Of entry tax return for vat

Found 10 free book(s)Amendments to tax returns - GOV.UK

assets.publishing.service.gov.ukCorporation Tax Self-Assessment (CTSA) and VAT returns differ and are not ... tax return is therefore linked to the filing date for the particular return. For example, if a taxpayer has filed a 2016-2017 return online (with a filing date ... where a taxpayer forgot to fill in an entry or wants to change an entry. HMRC

Tax and Duty Manual VAT – Postponed Accounting VAT ...

www.revenue.ieto the entry at the PA1 field on the return (subject to the usual rules of deductibility). 4 Postponed Accounting Entries on VAT Return of Trading Details (RTD). ROS online VAT RTD second screen refers to ‘Acquisitions from the European Union and Non-European Union’. The second column of the VAT RTD paper return refers to such acquisitions.

Value added tax (VAT) control account

aat-interactive.org.ukThe information on the VAT return should agree with the amounts recorded in the VAT control account. Where do the entries come from? Transactions that include VAT are analysed in the various books of prime entry (where transactions are first recorded) and the VAT element is then posted directly to the VAT control account.

ELECTRONIC TAX RETURNS FILING SYSTEM

gateway.tra.go.tzE-Filer should click on the “Value Added Tax RETURN” link where a ITX240.01.B_VAT form will load. The e-Filer is required to fill the fields on the form appropriately, on completion the e-filer can then confirm by checking the “I have completed filling Part 1 of this return” checkbox.

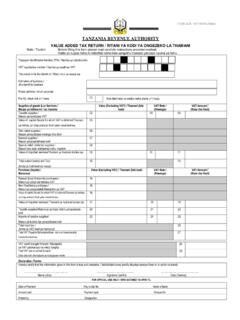

VALUE ADDED TAX RETURN / RITANI YA KODI YA …

www.tra.go.tz01 Should be ticked for NIL return/Weka alama ya tiki endapo ritani haina malipo. 02 Value of taxable supplies/Thamani ya mauzo yanayotozwa kodi. 03 Rate of tax/Kiwango cha kodi. 04 VAT amount/Kiasi cha kodi kilichotozwa. 05 Value of purchases on Capital Goods on which VAT has been deferred /Thamani ya manunuzi kwenye bidhaa za mtaji

The Oman VAT Law - Unofficial English translation

www2.deloitte.comInput Tax: The tax borne by the Taxable Person in respect of the goods or services supplied to him or imported for the purpose of conducting the activity. Output Tax: The tax due that is charged on taxable supplies of goods and services. First Point of Entry: The first customs entry check point for goods entering the GCC region from abroad in

VAT Guide 'Value added tax in Austria' - PwC

www.pwc.atIn certain circumstances, import VAT (“EUSt”) can be settled via the Austrian tax account of the taxable person and can be offset against the input VAT declared in the monthly VAT return. In this case, no actual payment of import VAT is necessary.

Technical Guidance Note Import VAT: Postponed VAT ... - …

www.bifa.orgVAT is due immediately, it can usually be deferred to the fifteenth of the following month by using a duty deferment account if available. The import VAT can then usually be reclaimed as input tax on the next VAT return (subject to the normal VAT rules on input tax deduction).

VALUE ADDED TAX ACT, 2014 - Department of Inland Revenue

inlandrevenue.finance.gov.bsVALUE ADDED TAX ACT, 2014 c VALUE ADDED TAX ACT, 2014 AN ACT TO PROVIDE FOR THE IMPOSITION ASSESSMENT AND COLLECTION OF VALUE ADDED TAX ON THE SUPPLY AND IMPORTATION OF GOODS AND SERVICES IN THE BAHAMAS AND FOR CONNECTED MATTERS Enacted by the Parliament of The Bahamas PART I – …

BIR Form 2550M (ENCS) - Page 2 ALPHANUMERIC TAX …

www.lawphil.netBIR FORM NO. 2550M - Monthly Value-Added Tax Declaration VM 100 VM 010 VB 113 VB108 VB109 VB 111 Guidelines and Instructions VM 040 VM 110 VM 120 VM 130 VM 140 VM 030 VM 020 VM 150 VM 050 ALPHANUMERIC TAX CODES (ATC) VQ010 VB 102 VH 010 VP 102 INDUSTRIES COVERED BY VAT ATC INDUSTRIES COVERED BY VAT ATC INDUSTRIES …