Nonresident real property estimated income

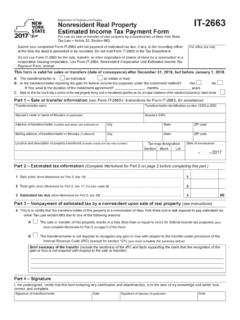

Found 8 free book(s)Form IT-2663:2017:Nonresident Real Property …

www.vintageabstract.comDepartment of Taxation and Finance Nonresident Real Property Estimated Income Tax Payment Form For use on sale or transfer of real property by a nonresident …

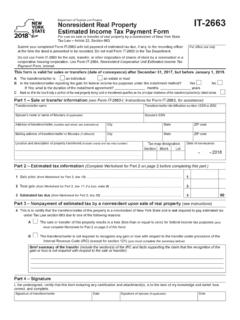

Form IT-2663:2018:Nonresident Real Property …

www.tax.ny.govDepartment of Taxation and Finance Nonresident Real Property Estimated Income Tax Payment Form For use on sale or transfer of real property by a nonresident …

Form TP-584:4/13:Combined Real Estate Transfer …

www.tax.ny.govPage 2 of 4 TP-584 (4/13) Part III – Explanation of exemption claimed on Part I, line 1 (check any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason:

FTB Pub 1017, Resident and Nonresident …

www.countyairports.orgfrom all payments or distributions of California source income made to a nonresident payee unless the withholding agent receives a certified FTB …

2017 Income Tax Return FORM for Trusts and CT …

www.ct.gov2017 FORM CT-1041 Connecticut Income Tax Return for Trusts and Estates • Resident Trusts and Estates • Nonresident Trusts and Estates • …

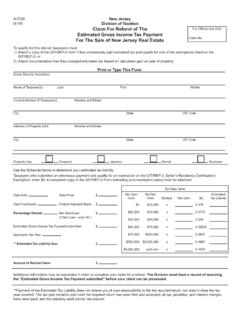

A-3128 - Claim for Refund of Estimated Gross …

www.state.nj.usA-3128 State of New Jersey (2-17) Division of Taxation. CLAIM FOR REFUND OF. ESTIMATED GROSS INCOME TAX PAYMENT. PAID UNDER PROVISIONS OF C. 55, P.L. 2004. In order to qualify for this refund --

TP-584 New York State Department of Taxation …

www.judicialtitle.comNew York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the

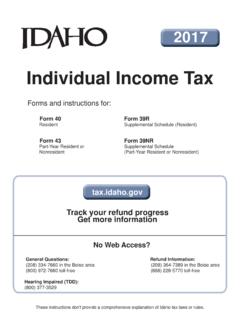

Individual Income Tax Instructions Packet

tax.idaho.govForms and instructions for: Form 40 Form 39R Resident Supplemental Schedule (Resident) Form 43 Form 39NR Part-Year Resident or Supplemental Schedule

Similar queries

2017:Nonresident Real Property, Nonresident Real Property Estimated Income, Real property, Nonresident, IT-2663, Nonresident Real Property, TP-584, Real, 1017, Resident and Nonresident, Income, Connecticut Income, For Refund of Estimated Gross, New Jersey, FOR REFUND OF. ESTIMATED GROSS INCOME TAX PAYMENT, York State Department of Taxation, York State Department of Taxation and, Instructions