Farmer S Exemption Certificate

Found 9 free book(s),STATE INDIANA Indiana Department of Revenue

www.nscorp.comForm ST-105 Indiana Department of Revenue State Form 49065 R4/ 8 -05 General Sales Tax Exemption Certificate Indiana registered retail merchants and businesses located outside Indiana may use this certificate.The claimed exemption must be allowed by Indiana code. Exemption statutes of other states are not valid for purchases from Indiana vendors.

Form ST-105 Indiana Department of Revenue State Form ...

www.newwavetech.comForm ST-105 State Form :19065 R'+/ 8-0-5 Indiana Department of Revenue General Sales Thx Exemption Certificate Indiana registered relail merchants and businesses located outside Indiana may use this certificate.

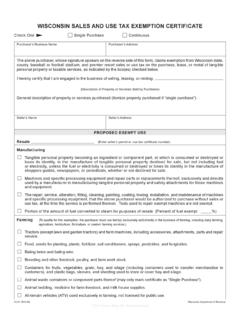

WISCONSIN SALES AND USE TAX EXEMPTION …

www.edist.comWISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE S-211 (R.9-00) Wisconsin Department of Revenue This Form May Be Reproduced Check One Single Purchase Continuous

CHAPTER 12A-1, FLORIDA ADMINISTRATIVE CODE

floridarevenue.com2 SUGGESTED PURCHASER’S EXEMPTION CERTIFICATE ITEMS FOR AGRICULTURAL USE OR FOR AGRICULTURAL PURPOSES AND POWER FARM EQUIPMENT This is to certify that the items identified below, purchased on or after _____ (date)

KANSAS DEPARTMENT OF REVENUE

www.ksrevenue.orgKANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from:

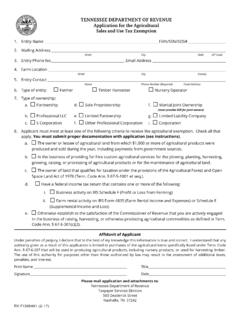

TENNESSEE DEPARTMENT OF REVENUE Application for the ...

www.tn.govRV-F1308401 (2-17) Tenn. Code Ann. § 67-6-207 provides a sales and use tax exemption to “qualified farmers and nurserymen” for the purchase of specifically listed agricultural items.

Sales Tax Exemption Administration - New Jersey

www.state.nj.usRev. 8/07 Sales Tax Exemption Administration . Tax Topic Bulletin S&U-6 . Introduction . The New Jersey Sales and Use Tax Act (the “Act”) imposes a tax on receipts from every retail

Form ST-125:6/18:Farmer's and Commercial Horse Boarding ...

www.tax.ny.govI certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. The property or service(s) will be used or consumed in farm production or in a commercial horse boarding

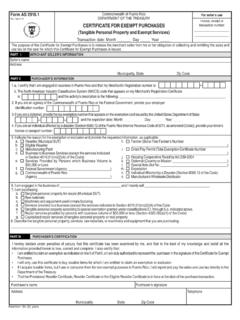

CERTIFICATE FOR EXEMPT PURCHASES transaction number ...

www.hacienda.gobierno.pr1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. INSTRUCTIONS Who must complete this form? This form must be completed by: A purchaser registered in the Merchant’s Registry ...

Similar queries

INDIANA Indiana, Indiana, Exemption Certificate Indiana, Certificate, Exemption, Indiana Department of Revenue State, General Sales Thx Exemption Certificate, WISCONSIN SALES AND USE TAX EXEMPTION, WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE S, S EXEMPTION CERTIFICATE, EXEMPTION CERTIFICATE, TENNESSEE, Sales Tax Exemption Administration, New Jersey, Farmer, CERTIFICATE FOR EXEMPT PURCHASES