Search results with tag "Foreign account"

CHAPTER I FOREIGN EXCHANGE MARKETS I. Introduction to …

www.bauer.uh.eduThe foreign accounts used to settle international payments can be held by foreign branches of the same bank, or in an account with a correspondent bank. A correspondent bank relationship is established when two banks maintain a correspondent …

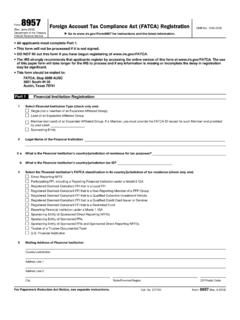

Form 8957 Foreign Account Tax Compliance Act (FATCA ...

www.irs.govForm 8957 (Rev. June 2018) Department of the Treasury Internal Revenue Service . Foreign Account Tax Compliance Act (FATCA) Registration . . Go to

FATCAQUESTIONNAIRE FATCA Foreign Account …

fatcaconsultants.comFATCA C O N S U L T A N T S Foreign Account Tax Compliance Act. TM Thepurposeofthisquestionnaireistoobtaininformation toassistusintheprocessofregisteringyourentity ...

Scotiabank GIINs – 2018.09.05 (Foreign Account …

www.scotiabank.comScotiabank GIINs – 2018.09.05 fFF_ FATCA / CRS (Foreign Account Tax Compliance Act / Common Reporting Standard) Country/pais/pays Name/nombre/nom GIIN W-8BEN-E CRS

Dividends Ordinary Interest and

www.irs.govPart III. Foreign Accounts and Trusts. Regardless of whether you are required to file FinCEN Form 114 (FBAR), you may be re-quired to file Form 8938, Statement of Specified Foreign Financial Assets, with your income tax return. Failure to file Form 8938 may result …

Introduction To The Citi FATCA/CRS Entity Self ...

www.citibank.comTo comply with tax information reporting requirements of governmental authorities such as Foreign Account Tax Compliance Act (“FATCA”) and Common Reporting Standard (“CRS”), Citi must obtain certain information about each account holder’s tax residency and tax classification status. In certain circumstances, Citi may be required to ...

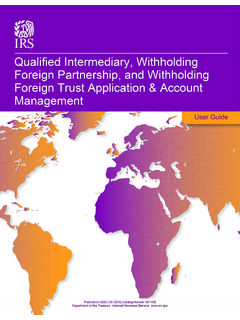

Foreign Account Tax Compliance Act FATCA

www.irs.govWithholding Foreign Trust Application and Account Management Foreign Account Tax Compliance Act. User Guide June 2021. Publication 5262 (Rev. 06-2021) Catalog Number 69140Z Department of the Treasury. Internal Revenue . Service www.irs.gov. QI/WP/WT Application and Account Management User Guide 2 . Contents

Foreign Corrupt Practices Act (“FCPA”)

www.bakerlaw.comforeign accounts. Officers, directors, employees, agents and stockholders acting on behalf of an issuer or U.S. company can be held liable under the FCPA and can face charges distinct from those of the entity. The 1998 Amendments to the FCPA expanded the jurisdiction of the FCPA to include foreign companies if they cause,

Similar queries

Foreign, Foreign accounts, Foreign Account, Foreign Account Tax Compliance Act, Scotiabank, Foreign Account Tax Compliance Act / Common Reporting Standard, FBAR, Foreign Financial, Citi FATCA, FATCA, Citi, Account, Application and Account Management Foreign Account, Application and Account Management User, Foreign Corrupt Practices Act “FCPA