Deduction directive pension and provident funds

Found 5 free book(s)Request for a Tax Deduction Directive Pension and ...

www.sars.gov.zaRequest for a Tax Deduction Directive Pension and Provident Funds on Retirement/Death before Retirement FORM A&D Taxpayer Details Application no. Residential Address

Request for a Tax Deduction Directive Pension and ...

www.sars.gov.zaRequest for a Tax Deduction Directive Pension and Provident Funds - Events Before Retirement or Death FORM B FORM B Version: v2017.00.15 Page of Page: 01/04

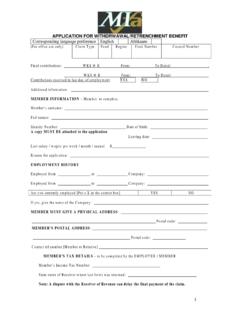

APPLICATION FOR …

www.mifa.org.zaR R R R 1 8 2 0 4 C C Y Y Particulars of gross lump sum due (Continue) In thecaseof aProvident fund, total contributions (e xcluding profit and interest) by memberto thefund R Did the fund pay any portion of the lump sum payment into another fund?

Employee tax certificate (IRP5 or IT3(a)) explained - …

www.finfocus.co.zaPublished: 1/2/2017 Employee tax certificate (IRP5 or IT3(a)) explained 1 / 5 The tax season for individuals runs from July to November every year.

GUIDE FOR EMPLOYERS IN RESPECT OF …

www.sapayroll.co.zaeffective date 2014.03.01 guide for employers in respect of employees’ tax (2015 tax year) paye-gen-01-g04 revision: 12 page 2 of 63 table of contents