Household Employer S

Found 8 free book(s)2022 HOUSEHOLD EMPLOYER’S GUIDE

edd.ca.gov2022 HOUSEHOLD EMPLOYER’S GUIDE. Important Information. Electronic Reporting and Payment Requirement:All employers must electronically submit employment tax returns, wage reports, and payroll tax deposits to the Employment Development Department (EDD). For

Qualified Small Employer Health Reimbursement …

www.healthcare.govyou (and any household members who are also provided the QSEHRA) aren’t eligible for a premium tax credit to lower the cost of Marketplace coverage for you and your household members. You’ll use your employer’s QSEHRA to help pay your premiums. If you’re starting your Marketplace application and don’t want to see if you

2021 Publication 926 - IRS tax forms

www.irs.gov2021 federal income tax withholding. The household employer rules for federal income tax withholding have not changed. That is, you're not required to withhold fed-eral income tax from wages you pay a household em-ployee. You should withhold federal income tax only if your household employee asks you to withhold it and you agree.

12. Filing Form 941 or Form 944 What's New 27

www.irs.govEmployer Identification Number \⠠怀䔠怀䤠怀丠怀尩 ... of household workers you pay $2,400 or more in cash wa-ges in 2022. Social security and Medicare taxes apply to election workers who are paid $2,000 or more in cash or an equivalent form of compensation in 2022. Reminders.

EMPLOYEES INFORMATION NHIP PREMIUM EMPLOYEE …

www.philhealth.gov.phEMPLOYER TYPE PRIVATE GOVERNMENT HOUSEHOLD REPORT TYPE REGULAR RF-1 ADDITION TO PREVIOUS RF-1 DEDUCTION TO PREVIOUS RF-1 APPLICABLE PERIOD _____ PHILHEALTH IDENTIFICATION NUMBER (PIN) EMPLOYEES INFORMATION Fill out this portion only if declared employee/s has not yet been issued his/her PIN 9 NHIP PREMIUM …

Employer Coverage Tool - HealthCare.gov

www.healthcare.gov3. List the first and last names of each person in the employee’s household and tell us if they could get health coverage through the employer named in box 4 below, even if they’re not currently enrolled. EMPLOYER information Ask the employer to enter the information in boxes 4–13. 4. Employer name 5.

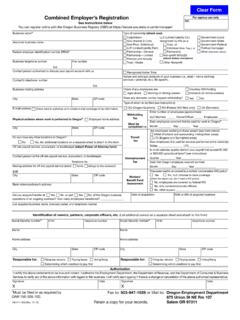

Combined Employer’s Registration - Oregon

www.oregon.govInstructions for Combined Employer’s Registration Transit taxes TriMet tax is an employer-paid excise tax based on payrolls for services performed in Multnomah and parts of Washington and Clackamas counties. Please refer to the map in the Oregon Business Guide. LTD (Lane Transit District) covers the Eugene/Springfield area of Lane county.

2020 Income Limits

www.hcd.ca.govhousehold income levels for extremely low-, very low-, low-, and moderate-income households for California’s 58 counties. The 2020 State Income Limits are on the California Department of Housing and Community Development (HCD) website at .