Estimated income

Found 6 free book(s)Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govthe real property. However, you pay estimated personal income tax only on that portion of the gain that will be reported on your 2021 federal income tax return. For payments of estimated income tax due on installment payments received in tax years after 2021, you must use either Form IT-2105, Estimated Tax Payment Voucher for Individuals,

2021 Form 1040-ES (NR) - IRS tax forms

www.irs.govPay Estimated Tax, later. No income subject to estimated tax during first payment period. If, after March 31, 2021, you have a large change in income, deductions, additional taxes, or credits that requires you to start making estimated tax payments, you should figure the amount of your estimated tax payments by using the annualized income

2020 PA-40 ES INDIVIDUAL

www.revenue.pa.govDECLARATION OF ESTIMATED PERSONAL INCOME TAX DECLARATION OF ESTIMATED PERSONAL INCOME TAX (PA-40 ES) Use the 2020 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer’s …

2022 Form 1041-ES

www.irs.govHow To Figure Estimated Tax. Use the 2022 Estimated Tax Worksheet and 2022 Tax Rate Schedule, later, and the estate’s or trust’s 2021 tax return and instructions as a guide for figuring the 2022 estimated tax. If the estate or trust receives its income unevenly throughout the year, it may be able to lower or eliminate the

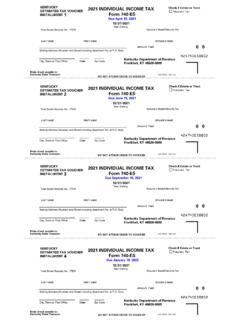

KENTUCKY 2021 INDIVIDUAL INCOME TAX ESTIMATED TAX …

revenue.ky.govESTIMATED TAX VOUCHER INSTALLMENT 1 Make check payable to: Kentucky State Treasurer. Your Social Security No. / FEIN Spouse's Social Security No. Amount Paid 0 0 42A740ES0002 Kentucky Department of Revenue Frankfort, KY 40620-0009 42A740ES (09/20) DO NOT ATTACH CHECK TO VOUCHER 2021 INDIVIDUAL INCOME TAX Form 740-ES Due …

2021 New Jersey Nonresident Return, Form NJ-1040NR

www.nj.gov47. Penalty for Underpayment of Estimated Tax. Check box if Form NJ-2210NR is enclosed ..... 47. 48. Total Tax and Penalty (Add line 46 and line 47) ..... 48. 49. Total New Jersey Income Tax Withheld (From enclosed Forms W-2 and