Levy Of Excise Duty

Found 10 free book(s)SCHEDULE NO. 1 CONTENTS ORDINARY CUSTOMS DUTY, …

importexportlicense.co.zaORDINARY CUSTOMS DUTY, SPECIFIC EXCISE DUTIES, AD VALOREM EXCISE DUTIES, ENVIRONMENTAL LEVY, FUEL LEVY, ROAD ACCIDENT FUND LEVY, HEALTH PROMOTION LEVY AND ORDINARY LEVY . GENERAL NOTES . NOTE . A General Rules for the interpretation of this Schedule B Duty assessment . C Value for duty purposes . D Mass for …

VALUE ADDED TAX ACT - Kenya Law Reports

www.kenyalaw.org“duty of customs” means excise duty, import duty, export duty, suspended duty, dumping duty, levy, cess, imposition, tax or surtax charged under and law for the time being in force relating to customs and excise; “entertainment” means an exhibition, performance or amusement to

Office use only Application for refund of fuel excise duty ...

www.nzta.govt.nzLegislation providing for the refund of excise duty on fuels is contained in section 5 of the Land Transport Management (Apportionment . and Refund of Excise Duty and Excise-Equivalent Duty) Regulations 2004. Refunds of ACC levies are provided by the Injury Prevention, Rehabilitation and Compensation (Refund of Fuel Levy) Regulations 2003.

Federal Excise Act, 2005

download1.fbr.gov.pkChapter-II – Levy, Collection and Payment of duty 10 3 Duties specified in the First Schedule to be levied. 10 4 Filing of return and payment of duty etc 12 5 Zero rate of duty and drawback of duty etc. 13 6 Adjustment of duties of excise. 13 7 Application of the provisions of the Sales Tax Act, 1990. 14 8 Default surcharge. 15

THE CUSTOMS TARIFF ACT, 1975

www.cbic.gov.inLevy of additional duty equal to excise duty, sales tax, local taxes and other charges. — (1) Any article which is imported into India shall, in addition, be liable to a duty (hereafter in this section referred to as the additional duty) equal to the excise

Circular No. 1053/02/2017-CX F.No. 96/1/2017-CX.I ...

www.eximguru.comThe demand of duty may also arise on account of duty collected without the authority of levy or in excess of the levy but not deposited with the department in terms of Section 11D of the Central Excise Act, 1944. 1.2 Demand of duty from the assessee is made by way of issue of a …

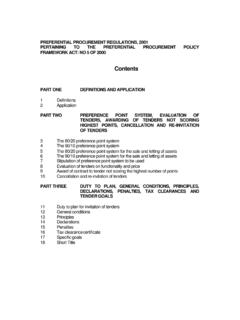

PPPF REGULATIONS APPROVED - National Treasury

www.treasury.gov.zaexcise duty and any other duty, levy, or tax which, in terms of a law or regulation is binding on the contractor and demonstrably has an influence on the price of any supplies, or the rendering costs of any service, for the execution of the contract; (h) “Historically Disadvantaged Individual (HDI)” means a …

Taxation in Uganda

www.gtuganda.co.ugcustoms duties which include import duty, Value Added Tax, Withholding tax, Excise duty and other duties e.g. environmental levy. Applicable tax rates are defined in the Customs External Tariff. Goods are valued using the following methods adopted by GATT (General Agreement on Tariff and Trade) and applied chronologically – 1) Transaction value.

INDIRECT TAXATION - icmai.in

www.icmai.in2.5 Levy, Collection & Exemptions from Excise Duty 2.3 2.6Goods 2.6 2.7 Excisability of Plant & Machinery, Waste and Scrap 2.10 2.8Manufacture 2.11 2.9Manufacturer 2.14 2.10 Classification of Goods 2.16 2.11 Valuation of Goods 2.21 2.12 Valuation in case of Job Work – Rule 10A 2.34 2.13 Some Critical Issues in Central Excise 2.35

Customs Procedure Codes

www.burs.org.bwRebate full duty less duty in Section A of Pt 2 of Sch. 1 4000, 4052, 4053, 4071 409 1 motor vehicle /family imported for personal use on change of residence owned and used abroad for less than 12 months as specified in rebate item 407.04 Rebate full duty less duty in Section A of Pt 2 of Sch. 1, less the duty calculated pro rata on a daily basis