Common Reporting Standard Crs Entity

Found 8 free book(s)How to fill in the Common Reporting Standard (CRS) Entity ...

www.crs.hsbc.comWhat is the Common Reporting Standard? The Organisation for Economic Co-operation and Development (OECD) has developed the Common Reporting Standard (CRS) to stop individuals and Entities evading tax by hiding assets and income in foreign financial accounts. More than 90 countries have committed to rolling out the CRS.

Country-by-Country Reporting XML Schema - OECD

www.oecd.orgthe OECD’s Common Reporting Standard XML Schema, the United States’ FATCA XML Schema and the European Union’s Fisc 153 format. ... Reporting Entity and each Constituent Entity, as well as a summary of the activities of the MNE …

CRS-related Frequently Asked Questions - OECD

www.oecd.orgCommon Reporting Standard (CRS). These FAQs were received from business and government delegates. The answers to ... The Standard provides that where the settlor of a trust is an Entity, Reporting Financial Institutions must also identify the Controlling Person(s) of the settlor and report them as Controlling Person(s). Are the Controlling

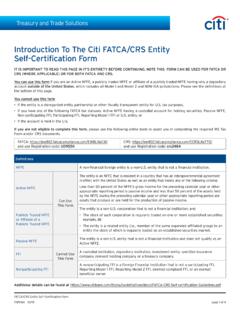

Introduction To The Citi FATCA/CRS Entity Self ...

www.citibank.com(“FATCA”) and Common Reporting Standard (“CRS”), Citi must obtain certain information about each account holder’s tax residency and tax classification status. In certain circumstances, Citi may be required to share this information with relevant tax authorities.

The Common Reporting Standard for Automatic Exchange …

www.ditc.kyCRS GUIDELINES Issued pursuant to Regulation 5A of the Tax Information Authority (International Tax Compliance) (Common Reporting Standard) Regulations, 2018 Date of Issue: 6 November 2020 Version 4.0 CRS Guidelines Version 4.0 replaces the previous Version 3.0 issued 15 March 2018

Entity Tax Residency Self-Certification Form (CRS-E(HK ...

www.crs.hsbc.comEntity Tax Residency Self-Certification Form (CRS-E(HK)) ... This is known as the Common Reporting Standard (the "CRS "). Under the CRS, we are required to determine where you are a "tax resident" (this will usually be where you are liable to pay corporate income taxes). If you are a tax resident outside the jurisdiction where your account is ...

FATCA/CRS FAQs:-

www.icicibank.com2. What is CRS? CRS is known as Common Reporting Standards. It is an information standard for the automatic exchange of information (AEoI), developed in the context of the Organisation for Economic Co-operation and Development (OECD). The Government of India has also joined the Multilateral Competent Authority

Self-Certification Form CRS - E

www.jpmorgan.com("OECD") Common Reporting Standard (“CRS”) require Financial Institutions ("FIs") to collect and report certain information about an account holder’s tax residency. If the account holder’s tax residence is located outside the country where the FI maintaining the account is located,