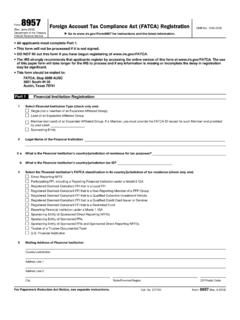

Foreign Account

Found 4 free book(s)Form 8957 Foreign Account Tax Compliance Act (FATCA ...

www.irs.govForm 8957 (Rev. June 2018) Department of the Treasury Internal Revenue Service . Foreign Account Tax Compliance Act (FATCA) Registration . . Go to

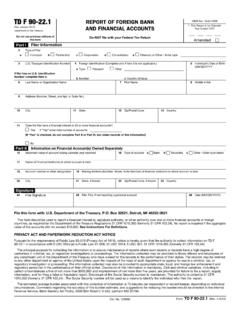

TD F 90-22.1 REPORT OF FOREIGN BANK - IRS tax forms

www.irs.govPart II Information on Financial Account(s) Owned Separately 15 Maximum value of account during calendar year reported 16 Type of account a Bank b Securities c Other—Enter type below 17 Name of Financial Institution in which account is held ... Foreign Financial Account. (b) (f) of .

2020 Form 8938 - IRS tax forms

www.irs.govPart V Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary (see instructions) If you have more than one account to report in Part V, attach a continuation statement for each additional account. See instructions. 1: Type of account Deposit:

1118 Foreign Tax Credit—Corporations - IRS tax forms

www.irs.govsection 909 and for which the related income is taken into account by the corporation during the current tax year ... part to report the tax deemed paid by the domestic corporation with respect to distributions of PTEP from first-tier foreign corporations under section 960(b). For each line