after the end of their fiscal year or 30 days after it has been accepted (Reviewed Financial Statement, Audited Financial Statement, and ...

State of Ohio 2021–2022 Home Energy Assistance Program ...

development.ohio.govagency from the most recently audited fiscal year? ... 1. 8 In determining a household’s income eligibility for LIHEAP, do you use gross income or net income? A: Gross Income ... 2.6 Describe estimated benefit levels for FY 2022: A: Minimum Benefit $45 Maximum Benefit $785.46 . Q: 2.7 Do you provide in-kind (e.g., blankets, space heaters) and ...

Draft Program Guidelines Low Income Household Water ...

www.csd.ca.govfollowing Program Guidelines for the federal Low Income Household Water Assistance Program (LIHWAP) Fiscal Year (FY) 2022-24, offering a program design framework for a one-time federally funded relief program providing financial assistance to low-income households to reduce water and wastewater arrearages prior to and during the COVID-19 pandemic.

Public Law 115–91 115th Congress An Act - Office of the ...

uscode.house.govThis Act may be cited as the ‘‘National Defense Authorization Act for Fiscal Year 2018’’. SEC. 2. ORGANIZATION OF ACT INTO DIVISIONS; TABLE OF CONTENTS. (a) DIVISIONS.—This Act is organized into four divisions as follows: (1) Division A—Department of Defense Authorizations. (2) Division B—Military Construction Authorizations.

FISCAL YEAR 2023 RECOMMENDED BUDGET

www.tn.gov10 • Joe Wegenka, Chief Economist, Fiscal Review Committee: • “I am certainly more confident in the current fiscal year number. Just looking at the way tax revenues have been coming in year …

Fiscal Year 2022/2023 Employer Contribution Rate

www.psers.pa.govDec 17, 2021 · fiscal year (FY) 2021/2022, which begins July 1, 20212. The 34.94% rate is composed of a 0.8 0% rate for ... PSERS' role expanded upon the passage of Act 5 of 2017 to include oversight of two new hybrid benefit options consisting of defined benefit and defined contribution (DC) components and a stand-alone DC plan. As of June 30, 2021, PSERS ...

Similar queries

Effectiveness, Fiscal Policy, Effectiveness of fiscal policy, Fiscal, Committee, Report, Fiscal year, RESULTS, Financial, Year, Fiscal 2021, De diciembre, sobre Régimen Fiscal de, De diciembre, sobre Régimen Fiscal de las Cooperativas, 2021, Year fiscal, State Fiscal, 2017, FISCAL IMPACT, Guidelines, 2022, Income, Eligibility, Calendar, For Fiscal Year, NATIONAL DEFENSE AUTHORIZATION ACT FOR FISCAL, Resistant Ambush Protected, Briefing Book, State, Recovery, State and local, Massachusetts Institute of Technology, Fiscal and monetary, 2019, CALENDAR YEAR 2019, Local, STATE AND LOCAL FISCAL RECOVERY, Plan, Fiscal de la, Las contribuciones, De las contribuciones, Facultades de comprobación de la autoridad fiscal, LGU FISCAL AND FINANCIAL PROFILE, Foreword, Procurement Policy for Bank Group Funded Operations, Policy, Period, Calendar year, Defense, Conference call, Manual, DEL DELITO, De la, Doctrina, Guidelines 2022, Income eligibility, Public Law 115, National Defense Authorization Act for Fiscal Year 2018