California retirement

Found 11 free book(s)Sample Options Letter for Resolving Medical ... - California

www.calhr.ca.govretirement pending approval of your disability retirement. Service Retirement: If you are eligible, you may apply for service retirement with CalPERS. A service retirement is a permanent separation from state service. Health benefits are available through CalPERS while you are on retirement. You would retain

A Complete Guide to Your UC Retirement Benefits

ucnet.universityofcalifornia.eduretirement benefit options and voluntary retirement savings plans that make up the University of California Retirement System (UCRS) as well as information about health and welfare benefits currently available to eligible UC retirees. The chart below illustrates the basic structure of …

Retirement Handbook - University of California

ucnet.universityofcalifornia.eduThe University of California Retirement Plan (UCRP), a traditional pension plan, is designed to provide lifetime monthly income and other retirement and survivor benefits. Some members may elect a lump sum cashout instead of monthly income. (See “Lump Sum Cashout” on page 11.)

Reinstatement From Retirement - CalPERS

www.calpers.ca.govThe California Public Employees’ Pension Reform Act of 2013 (PEPRA) changed the way CalPERS retirement benefits are applied. Before you come out of retirement, it’s important to understand whether your new service will be subject to the rules of PEPRA and how PEPRA may affect your future retirement benefit.

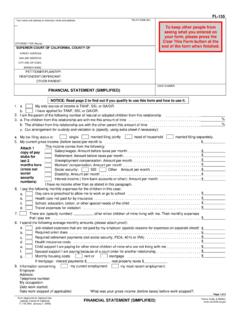

SUPERIOR COURT OF CALIFORNIA, COUNTY OF PETITIONER ...

www.courts.ca.govRetirement: Amount before taxes per month Unemployment compensation: Amount per month Workers' compensation: Amount per month Social security: SSI Other Amount per month Disability: Amount per month I have no income other than as stated in this paragraph. a. Day care or preschool to allow me to work or go to school b.

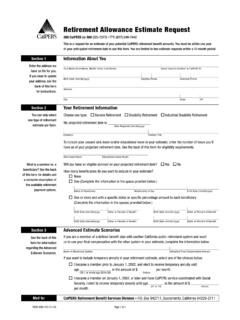

Retirement Allowance Estimate Request - CalPERS

www.calpers.ca.govEnter the name of the other California public retirement system you are a member of. • Enter your highest average annual compensation for any consecutive 12- or 36-month period of employment with the other retirement system. • To be eligible for full reciprocal benefits, such as final compensation exchange, you must retire concurrently. •

202 CALIFORNIA EMPLOYER’S GUIDE

edd.ca.govCalifornia Personal Income Tax (PIT) Withholding California PIT withholding is based on the amount of wages paid, the number of withholding allowances claimed by the employee, and the payroll period. Please refer to page 15 for additional information on PIT withholding or refer to the PIT withholding schedules available on page 17.

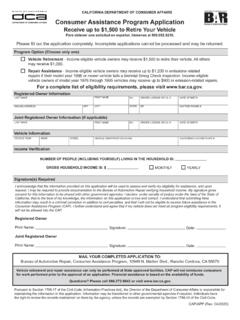

CALIFORNIA DEPARTMENT OF CONSUMER AFFAIRS …

bar.ca.govVehicle Retirement - Income-eligible vehicle owners may receive $1,500 to retire their vehicle. All others may receive $1,000. Repair Assistance - Income-eligible vehicle owners may receive up to $1,200 in emissions-related repairs if their model year 1996 or newer vehicle fails …

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

edd.ca.govCalifornia Employer Payroll Tax Account Number. PURPOSE: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Beginning January 1, 2020,

Applicable state tax withholding for retirement plan ...

personal.vanguard.comfor retirement plan distributions The information in this table is our application of state requirements as of June 30, 2020. States may change their requirements at any time. Although a state may allow more than one method to calculate state tax withholding, Vanguard uses the method listed below. (over)

CONSUMER ASSISTANCE PROGRAM - SmogTips.com

www.smogtips.comVEHICLE RETIREMENT REQUIREMENTS – Option 1 Under Vehicle Retirement Option 1, payment of one thousand five hundred dollars ($1,500) for each vehicle retired from operation for vehicle owners that meet income eligibility requirements. All other vehicle owners shall receive one thousand dollars ($1,000) for each vehicle retired from operation.