Transcription of What is CRS? - STANLIB

1 what is CRS? common reporting Standard (CRS) is a global standard developed by the Organisation for Economic Co-operation and Development (OECD) for the automatic exchange of financial account information between tax authorities worldwide. Over 80 countries (participating countries) including South Africa (SA) have agreed to exchange information under CRS, with a planned, phased approach implementation. Current list of countries that intend to adopt CRS: Under CRS, South African financial institutions including STANLIB are required to identify and report on certain accounts held directly or indirectly by tax residents in any of the overseas participating CRS countries.

2 The reportable information is required to be sent to the South African Revenue Services (SARS), who will then share it with the relevant overseas tax authorities where the account holders are identified as being tax resident. STANLIB is committed to being fully compliant with CRS regulations. To comply with CRS regulations, STANLIB must establish the tax status of account holders and may from time to time request further information and/or documentation from clients to confirm their tax status. If clients have relationships with other members of the STANLIB Group, they may receive more than one request for confirmation of their tax status.

3 It is important that clients respond to all such requests. If clients require any further information or have any questions concerning the CRS regulations, they should refer to the SARS website or speak to a tax advisor. When do CRS regulations come into effect? CRS came into effect on 01 March 2016 and applies to: a. New accounts opened on or after 01 March 2016; and b. Pre-existing accounts open as at 28 February 2016. Do CRS regulations replace FATCA (US Foreign Account Tax Compliance Act)? No, CRS operates alongside FATCA. FATCA applies to Americans only, CRS applies to all entities or persons who are not South African nationals.

4 Does CRS apply to all SA banks and financial institutions? Yes, all SA banks and financial institutions are required to comply with CRS regulations. Which accounts are impacted by CRS? a. A Depository Account includes any commercial current, savings, time or thrift account, or any account evidenced by a certificate of deposit, investment certificate, thrift certificate, certificate of indebtedness, or other similar instrument where cash is placed on deposit with an entity engaged in a banking or similar business. A Depository Account does not have to be an interest bearing account.

5 B. Custodial Accounts A Custodial Account is an account (other than an insurance contract or Annuity Contract) for the benefit of another person that holds one or more Financial Assets. c. Equity and debt interests in investment entities. Equity and debt interests are financial accounts if they are interests in an investment entity. d. Cash Value Insurance Contracts A Cash Value Insurance Contract is an investment product that has an element of life insurance attached to it. The life insurance element is often small compared to the investment element of the contract.

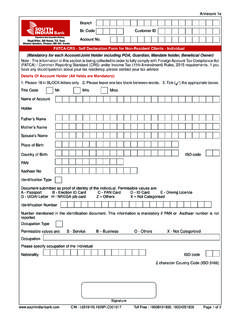

6 General insurance products, such as term life insurance, property or motor insurance, that do not carry any investment element are not financial accounts e. Annuity Contracts An Annuity Contract is a contract under which the issuer agrees to make payments for a period of time, determined in whole or in part by reference to the life expectancy of one or more individuals. what is the impact for clients? Clients will be required to provide STANLIB with a self-certification. A self-certification form is a form on which the client declares his tax status and provides information required for CRS.

7 This may form part of the account opening process and STANLIB will contact every client where further information is required or a self-certification form has to be completed. For pre-existing accounts open as at 28 February 2016 clients may be contacted to provide additional information or to complete a self-certification form. what happens if a client does not provide a self-certification? The account will be reported to SARS as undocumented. what happens if my tax residency changes? Please notify STANLIB to ensure we hold the correct tax residency status on your accounts, as this will affect whether your account is reported to SARS and which overseas tax authorities your information is shared with.

8 what should I do if I am unsure of what my classification is? If you are unsure of your classification under CRS, you should seek guidance from SARS or a tax advisor. what is the CRS reporting period? CRS first reporting period is 1 March 2016 to 28 February 2017. When will information be reported to SARS? STANLIB is required to submit an annual report to SARS by 31 May following the end of a CRS reporting period. For example, the annual report for the reporting period of 1 March 2016 to 28 February 2017 must be submitted to SARS by 31 May 2017. what information will be reported?

9 STANLIB has to report the identity of each person or entity holding the account and the balance and income of all accounts held by the person or entity being reported for each reporting period. The following specific information is currently required to be reported: a. Name b. Address c. Country of tax residence d. Tax identification number e. Account number f. Account balance g. Income (interest, dividends, gross proceeds, etc.) credited to the account holder s accounts h. Date and place of birth (for individuals)