Of Charitable Trusts

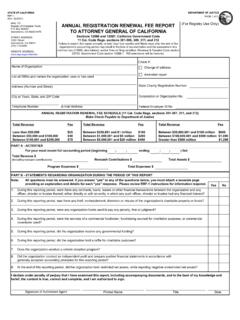

Found 6 free book(s)RRF-1, Annual Registration Renewal Fee Report and Instructions

oag.ca.govThe State Charity Registration Number is the Charitable Trust (CT) number assigned to an organization by the Registry of Charitable Trusts at the time of registration. If you do not know the organization's State Charity Registration Number, you may look it up using the Registry Search feature on the Attorney General's website at

Attorney General's Guide for Charities

www.oag.ca.govApr 14, 2021 · charitable gifts, which support the existence of charitable organizations. The Attorney General has oversight over charities, charitable trusts, as well as individuals and other organizations who hold charitable assets. 3 or engage in fundraising for charitable purposes. 4 “Is Our Organization a Charity?”

GUIDEBOOK FOR NEW HAMPSHIRE CHARITABLE …

www.doj.nh.govThe Charitable Trusts Unit prepared this Guidebook as a quick reference tool for directors, trustees, officers and executive directors of New Hampshire charitable organizations. It describes in brief terms the legal duties of directors and the common challenges

Handout: SECURE Act: Estate Planning for IRAs

us.aicpa.orgJan 17, 2020 · – Multi-generational Spray Trusts – Roth Conversions – Spousal Rollovers and the New Spousal Rollover Trap – IRAs Payable to CRTs – IRA Trusts for State Income Tax Savings – Life Insurance Solutions – Qualified Charitable Contributions – …

tax guide for charities - Inland Revenue Department

www.ird.gov.hk1. Exemption of charitable institutions and trusts of a public character (i.e. charities) from tax is granted by the legislature. Section 88 of the Inland Revenue Ordinance (Cap 112) (the IRO) provides that a charity is exempt from profits tax subject to …

Trusts: Common Law and IRC 501(c)(3) and 4947

www.irs.govregarding trusts, with a focus on charitable trusts and IRC 501(c)(3), and some discussion of IRC 4947. In this article This article contains the following topics: Topic See Page Overview 1 Basic Legal Rules Regarding Trusts and IRC 501(c)(3) 3 What is a trust? 4 Who are the parties to a trust? 5 Can a trust exist without assets? 7