Search results with tag "Filing status"

Tax Organizer for Individuals - Tax Pros Plus

www.taxprosplus.comall supporting documents, canceled checks, etc., as these items may later be needed to prove accuracy and completeness of a return. We will retain copies of your records and our work papers for your engagement for seven years, after which these ... Filing status: Single Head of Household Married filing joint Married filing separate Widower Year ...

886-H-HOH (October 2019) Supporting Documents to Prove ...

www.irs.govSupporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. Name of Taxpayer. Taxpayer Identification Number Tax Period Ending. If You Are:

Form 14824 (10-2021)

www.eitc.irs.govSupporting Documents to Prove Filing Status Taxpayer name. Taxpayer Identification Number Tax period ending If you filed your tax return as: Send photocopies of the following documents: Filing Status Test You are unmarried for the whole tax year if you obtained a final decree of divorce or separate maintenance by the last day of your tax year. You

2020 LOUISIANA TAX TABLE - Single or Married Filing ...

revenue.louisiana.gov2020 LOUISIANA TAX TABLE - Single or Married Filing Separately (Filing Status Box 1 or 3) To determine your Louisiana tax, locate the amount of your tax table income (Line 10 of Form IT-540) in the first two columns. Read across to the column with the same number as the total number of exemptions you claimed on Line 6D.

2019 Publication 1031 Guidelines for Determining Resident ...

www.ftb.ca.govCalifornia income tax return using either the married/RDP filing jointly or married/RDP filing separately filing status. For purposes of California income tax, references to a spouse, husband, or wife also refer to a California . RDP, unless otherwise specified. When we use the . initials RDP they refer to both a California registered

LIST OF LOCAL OFFICES AND CANDIDATE FILINGS …

www.co.boone.ne.usoffice vote for/term length name of candidate filing status party date of filing village trustees - petersburg** vote for 3 - 4 yrs corey stokes incumbent n/a 3/2/2018

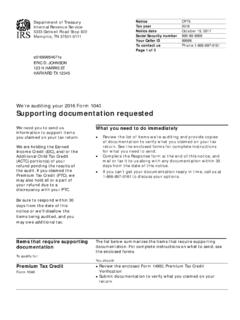

You need to send supporting documentation - IRS tax forms

www.irs.govFiling Status Form 1040 • Review the enclosed Form 886-H-HOH, Supporting Documents to Prove Head of Household Filing Status. • Submit the documentation requested to show you’rethe head of your household. If we don’t hear from you If you don’t mail or fax your supporting documentation within 30 days from

Earned Income Tax Credit Worksheet for Tax Year 2021

newtoncpapllc.comFor Taxpayers who have Filing Status - Head of Household . 1. What is your Marital Status? 2. If you are divorced or legally separated, can you provide the IRS with any of the following documents? - Divorce Decree - Separate maintenance agreement or separation agreement?

Filing Status (PDF) - IRS tax forms

apps.irs.gov3 See Publication 17, Your Federal Income Tax For Individuals, Filing Status, for rules applying to birth, death, or temporary absence during the year. There are special rules for claiming your parent as a qualifying person for head of household. See the Who Is a

Filing Status - IRS tax forms

apps.irs.govsubsequent divorce usually does not relieve either spouse of the liability associated with the joint return. In some cases, a spouse may be relieved of joint liability. Information is available in Publication 971, ... The income of taxpayers who lived in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas,

Similar queries

Tax Organizer for Individuals, Supporting documents, To prove, Filing Status, Head of Household, Filing, Supporting Documents to Prove, Supporting Documents to Prove Filing Status, Documents, California, Supporting, IRS tax forms, Supporting Documents to Prove Head of Household Filing Status, Head, Household, Status, Divorce, In Arizona