Filing status

Found 7 free book(s)LIST OF LOCAL OFFICES AND CANDIDATE FILINGS …

www.co.boone.ne.usoffice vote for/term length name of candidate filing status party date of filing village trustees - petersburg** vote for 3 - 4 yrs corey stokes incumbent n/a 3/2/2018

CERTIFIED STATEMENT OF INCOME AND TAX …

www.dfas.milCERTIFIED STATEMENT OF INCOME AND TAX FILING STATUS Extended TDY Tax Reimbursement Allowance (ETTRA) (For travel which began on or after 1/1/2015)

Electronic Filing Instructions In re Citigroup Inc. …

www.citigroupbondactionsettlement.com1 – In re Citigroup Inc. Bond Litigation Electronic Filing Instructions In re Citigroup Inc. Bond Litigation I. Important Notes – PLEASE READ

AFFIDAVIT OF IDENTITY AND RECEIPT OF FILING

www.michigan.govAFFIDAVIT OF IDENTITY AND RECEIPT OF FILING . PLEASE COMPLETE SECTIONS I, II, III AND IV BELOW (Print or Type) – See Reverse Side for Important Notifications

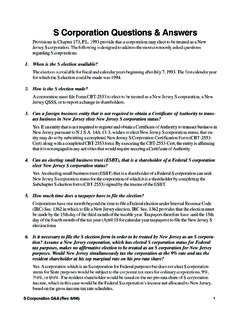

S Corporation Questions & Answers

www.state.nj.usS Corporation Q&A (Rev. 8/06) 4 S corporation status. However, the statute does provide for a reduced corporate tax rate based on the difference between the highest personal income tax rate and the corporation business tax rate.

RESIDENT, NON-RESIDENT AND PART-YEAR …

www.dor.ms.govform 80-100-16-8-1-000 (rev. 01/17) resident, non-resident . and . part-year resident . income tax instructions . 2016. individual income tax bureau. po box 1033

1. Tables for Figuring Amount Exempt from Levy on …

www.irs.govexempt from levy. 4. if the taxpayer in number 3 is over 65 and has a spouse who is blind, this taxpayer should write 2 in the ADDITIONAL STANDARD DEDUCTION space on Parts 3,4, and 5 of the levy.