Nontaxable

Found 8 free book(s)(Form 8849) Nontaxable Use of Fuels - IRS tax forms

www.irs.govnontaxable uses are listed in the Type of Use Table in the Form 8849 instructions. Exported taxable fuel. The claim rates for exported taxable fuel are listed on lines 1b, 2c, 3e, 4d, 8a, and 8b. Taxpayers making a claim for exported taxable fuel must include with their

Income Quick Reference Guide - IRS tax forms

apps.irs.gov1 If the taxpayer received a Form 1099-C, Cancellation of Debt, in relation to their main home, it can be nontaxable 2 If itemized in year paid and taxes were reduced because of deduction 3 An inheritance isn’t reported on the income tax return, but a distribution from an inherited pension or annuity is subject to the same tax as the original ...

2021 Form CT-706 NT Instructions Connecticut Estate Tax ...

portal.ct.govConnecticut Estate Tax Return (for Nontaxable Estates) General Information For decedents dying during 2021, the Connecticut estate tax exemption amount is $7.1 million. Therefore, Connecticut estate tax is due from a decedent’s estate if the Connecticut taxable estate is more than $7.1 million. The Connecticut taxable estate is the sum of:

2021 Publication 525 - IRS tax forms

www.irs.govwhether they are taxable or nontaxable. It in-cludes discussions on employee wages and fringe benefits, and income from bartering, part-nerships, S corporations, and royalties. It also includes information on disability pensions, life insurance proceeds, and welfare and other public assistance benefits. Check the index for

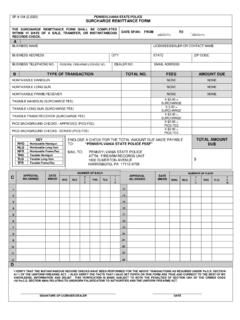

SP4-134 (3/2001) PENNSYLVANIA STATE POLICE

www.psp.pa.govNontaxable Long Gun NFR THG Taxable Handgun TLG Taxable Long Gun TFR Taxable Frame/Rec. Title: SP4-134 (3/2001) PENNSYLVANIA STATE POLICE Author: Sandra Grove Created Date: 2/25/2020 11:27:43 AM ...

Illinois Department of Revenue Claiming the New Federal ...

www2.illinois.govnontaxable for individuals with a Modified Adjusted Gross Income of less than $150,000. For more information see New Exclusion of up to $10,200 of Unemployment Compensation. Note: Railroad Unemployment and sick pay are not taxed by Illinois. If any amount of your Unemployment Exclusion includes railroad unemployment, do not include this amount on

Nontaxable Investment Income - State

www.state.nj.usNontaxable Investment Income Understanding Income Tax GIT-5 December 2020 Federal Securities (continued) Security Interest Capital Gain If issued in New Jersey E E If issued in other states T T If issued in D.C., Puerto Rico, or the Virgin Islands E E Inter-American Development Bank Bonds T T ...

Missouri Property Tax Credit

dor.mo.govAm I ElIgIblE? Use this diagram to determine if you or your spouse are eligible to claim the PROPERTY TAX CREDIT N O T E L I G I B L E Can you truthfully state that you do not employ illegal or unauthorized aliens?