Nonresident Tuition

Found 9 free book(s)California State University Nonresident Tuition Exemption

www.calstate.eduCALIFORNIA NONRESIDENT TUITION EXEMPTION REQUEST . Education Code § 68130.5, as amended, commonly known as . AB 540. Effective January 1, 2018. INSTRUCTIONS Complete and sign this form to request exemption from nonresident tuition charged to nonresident students. Once determined to be eligible, you will

Undergraduate Tuition and Required Fees

www.lsu.eduNov 09, 2021 · Undergraduate Tuition and Required Fees Last Updated on 11/09/2021 Fall 2021 Semester Fees Undergraduate Students Academic . Student Dedicated ; Excellence Technology Building Operational Excellence ; Resident ; Nonresident ; Nonresident ; Tuition Fees ; Fee Fee Use Fee Fee Fee ; Total ; Fee ; Total ; Full Time (12 or more hours): 15 hours ...

Part-Year Resident/Nonresident Tax Calculation Schedule …

tax.colorado.govFull-Year Resident Nonresident 305-day rule Military 3. Mark the federal form you filed: 1040 1040 NR 1040 SR Other ... • Student loan interest deduction, alimony, and tuition and fees deduction are allowed in the Colorado to federal total income ratio (line 21 / line 20).

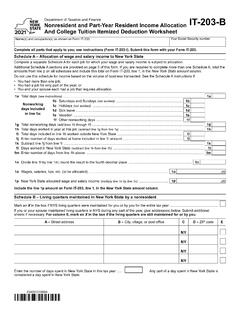

Form IT-203-B Nonresident and Part-Year Resident Income ...

www.tax.ny.govNonresident and Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your Social Security number Complete all parts that apply to you; see instructions (Form IT …

Publication 4011 (Rev. 8-2021) - IRS tax forms

www.irs.gov• If a nonresident alien receives a grant that is not from U.S. sources, it is not subject to U.S. tax. • Scholarship or fellowship grants that cover tuition and fees (and books and supplies if required of all students) are not subject to U.S. tax. (Financial aid that is dependent on the performance of services, such as a teaching assistant, is

Instructions for Form IT-196 New York Resident ...

www.tax.ny.govOct 01, 2021 · New York Resident, Nonresident, and Part-Year Resident Itemized Deductions IT-196-I Table 1 – New York State itemized deductions on separate New York State income tax returns ... card bills, buy a car, or pay tuition. 2) You, or your spouse if filing jointly, took out any mortgages after October 13, 1987, and used the proceeds to buy, build, or

Form 8917 (Rev. January 2020) - IRS tax forms

www.irs.govThe tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Use Form 8917 (Rev. January 2020) and these instructions for years after 2017, unless a newer revision is issued indicating it is

Form MO-1040 Book - 2019 Individual Income Tax Long Form

dor.mo.govare a nonresident with less than $600 of Missouri . income; or . c. have Missouri adjusted gross income less than the amount of your standard deduction for your filing status. Note: If you are not required to file a Mis souri return, but you received a Wage and Tax Statement (Form W …

2020 Schedule CA (540NR) California Adjustments ...

www.ftb.ca.gov7741203 Schedule CA (540NR) 2020 Side 1 California Adjustments — Nonresidents or Part-Year Residents Important: Attach this schedule behind Form 540NR, Side 5 as a supporting California schedule. Part I Residency Information. Complete all lines that apply to you and your spouse/RDP for taxable year 2020.