Health Flexible Spending Account Fsa

Found 7 free book(s)PLAN YEAR 2022 ENROLLMENT/CHANGE FORM FLEXIBLE …

www1.nyc.govThe Health Care Flexible Spending Account (HCFSA) Program and the Dependent Care Assistance Program (DeCAP) are divisions of the Office of Labor Relations’ Flexible Spending Accounts Program. PLAN YEAR 2022 ENROLLMENT/CHANGE FORM . FLEXIBLE SPENDING ACCOUNTS (FSA) PROGRAM. nyc.gov/fsa.

Health Flexible Spending Account - WageWorks

mybenefits.wageworks.comHealth Flexible Spending Account Health Flexible Spending Account – Frequently Asked Questions What is a health flexible spending account? A health flexible spending account (FSA) is part of your benefits package. This plan lets you use pre-tax dollars to pay for eligible health care expenses for you, your spouse, and your eligible dependents.

Flexible Spending AccountOver-the-counter Drug List

fhdafiles.fhda.eduFlexible Spending Account Over-the-counter Drug List Over-the-counter drugs now reimbursable — one more good reason to enroll in a health care Flexible Spending Account (FSA)! Non-prescription, over-the-counter (OTC) drugs and medicines are now reimbursable under health Flexible Spending Accounts (FSAs). When you

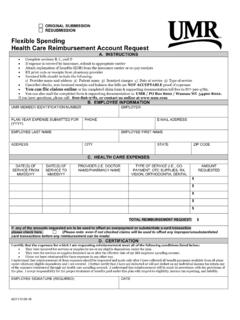

Flexible Spending Health Care Reimbursement Account …

fhs.umr.comFlexible Spending Health Care Reimbursement Account Request. A. INSTRUCTIONS • Complete sections B, C, and D • If expense is covered by insurance, submit to appropriate carrier • Attach explanation of benefits (EOB) from the insurance carrier or co-pay receipts • Rx print outs or receipts from pharmacy provider

Health Plans Tax-Favored Page 1 of 23 12:09 - 6-Jan-2022 ...

www.irs.govthat can be paid or reimbursed under health flexible spending arrangements (health FSAs), health savings ac-counts (HSAs), health reimbursement arrangements (HRAs), or Archer medical savings accounts (Archer MSAs). That is because the cost to diagnose and prevent COVID-19 is an eligible medical expense for tax purpo-ses.

Flexible Spending Account (FSA) Frequently Asked Questions

www.flexiblebenefit.comFlexible Spending Account (FSA) Frequently Asked Questions 1. What happens if I don’t spend all of the money? Where does it go? You will forfeit the money that remains in your account. Any excess funds are kept by the employer and can be used to offset the costs of administering the program. The IRS regulations require this,

Request for Reimbursement - myuhc

www.myuhc.comMail to: Health Care Account Service Center P.O. Box 740378 Atlanta, GA 30374 uFax: (248) 733-6148 u Toll-free fax: 1-866-262-6354 Please reimburse me for the expenses I am submitting on this form. By signing below I certify (promise) that: uThe expenses I am submitting were spent by me or my spouse or eligible dependents; uThese are eligible ...