Epcrs

Found 3 free book(s)How to Correct Missed or Late Contributions (Employee and ...

wwwrs.massmutual.comSystem. EPCRS includes procedures for correcting plan related problems through self-correction or filing a voluntary application with the IRS. Generally, missed employee contributions result when an employee is not allowed to defer in accordance with the provisions of the plan document. In that case, EPCRS requires the plan

Rev. Proc. 2019-19 TABLE OF CONTENTS SYSTEM .01 Purpose p.

www.irs.govsystem, the Employee Plans Compliance Resolution System ("EPCRS"), permits Plan Sponsors to correct these failures and thereby continue to provide their employees with retirement benefits on a tax-favored basis. The components of EPCRS are the Self-Correction Program ("SCP"), the Voluntary Correction Program ("VCP"), and the Audit

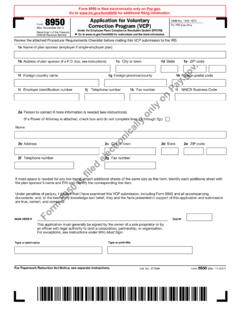

Form 8950 (Rev. November 2017) - IRS tax forms

www.irs.govSee the current EPCRS revenue procedure in effect at the time the submission is made to the IRS. 19. For each failure described in this VCP submission that includes a failure related to transferred assets, as defined in the current EPCRS revenue procedure, have you included an attachment that describes the related employer transaction,