Instructions For Amending State Returns

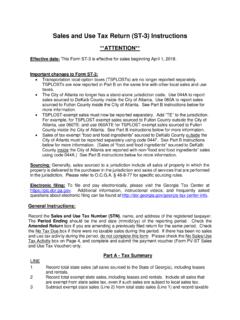

Found 6 free book(s)Sales and Use Tax Return (ST-3) Instructions

dor.georgia.govGeorgia, pays the other state’s 5% state sales tax at the time of purchase and returns to Georgia with the item. The purchaser will receive credit against Georgia’s 4% state use tax due and thus owes no additional state use tax . The purchaser owes local use tax at the rate in effect in the jurisdiction where the purchaser lives or

IFTA Quarterly Fuel Tax Return

dor.georgia.govInstructions Anyone holding a license under the International Fuel Tax Agreement is required to file an IFTA Quarterly Fuel Tax ... Check the Amended box if you are amending a previously filed return for the same quarter. ... Returns must be postmarked by the last day of the month following the end of the quarter, unless that day falls on the ...

CLGS-32-1 (10-21) TAXPAYER ANNUAL LOCAL EARNED …

keystonecollects.comPhiladelphia or out-of-state withholdings: If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-of-state municipality that imposes a local income tax, enter applicable amount on Line 12, as allowed by law. See instructions for Line 12. Use e-file to automatically enter the correct figure on Line 10.

COMBINED TAX RETURN FOR INDIVIDUALS FORM SP 2020 …

www.portland.govMar 24, 2021 · AMENDED RETURNS . The Revenue Division does not have a separateform for amended tax returns. To amend your Combined Tax Return, use the form for the tax year being amended and check the “Amended” box. If the address for the year you’re amending has changed, use your current mailing address and check the “Mailing Address Change” box.

School District Income Tax Return

tax.ohio.govWhen amending due to changes to my federal return, should I file my amended Ohio return(s) at the same time I file my amended federal return with the IRS? Refund: You should wait to file your amended Ohio IT 1040 and/or SD 100 until the IRS has approved the changes to your amended federal return. When filing your amended returns, you must include:

Amended and Prior Year Returns - IRS tax forms

apps.irs.govAmended returns can be prepared using tax software. However, only tax year 2019 Forms 1040 and 1040-SR returns can be amended and filed electronically using Form 1040-X. Part I, Exemptions and Dependents (on page 2), is used only if the taxpayer is increasing or decreasing the number of dependents claimed on the return being amended.