Search results with tag "Common reporting standard"

REVIEW OF DONOR REPORTING REQUIREMENTS ACROSS …

www.unjiu.orgstandardizing donor reporting among multiple organizations and donors, including common standard reporting of pooled funds, reporting on thematic or loosely earmarked multi-donor funded projects/programmes, and the United Nations template for inter-agency funding.

Guidance on the Common Reporting Standard for AEOI

www.ird.govt.nzGuidance on the . Common Reporting Standard . For . Automatic Exchange of Information . June 2017 . IN CONFIDENCE Page 1 of 165

The Common Reporting Standard for Automatic Exchange …

www.ditc.kyCRS GUIDELINES Issued pursuant to Regulation 5A of the Tax Information Authority (International Tax Compliance) (Common Reporting Standard) Regulations, 2018 Date of Issue: 6 November 2020 Version 4.0 CRS Guidelines Version 4.0 replaces the previous Version 3.0 issued 15 March 2018

CRS Common Reporting Standard - OECD.org

www.oecd.org5 agreement provides for automatic exchange of information between European Union Member States and Andorra, applying the OECD’s Common Reporting Standard.

CRS Controlling Person - Common Reporting Standard (CRS)

www.crs.hsbc.comCommon Reporting Standard (CRS) require financial institutions like us to collect and report information about where our customers are tax resident. Under these regulations, we have to ask you to provide the information requested in this form.

A guide to FACTA and the Common Reporting …

library.adviserzone.com04 A guide to FATCA and the Common Reporting Standard In summary We have included a matrix to help you check who may have to register and who may have obligations to comply with FATCA/CRS regulations:

Bahamas Competent Authority AEOI Portal User Guide v1

www.taxreporting.finance.gov.bsThe Bahamas Competent Authority AEOI Portal | User Guide | Version 1.0 4 1 Introduction 1.1 Purpose The purpose of this document is to provide an overview of the most commonly used functionality in The Bahamas Competent Authority AEOI Portal with respect to Financial Institutions meeting their reporting obligations under the OECD Common Reporting Standard (CRS) and the IRS Foreign Account

Country-by-Country Reporting XML Schema - OECD

www.oecd.orgthe OECD’s Common Reporting Standard XML Schema, the United States’ FATCA XML Schema and the European Union’s Fisc 153 format. ... Reporting Entity and each Constituent Entity, as well as a summary of the activities of the MNE …

CRS-related Frequently Asked Questions - OECD

www.oecd.orgCommon Reporting Standard (CRS). These FAQs were received from business and government delegates. The answers to ... The Standard provides that where the settlor of a trust is an Entity, Reporting Financial Institutions must also identify the Controlling Person(s) of the settlor and report them as Controlling Person(s). Are the Controlling

Foreign Account Tax Compliance Act (FATCA) and Common ...

www.ocbc.com.myAppendix 3 Page 1 of 11 OCBC Self-Certification Form for Entities_v.3 (010818) Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standards (CRS)

What is CRS? - STANLIB

www.stanlib.comWhat is CRS? Common Reporting Standard (CRS) is a global standard developed by the Organisation for Economic Co-operation and Development (OECD) for the automatic exchange of financial

Implementation Handbook: Standard for Automatic …

www.oecd.org1. The Common Reporting Standard (“CRS”) that contains the due diligence rules for financial institutions to follow to collect and report the information for the automatic exchange of financial information; 2. The Model Competent Authority Agreement (“CAA”) that specifies the financial information to be exchanged and links the CRS to the

Department for International Tax Cooperation

www.tia.gov.kyPage 1 of 2 Department for International Tax Cooperation CAYMAN ISLANDS _____ Common Reporting Standard (“CRS”) Legislation and Resources

CAYMAN ISLANDS - TIA

www.tia.gov.kyCayman Islands CRS Guidance Notes Version 3.0 Release Date: 15 March 2018 1 I. Overview A. General The Common Reporting Standard (“CRS”) was developed by the Organisation for Economic Co-operation and Development …

Table of Contents - IRAS

www.iras.gov.sg1 IRAS FAQs on the Common Reporting Standard (First published on 7 December 2016) Table of Contents A) GENERAL ..... 2

HMRC consultation: Mandatory Disclosure Rules

assets.publishing.service.gov.ukOECD model rules to replace the EU version of the rules. Previous engagement ... jurisdictions to implement the Common Reporting Standard (CRS) for automatic exchange of ... HMRC and other tax authorities in developing policies and tools to address loopholes. The draft regulations draw closely on the model rules themselves, to provide ...

