Form 990 Or 990

Found 3 free book(s)2021 Schedule E (Form 990) - IRS tax forms

www.irs.gov990-EZ to report information on private schools. Who Must File. An organization that answered “Yes” on Form 990, Part IV, line 13, or Form 990-EZ, Part VI, line 48, must complete and attach Schedule E to Form 990 or 990-EZ, as applicable. This means the organization checked the box on Schedule A (Form 990), Public Charity Status and

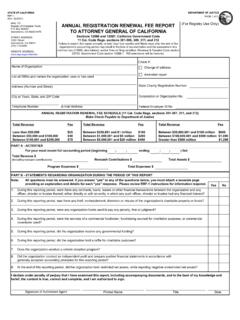

RRF-1, Annual Registration Renewal Fee Report ... - California

oag.ca.govA copy of IRS Form 990, 990-PF, 990-EZ, or 1120 as filed with IRS, together with all attachments and schedules, must be filed with the Attorney General's Registry of Charitable Trusts, together with Form RRF-1. Schedule B is not required. Organizations whose revenue falls below the threshold for filing IRS Form 990-EZ shall file Form RRF-1 with the

2021 Form 990 - IRS tax forms

www.irs.govForm 990 Department of the Treasury Internal Revenue Service Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)