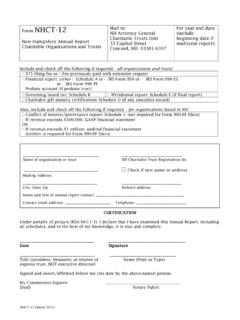

Charitable Trusts Unit

Found 8 free book(s)Form NHCT-12 For year end date - New Hampshire Attorney ...

www.doj.nh.govin Schedule B. For New Hampshire-based organizations and trusts, the Charitable Trusts Unit requires the home addresses, telephone numbers, and email addresses of board members so that the Unit can contact the board members individually, if needed, apart from management. The personal contact information is not subject to public disclosure.

ANNUAL REPORT INSTRUCTIONS - New Hampshire Attorney …

www.doj.nh.govCharitable Trusts Unit, it must file an updated copy along with Schedule C. Instructions for completing Schedule C are set forth below. 5. GAAP Financial Statement: Generally Accepted Accounting Principles (“GAAP”) is a commonly accepted way of recording and reporting accounting information and

1 Unit 01. Introduction to Taxation - University of Utah

content.csbs.utah.edu1 Unit 01. Introduction to Taxation our purposes, the sections on tax structure, types of tax, tax ... Charitable gifts are exempt –unlimited deduction Study Example 1-6 on Page 1-8 and 1-9 Other types of taxes ... Trusts and estates to the extent the trust’s or estate’s income is distributed (Example I: 1-23) ...

Charities Bureau Guidance Document Issue date: September ...

www.charitiesnys.com3 Throughout this guidance, the term “nonprofit” may be used to refer collectively to not-for-profit corporations and charitable trusts. 4 An amendment to Not-for-Profit Corporation Law § 713(f) that permits an employee to be the board chair under certain circumstances became effective on January 1, 2017.

Trusts and estates income tax rules - ird.govt.nz

www.ird.govt.nzCharitable trust A charitable trust is one in which the income can be used only for charitable purposes. For more information on charitable trusts, read our guide Charitable organisations (IR255). Corpus This is the market value of any property settled on a trust, at the date of settlement. Disposition of property

Sindh Act No.XXIX of 2020 - Provincial Assembly of Sindh

pas.gov.pkNO.PAS/LEGIS-B-19/2020- The Sindh Trusts Bill, 2020 having been passed by the Provincial Assembly of Sindh on 21 st August, 2020 and assented to by the Governor of Sindh on 22 nd September, 2020 is hereby published as an Act of the Legislature of Sindh. THE SINDH TRUSTS ACT, 2020 SINDH ACT NO. XXIX OF 2020 AN ACT

「認可慈善捐款」是指捐贈給 (i) 根據《税務條例》第88條獲 …

www.ird.gov.hk(ii) to the Government, for charitable purposes (for example : "Secretary for Home Affairs Incorporated - Donations to Sichuan Earthquake Relief Fund"). 截至2022年2月28日 根據《税務條例》第 88 條 獲豁免繳税的慈善機構及慈善信託的名單. LIST OF CHARITABLE INSTITUTIONS AND …

INCOME ELIGIBILITY GUIDELINES (Effective July 1, 2021 ...

www.health.ny.govDefinition of Income – Income means income before any deductions such as income taxes, Social Security taxes, insurance premiums, charitable contributions and bonds. It includes the following: (1) monetary compensation for services, including wages, salary, commissions or fees; (2) net income from nonfarm self-