Commissioner Of Income

Found 8 free book(s)Office of The Commissioner of Income Tax (International ...

office.incometaxindia.gov.inCommissioner of Income Tax (International Taxation)-2, New Delhi Annexure- I S. No. Name of Officer Design./Post Tel. No. Office/Fax Address 1. Sh. Kamlesh Chandra Varshney CIT(IT)-2, New Delhi 23234195 23234182(fax) Room No. 302, 3rd Floor, E2 Block, Dr. SPM Civic Centre, Minto Road, New Delhi 2. Smt. Anita Rai

FORM NO. 16A - Income Tax Department

www.incometaxindia.gov.initem II if tax is paid accompanied by an income-tax challan. 2. Non-Government deductors to fill information in item II. 3. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of the assessee. 4.

PENALTIES UNDER THE INCOME-TAX ACT

www.incometaxindia.gov.inUnder the Income-tax Act, penalties are levied for various defaults committed by the taxpayer. Some of the penalties are mandatory and a few are at the discretion of the tax ... accountant nominated by the Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner. Section 143(2) deals with the provisions ...

Low-Income Students: Who They Are and How They Pay for ...

nces.ed.govAssociate Commissioner The National Center for Education Statistics (NCES) is the primary federal entity for collecting, analyzing, ... be low income if they were single rather than mar-ried. The likelihood of being low income declined with age, in part because older students are more

Application for Farm Residence Property Tax Exemption

www.tax.nd.govOFFICE OF STATE TAX COMMISSIONER. SFN 24737 (9-2019) For farm residence property tax exemption under N.D.C.C. § 57-02-08(15), effective for property tax years 2020 and after. ... Is the annual gross income from farming activities of the occupant and spouse, if married, 66% or more

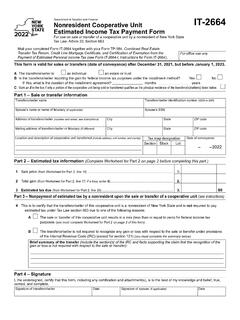

From IT-2664 Nonresident Cooperative Unit Estimated …

www.tax.ny.govEstimated Income Tax Payment Form For use on sale or transfer of a cooperative unit by a nonresident of New York State Tax Law–Article 22, Section 663 ... or the Commissioner of Taxation and Finance. (Currently designated delivery services are listed in Publication 55, Designated Private Delivery Services.

Part I - IRS tax forms

www.irs.gov1. Wages fall within the definition of income set forth in section 61(a)(1) of the Internal Revenue Code. Taxpayer A’s wages and other compensation for services are income subject to federal income tax and must be reported on Taxpayer A’s federal income tax return. 2. The payment of wages and other compensation for personal services is

Income Tax Guide for Native American Individuals and Sole ...

www.irs.govv. Commissioner, 295 U.S. 418 (1935) Income from trust land leased from the tribe or another Indian (for example, cattle ranching on tribal trust land used under grazing permits) Yes Form 1040 and any applicable return or schedule based on the character of the income : Has been held taxable on the ground that the individual Indian has