Financial Secretary in the Ministry of Finance - thebfsb.com

thebfsb.comFinalized December 12th, 2017 Financial Secretary in the Ministry of Finance THE BAHAMAS GUIDANCE NOTES ON THE COMMON REPORTING STANDARD FOR AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT

Jurisdiction’s name: Canada Information on Tax ...

www.oecd.orgTIN is required to be collected for exchange of information purposes under the Common Reporting Standard. Individuals For individuals resident in Canada, their authorized tax identification number is their -digit nine Canadian Social Insurance Number (SIN) issued by Service CanadaEvery individual resident in .

How to fill in the Common Reporting Standard (CRS) Entity ...

www.crs.hsbc.comYou might find this chart helpful in understanding the form. Identif Part 1 (C): In ... identification/service code number and resident registration number. ... If your Entity falls into ANY of these categories, please tick the relevant type of “Financial Institution” in Part 2 (1) (a) ...

CRS-related Frequently Asked Questions

www.oecd.orgCommon Reporting Standard (CRS). These FAQs were received from business and government delegates. The answers to such questions provide further precisions on the CRS and help to ensure consistency in implementation. More information on the CRS is available on the Automatic Exchange Portal.

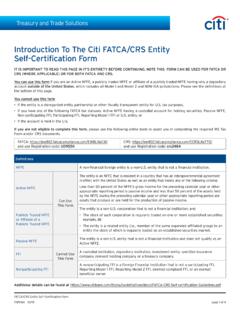

Introduction To The Citi FATCA/CRS Entity Self ...

www.citibank.com(“FATCA”) and Common Reporting Standard (“CRS”), Citi must obtain certain information about each account holder’s tax residency and tax classification status. In certain circumstances, Citi may be required to share this information with relevant tax authorities.

Entity Tax Residency Self-Certification Form (CRS-E(HK ...

www.crs.hsbc.comEntity Tax Residency Self-Certification Form (CRS-E(HK)) ... This is known as the Common Reporting Standard (the "CRS "). Under the CRS, we are required to determine where you are a "tax resident" (this will usually be where you are liable to pay corporate income taxes). If you are a tax resident outside the jurisdiction where your account is ...

Self-Certification Form CRS - E

www.jpmorgan.com("OECD") Common Reporting Standard (“CRS”) require Financial Institutions ("FIs") to collect and report certain information about an account holder’s tax residency. If the account holder’s tax residence is located outside the country where the FI maintaining the account is located,

Common Reporting Standard - IRAS

www.iras.gov.sgCommon Reporting Standard 2 Preface This draft e-Tax Guide is intended to assist businesses and those affected by the Common Reporting Standard (“CRS)”, in particular Singaporean Financial

Common Reporting Standard Status Message XML …

www.oecd.orgINTRODUCTION – 7 COMMON REPORTING STANDARD STATUS MESSAGE XML SCHEMA: USER GUIDE FOR TAX ADMINISTRATIONS © OECD 2017 Introduction With the first exchanges under the Common Reporting Standard being

COMMON REPORTING STANDARD (CRS): FACT SHEET 1. …

abs.org.sgCOMMON REPORTING STANDARD (CRS): FACT SHEET 1. What is CRS? CRS is an initiative by the G20 and Organisation for Economic Co-operation and Development (OECD) aimed at detecting and deterring tax evasion by taxpayers through the use of offshore accounts. Jurisdictions that commit to the CRS must adopt its

Common Reporting Standard (CRS) Guidance Notes - Hasil

www.hasil.gov.myCommon Reporting Standard (CRS) Guidance Notes 5 February 2018 Compliance Requirements for Income Tax (Automatic Exchange of Financial Account

Similar queries

Reporting, Common standard reporting, On the Common Reporting Standard for, On the . Common Reporting Standard . For, Common Reporting Standard, CRS Common Reporting Standard, For automatic, OECD, Common Reporting, Reporting Entity, Entity, Frequently Asked Questions, Standard, Common, Common Reporting Standards CRS, What is CRS, Implementation Handbook, Department for International Tax Cooperation, CAYMAN ISLANDS, Cayman Islands CRS Guidance Notes, Table of Contents, Loopholes, GUIDANCE NOTES, Common Reporting Standard (CRS) Entity, Chart, Identification, Tick, Citi, CRS Entity, Entity Tax Residency Self-Certification Form CRS, Self-Certification Form CRS - E, COMMON REPORTING STANDARD STATUS MESSAGE XML, COMMON REPORTING STANDARD (CRS): FACT SHEET, Common Reporting Standard (CRS) Guidance Notes