Homestead Exemption Program

Found 7 free book(s)West Virginia State Tax

tax.wv.govparticipating in the Homestead Exemption Program: They must owe and pay a property tax liability on the Homestead Exemption eligible home (i.e., the assessed value of the eligible home must be greater than $20,000 prior to the application of the Homestead Exemption). Their federal adjusted gross income must meet the low-income test.

PROPERTY TAX SAVINGS - Greenville County

www.greenvillecounty.orgHomestead Exemption (SC Code of Laws 12-37-250) The S. C. Homestead Tax Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property. The

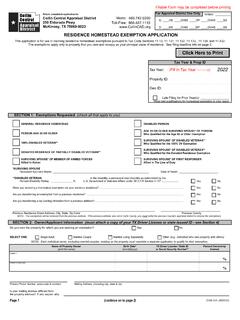

Residence Homestead Exemption Application

comptroller.texas.gov3. that I/the property owner do(es) not claim an exemption on another residence homestead or claim a residence homestead exemption on a residence homestead outside Texas. * May be used by appraisal district to determine eligibility for persons age 65 or older exemption or surviving spouse exemptions (Tax Code §11.43(m))

50-114 Application for Residence Homestead Exemption

www.mclennancad.orgPursuant to Tax Code Section 11.431, you may file a late application for a residence homestead exemption, including an exemption under Tax Code Sections 11.131, 11.132 and 11.133, after the deadline for filing has passed if it is filed not later than one year after the delinquency date for the taxes on the

Application for Residence Homestead Exemption

kaufman-cad.orgPursuant to Tax Code Section 11.431, you may "le a late application for a residence homestead exemption, including an exemption under Tax Code Sections 11.131, 11.132 and 11.133 after the deadline for "ling has passed if it is "led not later than one …

RESIDENCE HOMESTEAD EXEMPTION APPLICATION

www.collincad.orgHomestead Exemption, no later than two years after the tax deliquency date. • Re‐Filing: If the chief appraiser grants the exemption(s), you do not need to reapply annually. You must reapply, however, if the chief appraiser requires you to do so by sending you a new application asking you to

BOARD OF REVIEW Homeowners Property Tax Assistance …

detroitmi.gov3. Homeowners may be granted a full (100%), partial 50% exemption or partial 25% exemption. Regarding a Homestead Property Tax Credit that is forwarded to the City of Detroit, the proportioned amount remaining shall be exempt in whole or in part in accordance with the decision of the Board of Review.